Insure Your Tomorrow: The Best Life Insurance Policies

Are you looking for the best life insurance policies to protect your loved ones and secure their future? Look no further! In this article, we will explore the top picks for life insurance that will give you peace of mind and ensure your tomorrow is well-insured.

Life insurance is a crucial investment that provides financial protection for your family in the event of your untimely death. It can help cover funeral expenses, pay off outstanding debts, and provide a source of income for your loved ones. With so many options available in the market, it can be overwhelming to choose the right policy that suits your needs. That’s why we have curated a list of the best life insurance policies that offer comprehensive coverage and competitive rates.

![Top Best Life Insurance Companies Reviews For [QUOTES] Top Best Life Insurance Companies Reviews For [QUOTES]](https://artmy.biz.id/wp-content/uploads/2024/07/top-best-life-insurance-companies-reviews-for-quotes_0.png)

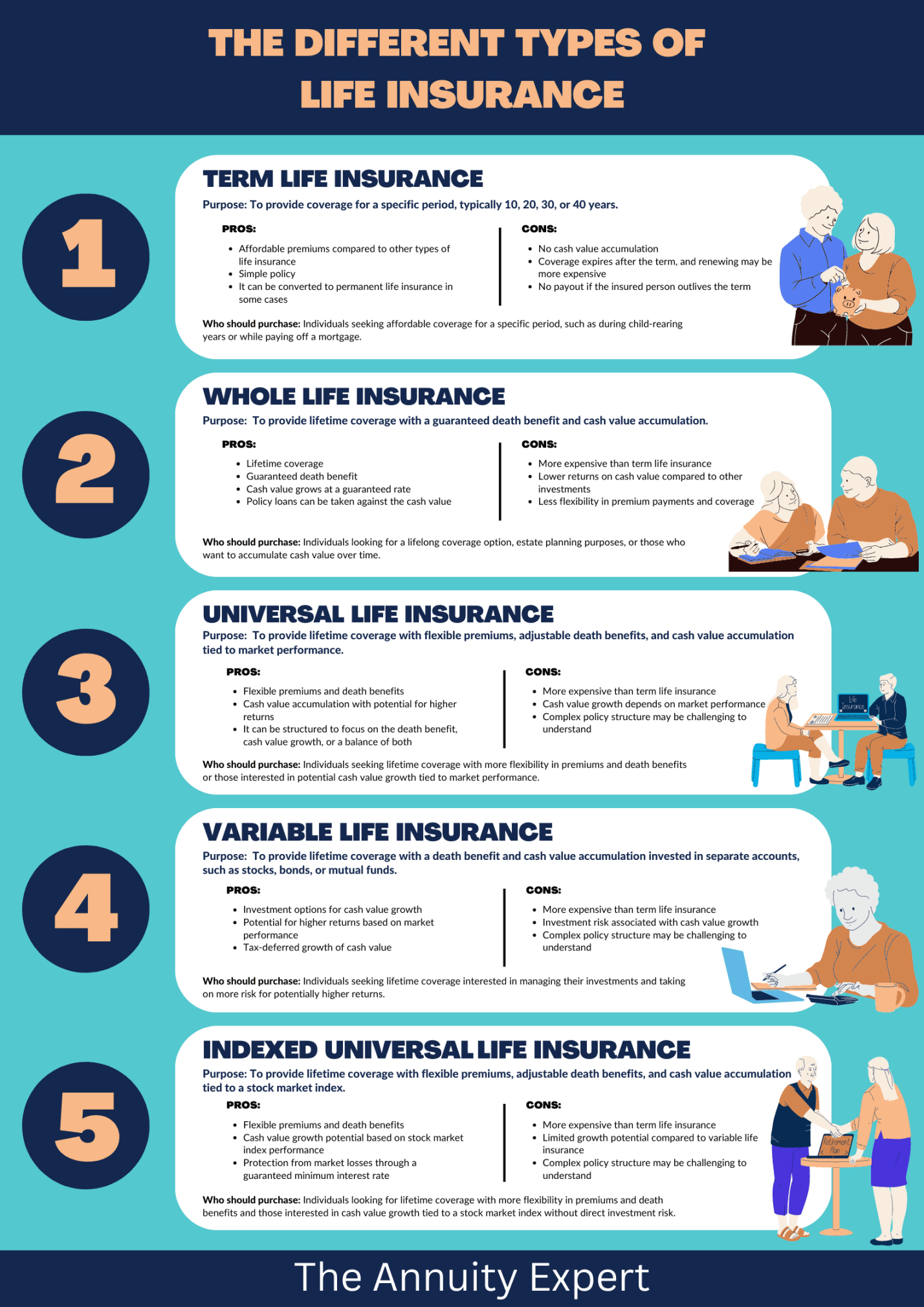

One of the top picks on our list is the term life insurance policy. This type of policy provides coverage for a specific period, usually between 10 to 30 years. It is ideal for individuals who want to protect their loved ones during their working years when they have the most financial responsibilities. Term life insurance is affordable, easy to understand, and offers a high coverage amount for a low premium. With flexible options to choose from, you can tailor the policy to meet your specific needs and budget.

