Golden Years Coverage: Life Insurance for Seniors 80+

As we enter our golden years, it’s important to make sure that we have the necessary protection in place to take care of ourselves and our loved ones. This is especially true when it comes to life insurance for seniors 80 and up. While it may seem daunting to think about purchasing life insurance at this stage in life, there are actually a variety of options available that can provide the coverage you need.

One of the best life insurance options for seniors 80 and up is whole life insurance. This type of policy provides coverage for the rest of your life, as long as you continue to pay the premiums. Whole life insurance also builds cash value over time, which can be used to supplement your retirement income or cover unexpected expenses. This can be especially helpful for seniors who may be living on a fixed income.

Another option for seniors 80 and up is term life insurance. While term life insurance is typically more affordable than whole life insurance, it does have a set term, usually ranging from 10 to 30 years. This can be a good option for seniors who are looking for coverage for a specific period of time, such as to cover a mortgage or other debt that will be paid off within that time frame.

For seniors who are in good health, there are also options for no medical exam life insurance. These policies allow seniors to skip the medical exam typically required for life insurance applications, making the application process quicker and easier. While these policies may have higher premiums than traditional life insurance policies, they can be a good option for seniors who may have difficulty qualifying for coverage due to health issues.

There are also guaranteed issue life insurance policies available for seniors 80 and up. These policies do not require a medical exam or health questionnaire, making them an easy option for seniors who may have health issues that make it difficult to qualify for traditional life insurance. While these policies typically have lower coverage amounts and higher premiums, they can provide peace of mind for seniors who want to make sure their final expenses are covered.

