Protecting Your Happy Place: Understanding Home Insurance

When it comes to ensuring the safety and security of your home, there’s no better way to do so than with a comprehensive home insurance policy. Your home is not just a place where you live; it’s your sanctuary, your happy place, your haven from the outside world. And just like any other valuable asset, it deserves to be protected.

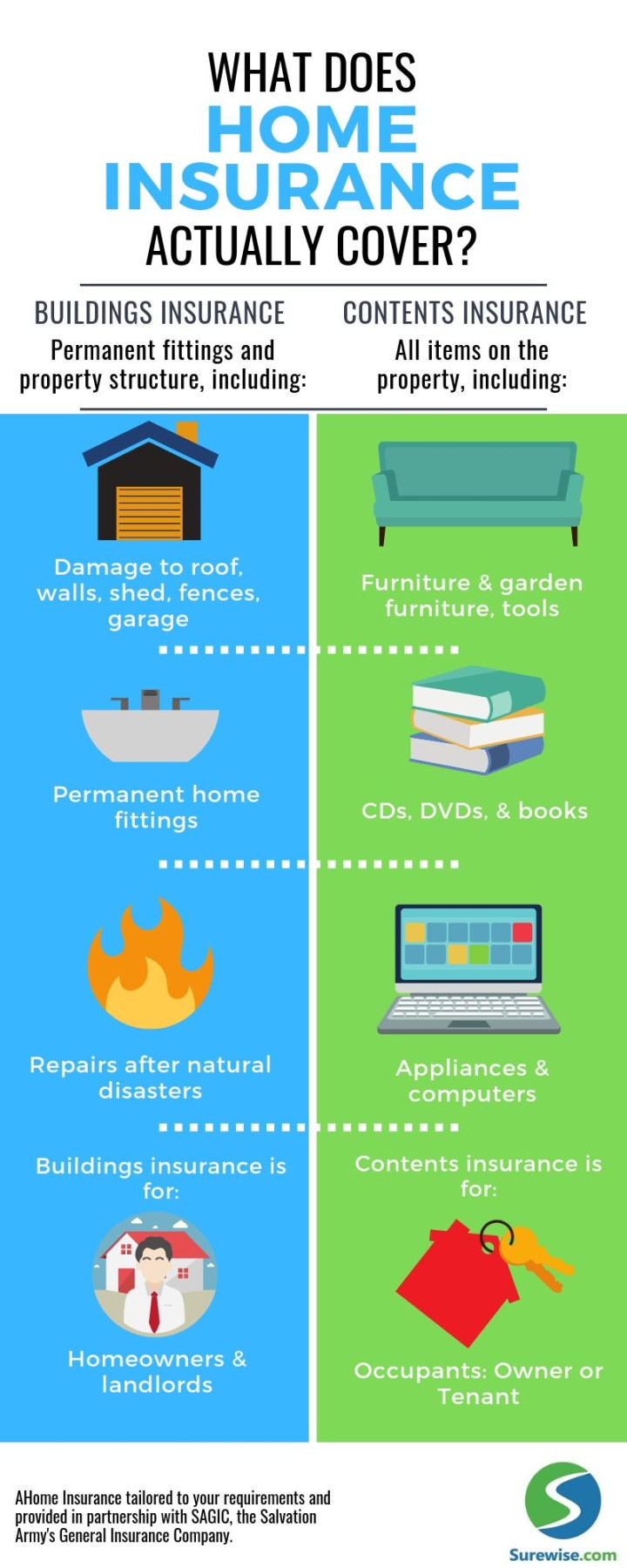

Home insurance is designed to provide financial protection in the event of damage to your home or its contents. It covers a wide range of perils, from fire and theft to natural disasters like hurricanes and earthquakes. Understanding what’s covered by your home insurance policy is crucial in order to make sure you have the right level of protection for your specific needs.

One of the most basic coverages provided by home insurance is dwelling coverage. This protects the physical structure of your home, including the walls, roof, floors, and foundation, in the event of damage from covered perils. It’s important to make sure you have enough dwelling coverage to rebuild your home in the event of a total loss.

In addition to dwelling coverage, home insurance also typically includes coverage for other structures on your property, such as a garage, shed, or fence. Personal property coverage is another important component of home insurance, covering your belongings inside your home, such as furniture, electronics, clothing, and other personal items. It’s important to take inventory of your belongings and make sure you have enough personal property coverage to replace them in the event of a loss.

Liability coverage is another important aspect of home insurance, protecting you in the event that someone is injured on your property and sues you for damages. This coverage can help pay for legal fees, medical expenses, and other costs associated with a liability claim. Additionally, home insurance typically includes additional living expenses coverage, which can help cover the cost of temporary housing and other expenses if you’re unable to live in your home due to a covered loss.

