Uncovering the Mystery of Burial Insurance

When it comes to planning for the future, one topic that often gets overlooked is burial insurance. Many people are unfamiliar with what burial insurance is all about and how it can benefit them and their loved ones. In this article, we will delve into the world of burial insurance and shed some light on this often misunderstood form of coverage.

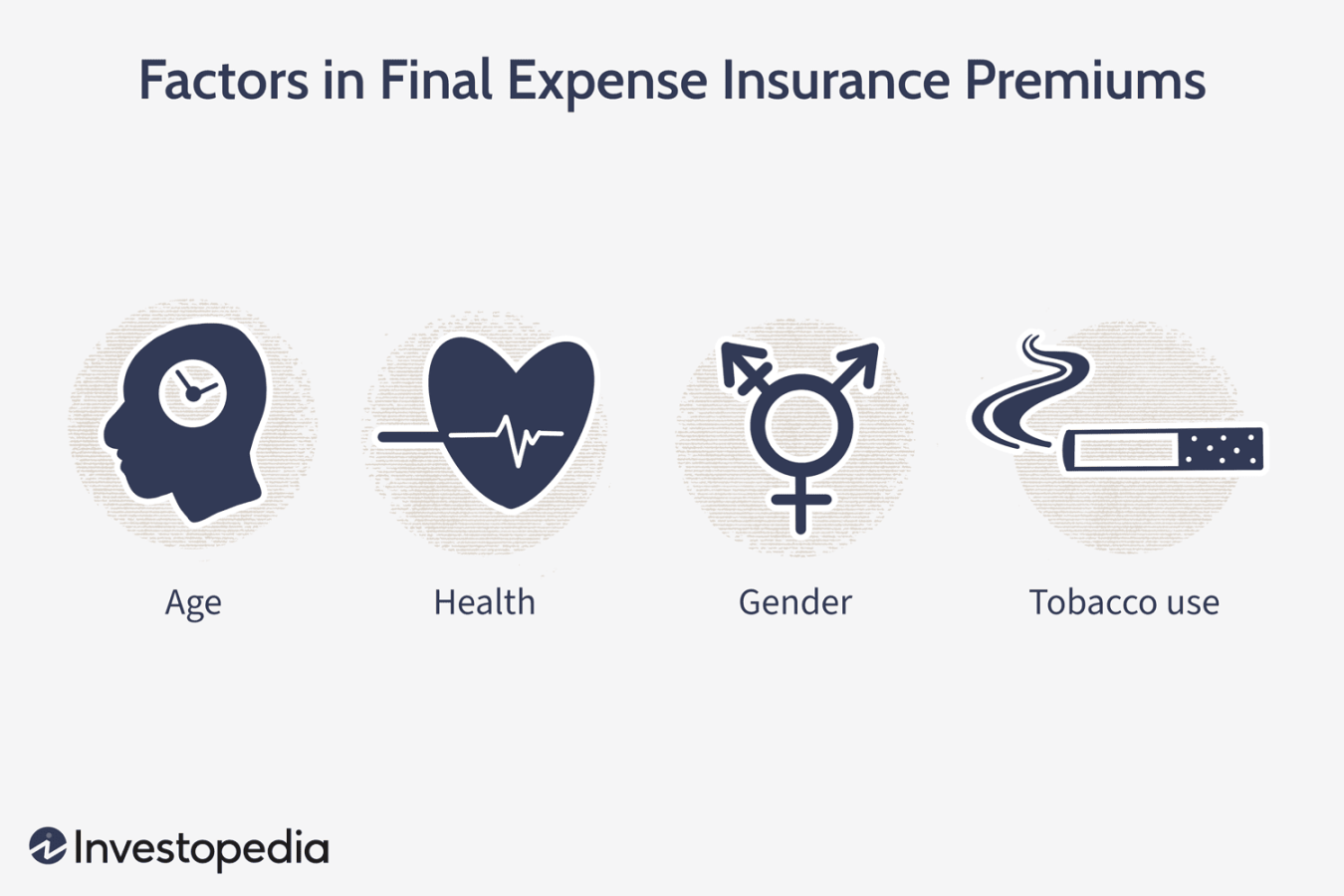

Burial insurance, also known as final expense insurance, is a type of insurance policy that is specifically designed to cover the costs associated with a funeral and burial. These costs can include the funeral service, casket, burial plot, headstone, and other related expenses. By investing in burial insurance, individuals can ensure that their loved ones are not burdened with these costs after they pass away.

