Secure Your Loved Ones’ Tomorrow

Life is full of uncertainties and unexpected events. While we can never predict what the future holds, we can certainly take steps to protect our loved ones in case of any unfortunate circumstances. One of the best ways to do this is by securing a life insurance policy.

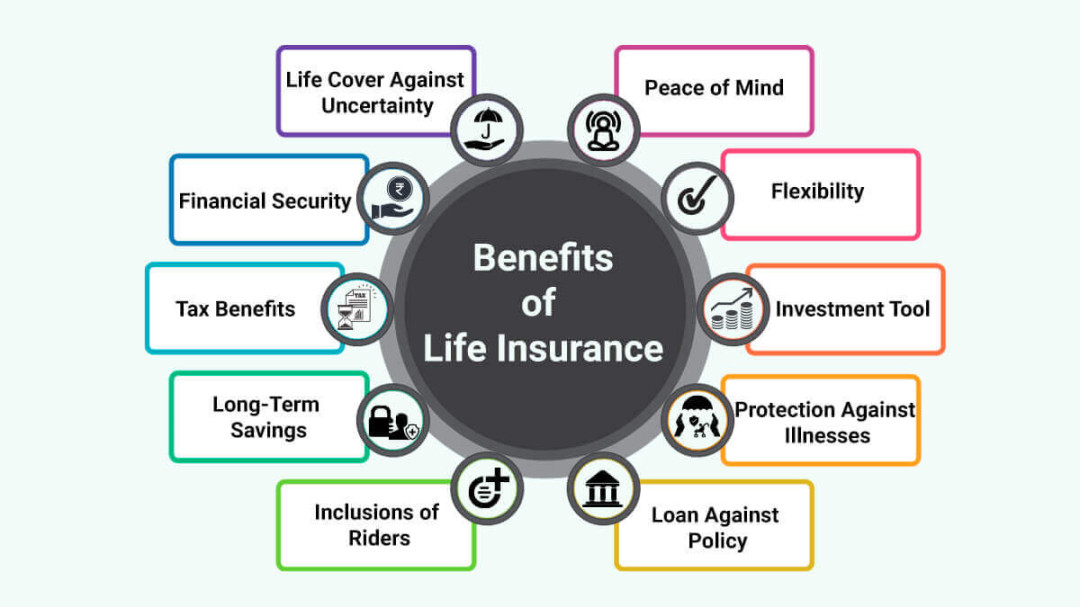

Life insurance is a crucial tool that can provide financial security to your family when you are no longer around. It ensures that your loved ones are taken care of financially, even in your absence. This peace of mind is priceless and can save your family’s future in more ways than one.

Imagine a scenario where you are the sole breadwinner of your family. Your spouse and children rely on your income to meet their daily needs and expenses. Now, what would happen if you were to suddenly pass away? Without a life insurance policy in place, your family could face financial hardship and struggle to make ends meet.

With a life insurance policy, you can ensure that your loved ones are protected financially. The death benefit provided by the policy can help cover living expenses, mortgage payments, children’s education, and other financial obligations. This support can make a world of difference in your family’s future and give them the stability they need to move forward.

Moreover, life insurance can also help your family maintain their quality of life and lifestyle. It can provide a safety net that allows your loved ones to continue living comfortably, even after you are gone. This financial security can alleviate the stress and burden of worrying about money and allow your family to focus on healing and moving forward together.

Additionally, life insurance can also play a crucial role in estate planning and inheritance. It can help you leave a lasting legacy for your family and ensure that your hard-earned assets are passed down to the next generation. By securing a life insurance policy, you can protect your family’s financial future and leave behind a lasting impact that benefits generations to come.

In conclusion, securing a life insurance policy is not just about protecting yourself; it’s about securing your loved ones’ tomorrow. It’s about providing for your family in times of need and ensuring that they have the financial support they need to thrive. Life insurance can save your family’s future and give you the peace of mind knowing that your loved ones are taken care of, no matter what life throws at you. So, don’t wait any longer – invest in a life insurance policy today and secure your family’s tomorrow.

Protecting Your Family’s Financial Future

Life insurance is often seen as a necessary evil – something that we know we should have, but hope we never have to use. However, when it comes to protecting your family’s future, life insurance can be a lifesaver. It provides a safety net that ensures your loved ones are taken care of financially, even if the worst were to happen to you.

One of the main reasons why life insurance is so important in safeguarding your family’s financial future is because it can replace lost income. If you were to pass away unexpectedly, your family would not only be dealing with the emotional devastation of losing you, but also the financial burden of trying to make ends meet without your income. Life insurance can provide them with a source of income to cover expenses such as mortgage payments, bills, and other day-to-day costs.

Additionally, life insurance can also help cover any outstanding debts or loans that you may have. Leaving behind debt can be a heavy burden on your family, and life insurance can ensure that they are not left with the responsibility of paying off your debts. This can provide them with peace of mind and financial stability during a difficult time.

Another important aspect of life insurance is that it can help cover future expenses, such as education costs for your children. By having a life insurance policy in place, you can ensure that your children’s education is taken care of, even if you are no longer around to provide for them. This can give your children the opportunity to pursue their dreams and achieve their goals, without having to worry about how they will afford their education.

In addition to providing financial security for your family, life insurance can also help cover end-of-life expenses, such as funeral costs and medical bills. Dealing with the loss of a loved one is already emotionally draining, and having to worry about how to pay for a funeral can add even more stress to an already difficult situation. Life insurance can alleviate this financial burden and allow your family to focus on grieving and healing, rather than worrying about money.

Furthermore, life insurance can also be used as an estate planning tool to provide for your family’s long-term financial security. By naming beneficiaries in your life insurance policy, you can ensure that your loved ones are taken care of after you are gone. This can include providing an inheritance for your children or grandchildren, or leaving money to a charitable organization that is important to you. Life insurance can help you leave a lasting legacy and make a positive impact on the future of your family.

In conclusion, life insurance plays a crucial role in protecting your family’s financial future. It provides a safety net that ensures your loved ones are taken care of financially, even if you are no longer around to provide for them. By securing a life insurance policy, you can have peace of mind knowing that your family will be financially secure in the event of your passing. Life insurance may be a difficult topic to think about, but it is an essential tool in safeguarding your family’s future and ensuring that they are taken care of no matter what life may bring.