Secure Your Sanctuary: Top Home Insurance Plans

Keeping your home safe and secure is a top priority for any homeowner. From unexpected accidents to natural disasters, it’s essential to have the right home insurance plan in place to protect your sanctuary. With so many options available, it can be overwhelming to choose the best coverage for your needs. That’s where we come in to help you find the top home insurance plans to keep your home safe.

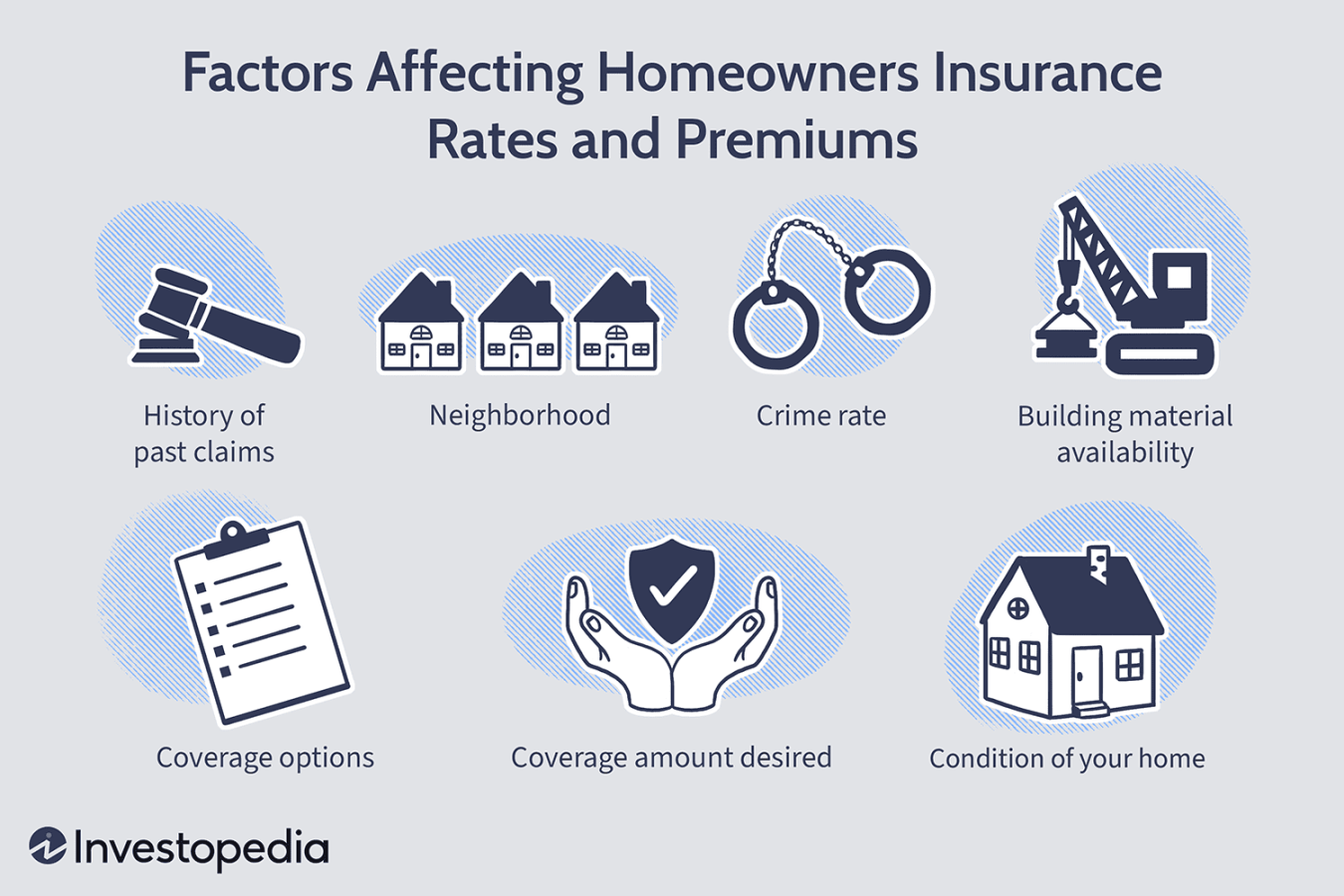

When it comes to securing your sanctuary, there are several key factors to consider when choosing a home insurance plan. The first step is to assess the value of your home and its contents. This will help you determine the amount of coverage you need to adequately protect your investment. You’ll also want to consider the location of your home and any specific risks that may be associated with it, such as proximity to flood zones or high-crime areas.