Another popular choice among our top picks is the whole life insurance policy. This type of policy provides coverage for your entire life, as long as premiums are paid on time. Whole life insurance offers a guaranteed death benefit, cash value accumulation, and dividends that can be used to supplement retirement income. It is a long-term investment that provides financial security for your loved ones and ensures your legacy is preserved. With fixed premiums and a guaranteed payout, whole life insurance is a reliable choice for those who want permanent coverage and financial stability.

For individuals who want a flexible and customizable life insurance policy, the universal life insurance policy is a great option. This type of policy offers adjustable premiums, death benefits, and cash value accumulation. Universal life insurance allows you to increase or decrease coverage amounts, change premium payment schedules, and access cash value for emergencies or retirement expenses. It provides the flexibility to adapt to your changing financial needs and goals, making it a versatile choice for individuals looking for long-term financial security.

If you are looking for a simple and affordable life insurance policy that offers guaranteed acceptance, the final expense insurance policy is a perfect choice. This type of policy is designed to cover end-of-life expenses, such as funeral costs, medical bills, and outstanding debts. Final expense insurance does not require a medical exam or health questionnaire, making it accessible to individuals with pre-existing conditions or high-risk factors. With guaranteed acceptance and fixed premiums, final expense insurance provides peace of mind knowing that your loved ones will not be burdened by financial obligations after your passing.

In conclusion, choosing the best life insurance policy is essential for protecting your loved ones and ensuring their financial security. Whether you prefer term life insurance for temporary coverage, whole life insurance for permanent protection, universal life insurance for flexibility, or final expense insurance for guaranteed acceptance, there is a policy that suits your needs and budget. With our top picks for life insurance, you can rest assured that your tomorrow is well-insured and your loved ones are taken care of.

Discover Our Top Picks for Peace of Mind!

In today’s fast-paced world, it’s more important than ever to ensure that you and your loved ones are protected financially in the event of unforeseen circumstances. That’s where life insurance comes in. By investing in a life insurance policy, you can have peace of mind knowing that your family will be taken care of in the event of your passing.

![Top Best Life Insurance Companies Reviews For [QUOTES] Top Best Life Insurance Companies Reviews For [QUOTES]](https://artmy.biz.id/wp-content/uploads/2024/07/top-best-life-insurance-companies-reviews-for-quotes.png)

But with so many options available on the market, how do you know which life insurance policy is the best fit for you? That’s where we come in. We have carefully researched and reviewed the top life insurance policies available to help you make an informed decision. Here are our top picks for peace of mind:

1. Term Life Insurance: Term life insurance is one of the most popular types of life insurance policies due to its affordability and simplicity. With term life insurance, you pay a fixed premium for a specific period of time (the term), typically ranging from 10 to 30 years. If you pass away during the term, your beneficiaries will receive a tax-free lump sum payment. Term life insurance is a great option for those looking for temporary coverage at an affordable price.

2. Whole Life Insurance: Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. In addition to the death benefit, whole life insurance also has a cash value component that grows over time. This cash value can be borrowed against or used to pay premiums. Whole life insurance offers peace of mind knowing that your loved ones will be taken care of no matter when you pass away.

3. Universal Life Insurance: Universal life insurance is another type of permanent life insurance that offers flexibility in premium payments and death benefits. With universal life insurance, you have the option to adjust your premium payments and death benefits to suit your changing needs. This type of policy also has a cash value component that can grow over time. Universal life insurance is a great option for those looking for flexibility in their life insurance coverage.

4. Variable Life Insurance: Variable life insurance is a type of permanent life insurance that allows you to invest a portion of your premium payments in a separate account. This account can be invested in a variety of investment options such as stocks, bonds, and mutual funds. The cash value of the policy can fluctuate based on the performance of the investments. Variable life insurance offers the potential for higher returns but also comes with higher risk.

5. Indexed Universal Life Insurance: Indexed universal life insurance is a type of universal life insurance that offers the potential for cash value growth based on the performance of a stock market index, such as the S&P 500. Indexed universal life insurance policies have a cap on the potential gains but also offer a floor to protect against market downturns. This type of policy combines the flexibility of universal life insurance with the potential for higher returns based on market performance.

In conclusion, investing in a life insurance policy is a crucial step in ensuring that your loved ones are protected financially in the event of your passing. With our top picks for peace of mind, you can find the right life insurance policy to fit your needs and budget. Don’t wait until it’s too late – invest in a life insurance policy today and gain peace of mind knowing that your family will be taken care of no matter what the future holds.