Secure Your Golden Years: Best Life Insurance Plans for Seniors

As we age, it becomes increasingly important to secure our financial futures and protect our loved ones. One of the best ways to do this is by investing in a life insurance plan that will provide peace of mind and financial security for our golden years. In this article, we will explore the top life insurance plans for seniors that offer the best coverage and benefits.

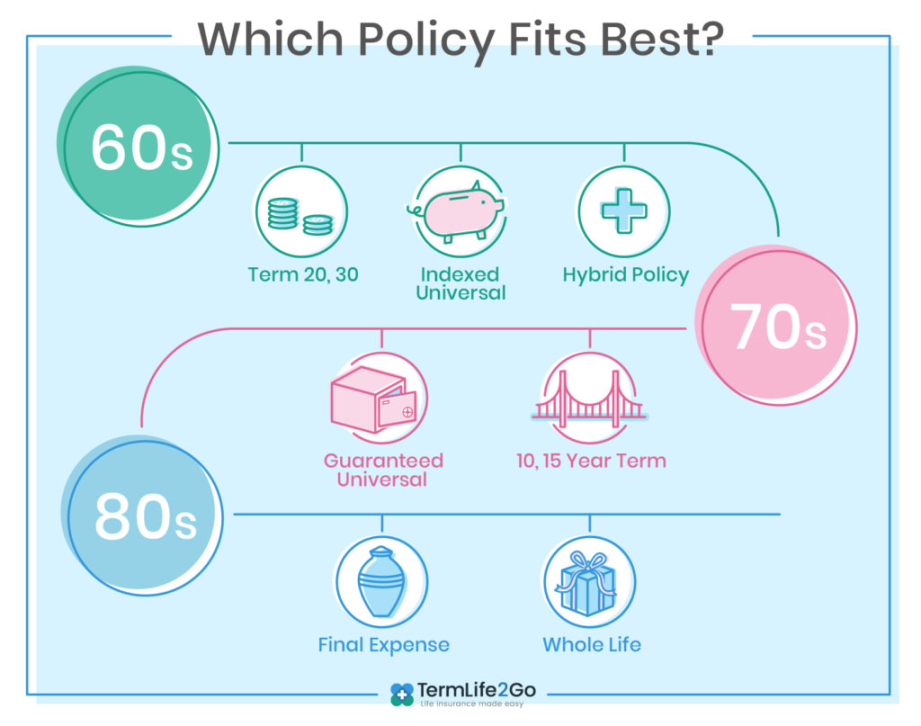

One of the most popular life insurance plans for seniors is whole life insurance. This type of insurance provides coverage for the insured’s entire life and offers a cash value component that grows over time. Whole life insurance is a great option for seniors who want to leave a legacy for their loved ones or cover final expenses. With whole life insurance, you can rest assured knowing that your beneficiaries will be taken care of financially when you pass away.

Another excellent option for seniors is term life insurance. Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. This type of insurance is more affordable than whole life insurance and is a great option for seniors who only need coverage for a certain period of time, such as to pay off a mortgage or cover college expenses for their children. Term life insurance offers peace of mind knowing that your loved ones will be financially protected during the term of the policy.

For seniors who are looking for a combination of life insurance and investment opportunities, universal life insurance may be the best option. Universal life insurance offers flexibility in premium payments and death benefits, as well as a cash value component that can be invested in various options, such as stocks and bonds. This type of insurance is ideal for seniors who want to build cash value over time while also having the protection of a life insurance policy.