One of the top home insurance plans to consider is comprehensive coverage. This type of plan provides protection for a wide range of risks, including fire, theft, vandalism, and natural disasters. With comprehensive coverage, you can have peace of mind knowing that your home and belongings are protected against a variety of potential threats.

Another important factor to consider when choosing a home insurance plan is the level of customer service and support offered by the insurance provider. In the event of a claim, you’ll want to work with a company that is responsive, helpful, and reliable. Look for a provider that has a reputation for excellent customer service and a track record of handling claims quickly and efficiently.

In addition to comprehensive coverage and excellent customer service, it’s also important to consider the cost of the home insurance plan. While you don’t want to skimp on coverage, you also don’t want to pay more than necessary for protection. Shop around and compare quotes from different providers to find a plan that offers the right balance of coverage and affordability.

One of the top home insurance plans that offers comprehensive coverage, excellent customer service, and competitive pricing is XYZ Home Insurance. With XYZ Home Insurance, you can customize your coverage to meet your specific needs and budget. Whether you’re looking for basic protection or enhanced coverage options, XYZ Home Insurance has a plan for you.

When you choose XYZ Home Insurance, you can rest easy knowing that your sanctuary is protected. With coverage for fire, theft, vandalism, and more, you can have peace of mind knowing that your home and belongings are safe and secure. And with XYZ Home Insurance’s top-notch customer service team, you can trust that help is just a phone call away in the event of a claim.

In conclusion, when it comes to securing your sanctuary, choosing the right home insurance plan is essential. By considering factors such as coverage, customer service, and cost, you can find the top home insurance plan to keep your home safe. With XYZ Home Insurance, you can protect your sanctuary with confidence and peace of mind. So don’t wait any longer – contact XYZ Home Insurance today to get started on securing your home and belongings.

Peace of Mind: Safeguarding Your Home

When it comes to keeping your home safe and secure, having the right insurance plan in place is essential. Your home is not just a place where you live, it’s your sanctuary, your safe haven from the outside world. That’s why it’s important to choose a home insurance plan that gives you peace of mind and safeguards your home from any unforeseen events.

One of the best ways to protect your home is by investing in a comprehensive home insurance plan that covers a wide range of risks. From natural disasters like floods and earthquakes to accidents like fires and theft, a good home insurance plan will have you covered no matter what happens. With the right coverage in place, you can rest easy knowing that your home and your belongings are protected.

There are many different home insurance plans available on the market, so it’s important to do your research and find the one that best fits your needs. Some plans offer basic coverage for things like fire and theft, while others provide more comprehensive protection for a wider range of risks. It’s important to carefully review the coverage options and choose a plan that gives you the peace of mind you need to feel secure in your home.

In addition to choosing the right coverage, it’s also important to consider the reputation and reliability of the insurance provider. You want to make sure that the company you choose has a good track record of customer service and claims handling, so that you can trust them to be there for you when you need them most. Reading reviews and getting recommendations from friends and family can help you find a reputable insurance provider that you can rely on.

Another important factor to consider when choosing a home insurance plan is the cost. While you don’t want to skimp on coverage, you also don’t want to pay more than you need to for insurance. It’s important to compare quotes from multiple providers and choose a plan that offers the right balance of coverage and affordability. With a little research and some comparison shopping, you can find a home insurance plan that fits your budget and gives you the peace of mind you need to feel secure in your home.

In addition to choosing the right insurance plan, there are also steps you can take to safeguard your home and prevent potential risks. Installing a security system, smoke detectors, and carbon monoxide alarms can help protect your home from theft and accidents. Keeping your home well-maintained and in good repair can also help prevent costly damage from things like leaks and electrical problems. By taking proactive steps to safeguard your home, you can reduce the likelihood of needing to make a claim on your insurance and keep your home safe and secure for years to come.

In conclusion, safeguarding your home with the right insurance plan is essential for protecting your sanctuary and giving you peace of mind. By choosing a comprehensive home insurance plan, selecting a reputable provider, and taking steps to prevent potential risks, you can ensure that your home is safe and secure no matter what comes your way. With the right coverage in place, you can rest easy knowing that your home and your belongings are protected, allowing you to enjoy the comfort and security of your home to the fullest.