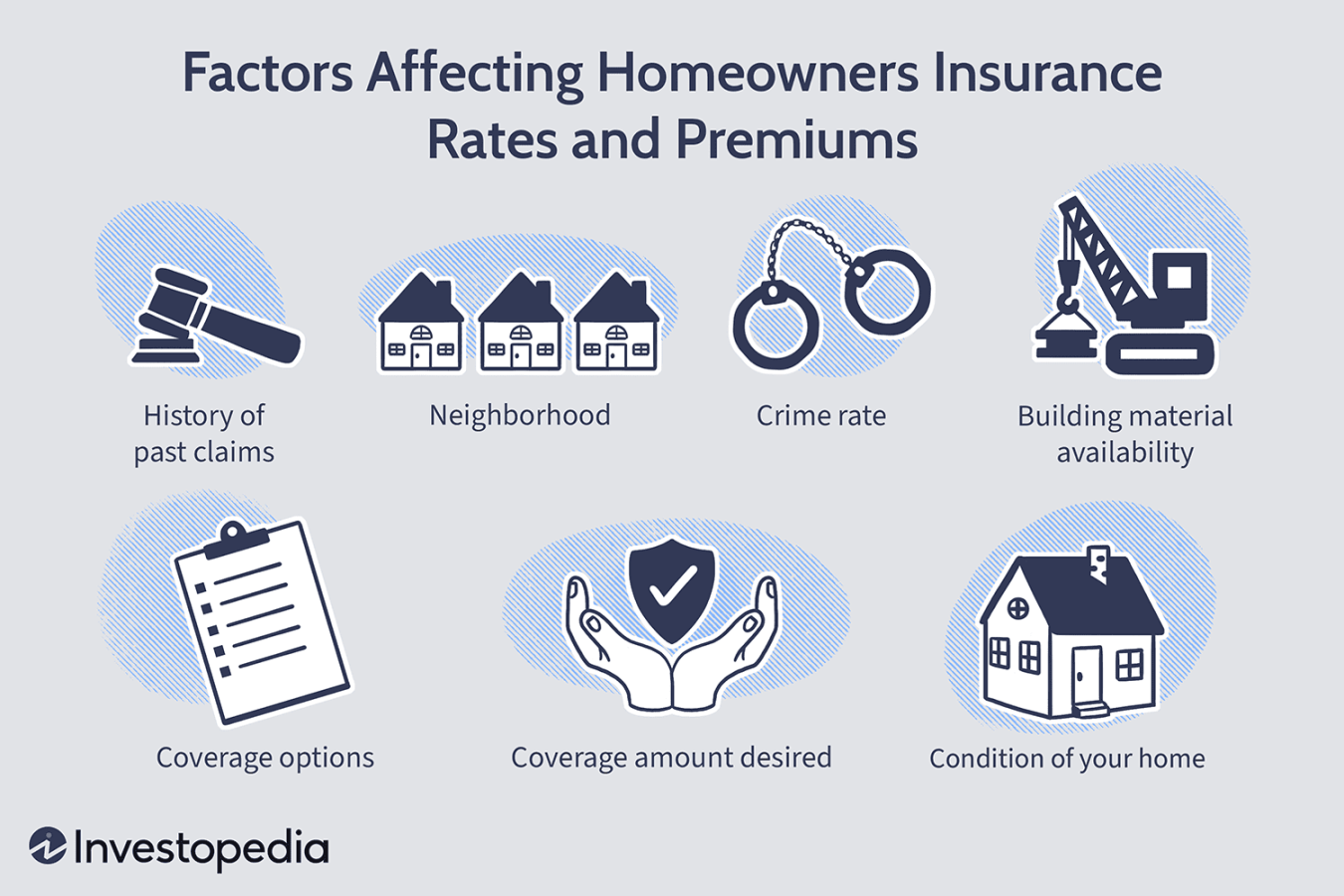

It’s important to note that not all perils are covered by a standard home insurance policy. For example, floods and earthquakes are typically not covered and require separate insurance policies. It’s important to carefully review your policy to understand what is and isn’t covered, and to consider purchasing additional coverage if needed.

In conclusion, home insurance is a vital tool in protecting your happy place and ensuring your peace of mind. By understanding what’s covered by your policy and making sure you have the right level of protection for your specific needs, you can rest easy knowing that your home and belongings are safeguarded against life’s unexpected events. So don’t wait, make sure your happy place is properly protected with a comprehensive home insurance policy today.

Unveiling the Magic: Discovering What’s Covered

Home insurance is like a magical cloak that wraps around your house, protecting it from unexpected disasters and mishaps. But do you ever wonder what exactly is covered by this enchanting shield? Let’s delve into the mystical world of home insurance and uncover the secrets of what lies beneath.

One of the most common types of coverage provided by home insurance is dwelling coverage. This is the foundation of your policy, protecting the physical structure of your home from perils such as fire, wind, hail, and vandalism. If your home is damaged or destroyed by any of these covered events, your insurance will help pay for repairs or rebuilding.

But what about the treasures inside your home? That’s where personal property coverage comes in. This magical provision ensures that your belongings, from furniture to electronics to clothing, are protected in case of theft, damage, or loss. Imagine the peace of mind knowing that even if your favorite wizard hat goes missing or your prized collection of spell books is damaged, your insurance has you covered.

Another important aspect of home insurance is liability coverage. This mystical protection shields you from financial ruin in case someone is injured on your property or if you accidentally cause damage to someone else’s property. Whether a guest slips on a spilled potion or your magical pet dragon accidentally sets fire to a neighbor’s garden, liability coverage will help cover legal fees and medical expenses.

But wait, there’s more! Additional living expenses coverage is like a safety net that catches you when your home becomes uninhabitable due to a covered event. If your house is damaged by a covered peril and you need to temporarily live elsewhere, this provision will help cover the cost of hotel stays, meals, and other necessary expenses until you can return home.

And let’s not forget about the magical enhancements you can add to your policy. Optional coverages such as flood insurance, earthquake insurance, and identity theft protection can provide extra layers of security and peace of mind. With these additional spells in your insurance arsenal, you can rest easy knowing that you’re fully protected against a wide range of potential threats.

In the world of home insurance, knowledge is power. By understanding what’s covered by your policy, you can wield the magic of protection with confidence and peace of mind. So take a closer look at your policy, unravel the mystery of coverage, and unlock the full potential of your insurance magic. Your happy place deserves nothing less than the best protection, and with the right coverage in place, you can rest assured that your home is safe and secure, no matter what challenges may come your way.