One of the main benefits of burial insurance is that it provides peace of mind to both the policyholder and their family members. Knowing that there is a plan in place to cover the costs of a funeral can alleviate a significant amount of stress and worry during an already difficult time. This type of insurance can also help prevent financial strain on family members who may be struggling to cover these expenses on their own.

Another advantage of burial insurance is that it is typically more affordable than traditional life insurance policies. Since burial insurance is meant to cover a specific expense rather than provide a large sum of money to beneficiaries, the premiums are often lower and more manageable for individuals on a budget. This makes burial insurance a practical and cost-effective option for those who are looking to plan ahead for their final expenses.

Additionally, burial insurance is easy to obtain and does not require a medical exam. This can be particularly beneficial for individuals who may have pre-existing health conditions or who are older in age. By bypassing the need for a medical exam, individuals can secure coverage quickly and without any hassle.

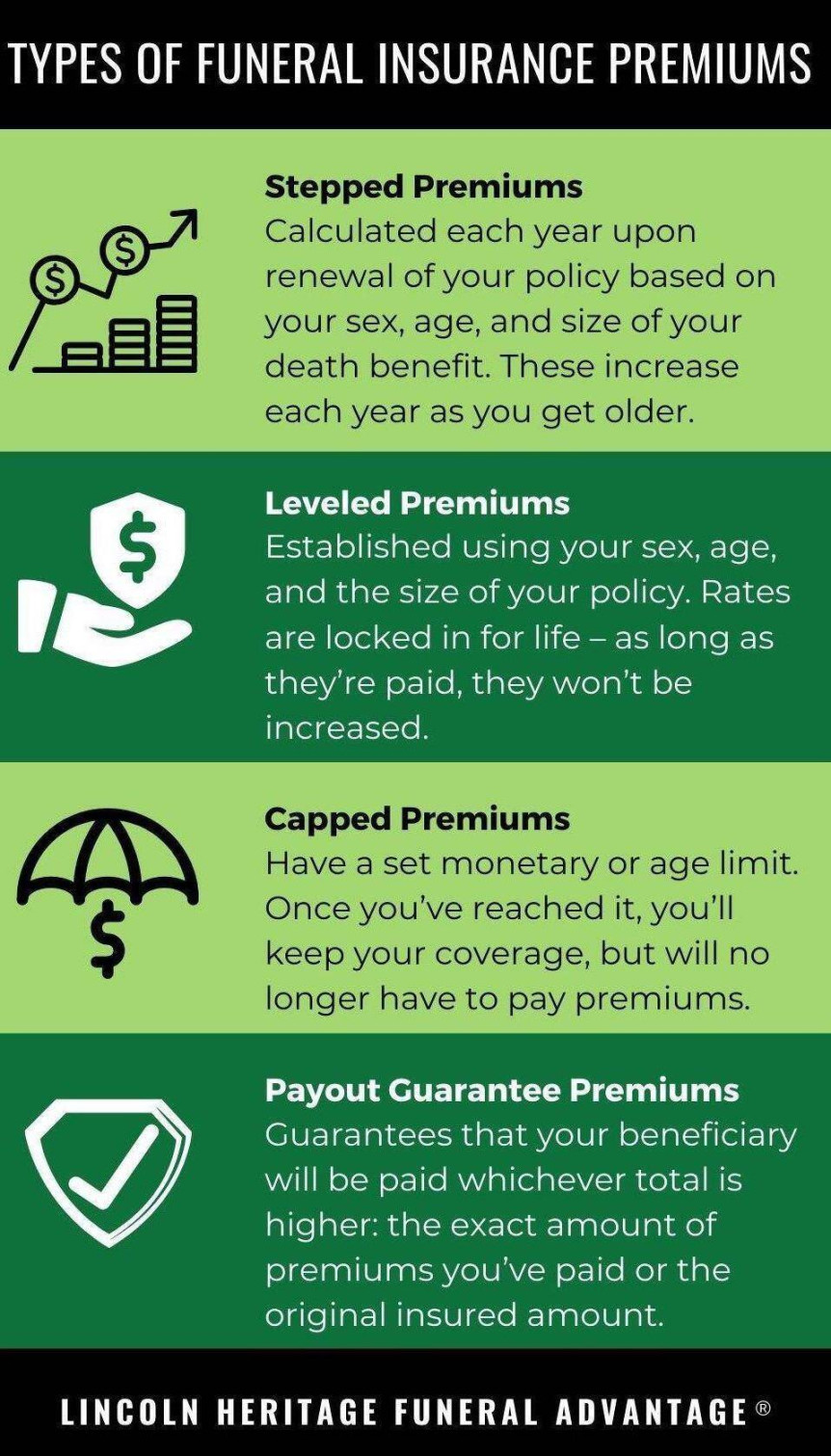

It is important to note that burial insurance policies vary in terms of coverage and benefits. Some policies may only cover the cost of a funeral and burial, while others may also provide additional benefits such as assistance with estate planning or legal services. It is crucial for individuals to carefully review the terms of the policy and choose one that best fits their needs and preferences.

In conclusion, burial insurance is a valuable form of coverage that can provide financial security and peace of mind to individuals and their loved ones. By understanding the benefits of burial insurance and how it works, individuals can make informed decisions when it comes to planning for their final expenses. Whether you are young or old, healthy or facing health challenges, burial insurance is a practical and accessible option for ensuring that your funeral and burial costs are taken care of when the time comes.

Exploring the Benefits of Final Expense Coverage

When it comes to planning for the future, one topic that often gets overlooked is burial insurance. Many people don’t realize the importance of having a plan in place to cover their final expenses. However, with the rising costs of funerals and burials, it’s essential to consider how you will cover these expenses when the time comes.