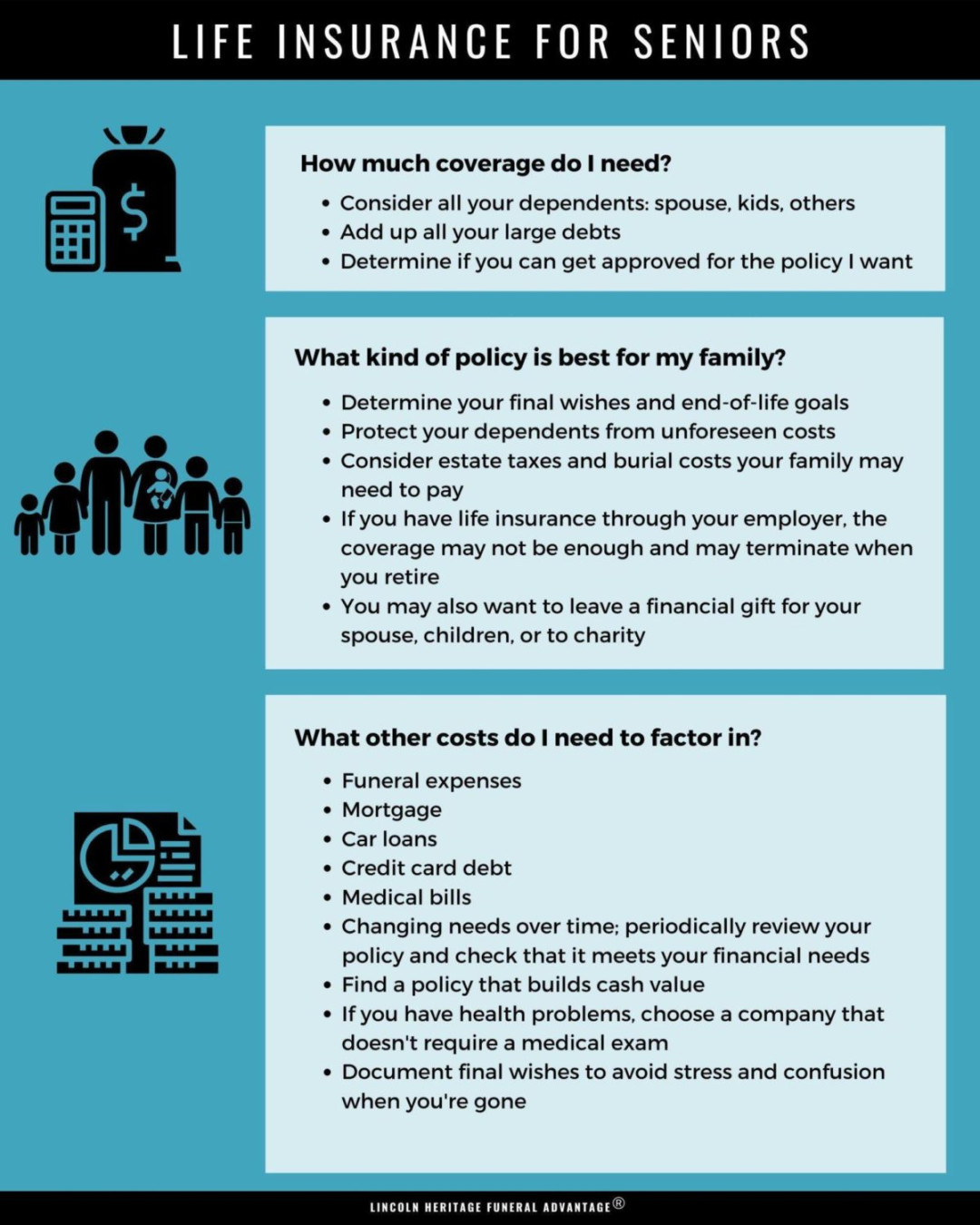

Another great option for seniors is guaranteed issue life insurance. This type of insurance is designed for seniors who may have health issues that make it difficult to qualify for traditional life insurance policies. Guaranteed issue life insurance does not require a medical exam or health questionnaire, making it easy for seniors to get coverage. While premiums may be higher for guaranteed issue life insurance, it provides peace of mind knowing that you have coverage regardless of your health status.

In addition to these traditional life insurance options, there are also specialized plans available for seniors, such as final expense insurance and burial insurance. These types of insurance plans are specifically designed to cover funeral and burial expenses, ensuring that your loved ones are not burdened with these costs when you pass away. Final expense insurance and burial insurance offer peace of mind knowing that your final wishes will be carried out without financial strain on your family.

In conclusion, there are a variety of life insurance plans available for seniors that offer different types of coverage and benefits. Whether you are looking for a simple term life insurance policy or a more comprehensive whole life insurance plan, there is a policy that will suit your needs and provide financial security for your golden years. By investing in a life insurance plan, you can rest assured knowing that your loved ones will be taken care of and your legacy will be protected.

Peace of Mind in Retirement: Top Insurance Options for Older Adults

Retirement is a time to relax, travel, and enjoy the fruits of your labor. However, it can also be a time of uncertainty, especially when it comes to financial planning. One way to ensure peace of mind in retirement is to invest in the right life insurance plan. With the plethora of options available in the market, choosing the best insurance plan for older adults can be overwhelming. To help you make an informed decision, here are some of the top insurance options to consider for a secure future.

Term Life Insurance

Term life insurance is a popular choice for older adults looking for affordable coverage. This type of insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is a cost-effective option that offers a death benefit to your beneficiaries if you pass away during the term of the policy. Term life insurance can be a great choice for those looking to cover specific financial obligations, such as mortgage payments or college tuition for grandchildren.

Whole Life Insurance

Whole life insurance is a permanent insurance option that provides coverage for your entire life. This type of insurance offers a death benefit to your beneficiaries, as well as a cash value component that grows over time. Whole life insurance can be a valuable investment for older adults looking for long-term financial security. It can help cover final expenses, estate taxes, and provide a legacy for your loved ones.

Universal Life Insurance

Universal life insurance is another permanent insurance option that offers flexibility and investment opportunities. This type of insurance allows you to adjust your premiums and death benefit as your financial needs change. Universal life insurance also includes a cash value component that earns interest over time. It can be a great option for older adults looking for a customizable insurance plan that can adapt to their evolving financial goals.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of insurance that does not require a medical exam or health questionnaire. This makes it an ideal choice for older adults with pre-existing health conditions who may have difficulty qualifying for traditional life insurance. Guaranteed issue life insurance provides a death benefit to your beneficiaries and can help cover final expenses, such as funeral costs. While premiums for guaranteed issue life insurance may be higher than other types of insurance, the peace of mind it offers is invaluable.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is designed to cover end-of-life expenses, such as funeral costs and medical bills. This type of insurance is typically available to older adults up to age 85 and offers a death benefit to your beneficiaries. Final expense insurance can help alleviate the financial burden on your loved ones during a difficult time. It is a practical and thoughtful investment for older adults who want to ensure their final wishes are met without causing financial strain on their family.

Long-Term Care Insurance

Long-term care insurance is a crucial insurance option for older adults who may require assistance with daily activities as they age. This type of insurance helps cover the costs of long-term care services, such as nursing home care, assisted living, and in-home care. Long-term care insurance can provide peace of mind by ensuring you have access to quality care without depleting your savings. It is an essential investment for older adults who want to protect their assets and maintain their independence in retirement.

In conclusion, choosing the right life insurance plan is essential for older adults looking to secure their financial future and ensure peace of mind in retirement. Whether you opt for term life insurance, whole life insurance, universal life insurance, guaranteed issue life insurance, final expense insurance, or long-term care insurance, each option offers unique benefits to meet your individual needs. By selecting the best insurance plan for your situation, you can enjoy your golden years with confidence and security.