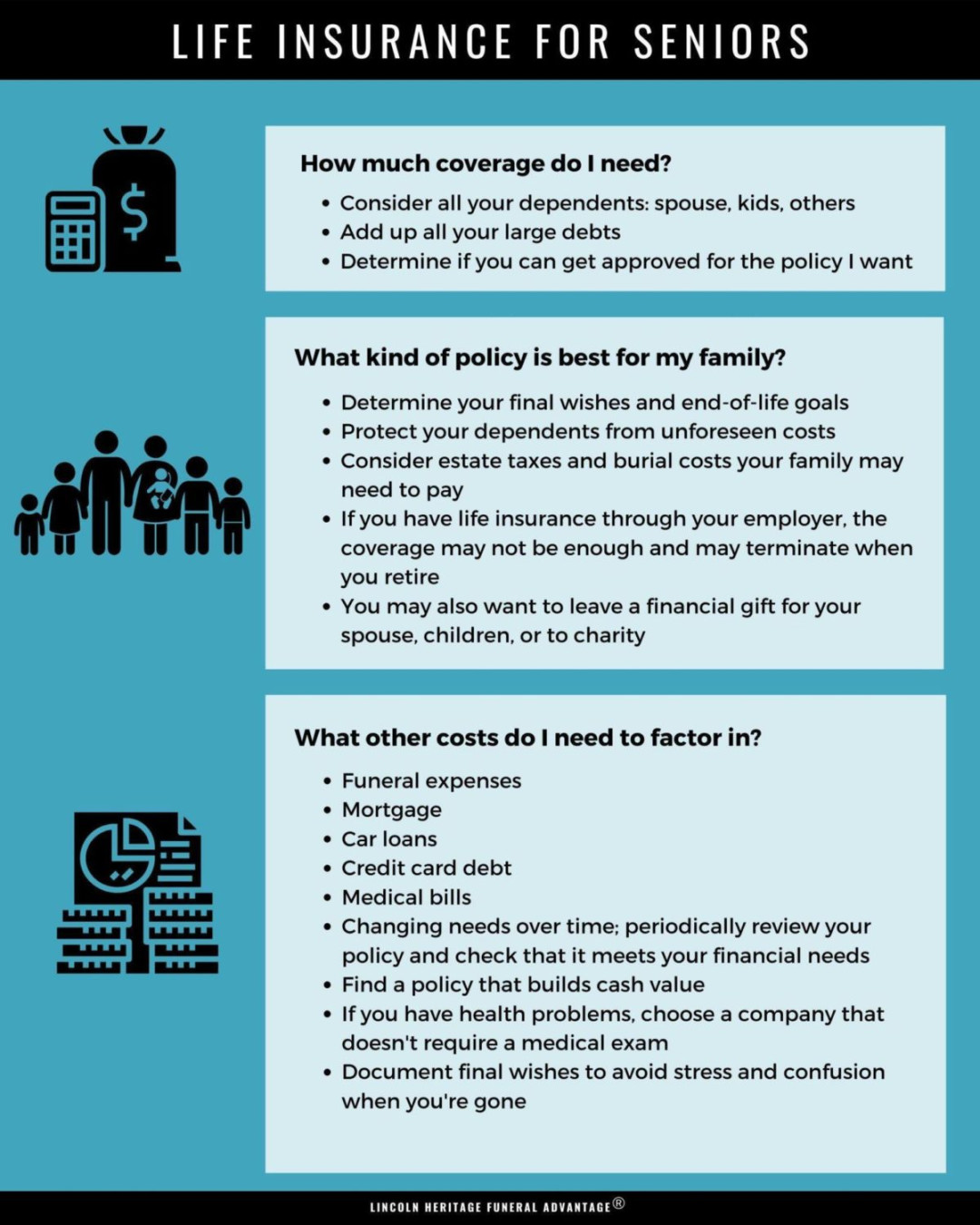

It’s important to carefully consider your options when choosing a life insurance policy as a senior 80 and up. Make sure to compare quotes from multiple insurance companies to find the best coverage at a price that fits your budget. You may also want to consider speaking with a financial advisor or insurance agent who can help you navigate the complexities of life insurance and find the best policy for your needs.

In conclusion, while purchasing life insurance as a senior 80 and up may seem like a daunting task, there are plenty of options available to help you protect yourself and your loved ones. Whether you choose whole life insurance, term life insurance, no medical exam life insurance, or guaranteed issue life insurance, there is a policy out there that can provide the coverage you need at a price you can afford. Take the time to explore your options and find the right policy for your golden years.

Stay Protected in Your Eighties with these Policies

As we grow older, our priorities shift and our needs change. This is especially true when it comes to life insurance. Seniors aged 80 and up have unique considerations when it comes to choosing the right policy to protect themselves and their loved ones. Fortunately, there are a variety of options available to ensure that you can stay protected in your golden years.

One of the most popular life insurance options for seniors 80 and up is guaranteed issue life insurance. This type of policy is designed for individuals who may have health issues that make it difficult to qualify for traditional life insurance. With guaranteed issue life insurance, there are no medical exams or health questions required. As long as you meet the age requirements, you can secure coverage to provide financial protection for your loved ones.

Another great option for seniors in their eighties is whole life insurance. This type of policy provides lifelong coverage and builds cash value over time. Whole life insurance can be a great way to leave a financial legacy for your family or cover final expenses such as funeral costs. With whole life insurance, you can have peace of mind knowing that your loved ones will be taken care of when you pass away.

For seniors who are looking for a more flexible option, term life insurance may be a good choice. Term life insurance provides coverage for a specific period of time, usually 10, 20, or 30 years. This can be a cost-effective way to ensure that your loved ones are protected during a specific time frame, such as while you are still paying off a mortgage or until your children are grown and financially independent.

Seniors aged 80 and up may also want to consider burial insurance, also known as final expense insurance. This type of policy is specifically designed to cover end-of-life expenses such as funeral costs, medical bills, and outstanding debts. Burial insurance can provide peace of mind knowing that your loved ones will not be burdened with financial obligations after you pass away.

In addition to these traditional life insurance options, seniors in their eighties may also benefit from considering a life settlement. A life settlement allows you to sell your life insurance policy to a third party for a lump sum cash payment. This can be a great option if you no longer need the coverage or if you are looking to access funds for medical expenses or other financial needs.

No matter which life insurance option you choose, it is important to carefully consider your individual needs and financial goals. By staying protected in your eighties with the right policy, you can ensure that your loved ones are taken care of and that you have peace of mind knowing that you are prepared for whatever the future may hold.