Final expense coverage, also known as burial insurance, is a type of insurance policy specifically designed to cover the costs associated with a person’s funeral and burial. This type of insurance can help alleviate the financial burden on your loved ones during a difficult time.

One of the key benefits of final expense coverage is that it allows you to customize your policy to meet your specific needs. You can choose the amount of coverage you want, allowing you to ensure that your final expenses are fully covered. This can give you peace of mind knowing that your loved ones won’t be left to cover these costs on their own.

Another benefit of final expense coverage is that it is typically easier to qualify for than traditional life insurance policies. This can be especially beneficial for older individuals or those with pre-existing health conditions who may have difficulty obtaining traditional life insurance. With final expense coverage, you can secure the coverage you need without having to undergo a medical exam.

In addition to providing financial protection for your loved ones, final expense coverage can also offer emotional support during a difficult time. Losing a loved one is never easy, and the last thing you want to worry about is how you will pay for their funeral and burial. With final expense coverage in place, you can rest assured knowing that these costs are taken care of.

Furthermore, final expense coverage is typically affordable and can be paid for in small monthly premiums. This makes it a budget-friendly option for individuals looking to secure financial protection for their loved ones without breaking the bank. By setting aside a small amount each month, you can ensure that your final expenses are covered without putting a strain on your finances.

One important aspect to consider when exploring the benefits of final expense coverage is the flexibility it offers. Unlike traditional life insurance policies, final expense coverage can be used for any purpose, not just funeral and burial expenses. This means that your beneficiaries can use the funds from your policy to cover any outstanding debts, medical bills, or other financial obligations they may have.

Overall, final expense coverage is a valuable tool for individuals looking to protect their loved ones from the financial burden of funeral and burial expenses. By customizing your policy to meet your specific needs, securing coverage without a medical exam, and ensuring affordable monthly premiums, you can rest easy knowing that your final expenses are taken care of. Don’t wait until it’s too late – explore the benefits of final expense coverage today and give your loved ones the peace of mind they deserve.