Deciding Between Term and Whole Life Insurance

When it comes to choosing the right insurance policy for yourself and your loved ones, one of the biggest decisions you’ll have to make is whether to go with term life insurance or whole life insurance. Each type of insurance has its own set of pros and cons, and it’s important to understand them before making a decision.

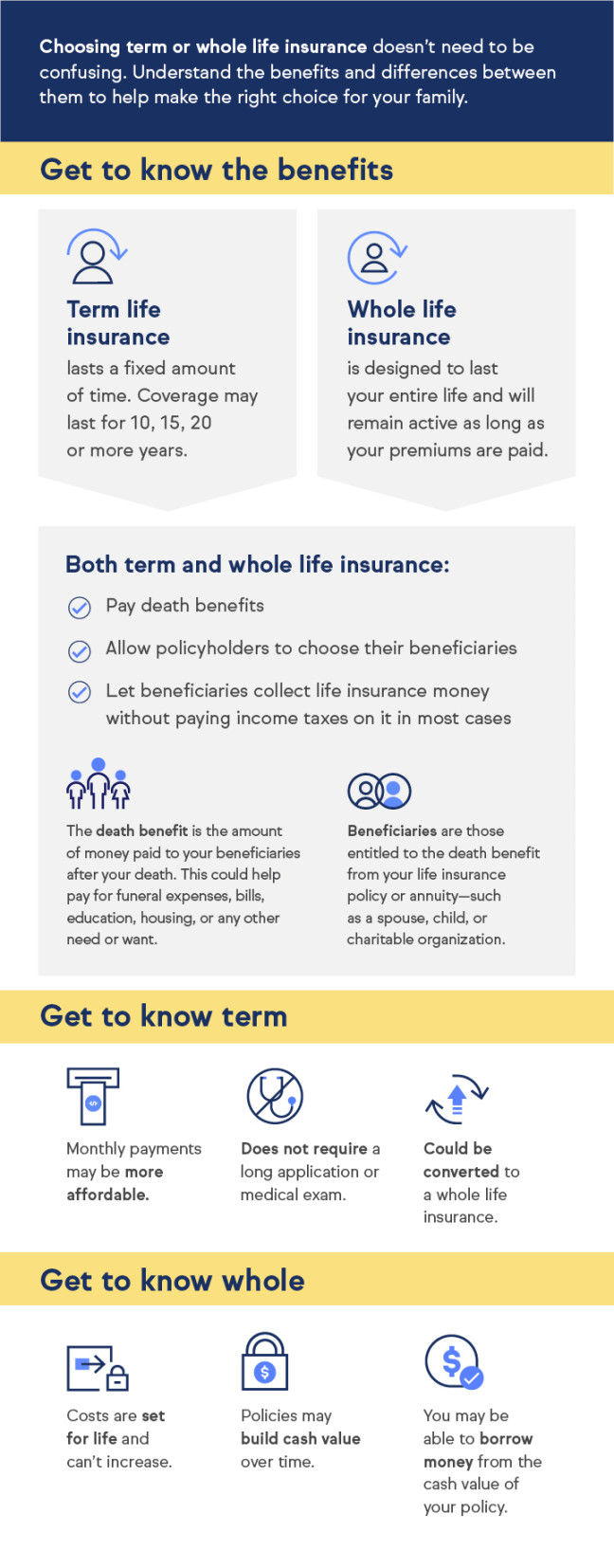

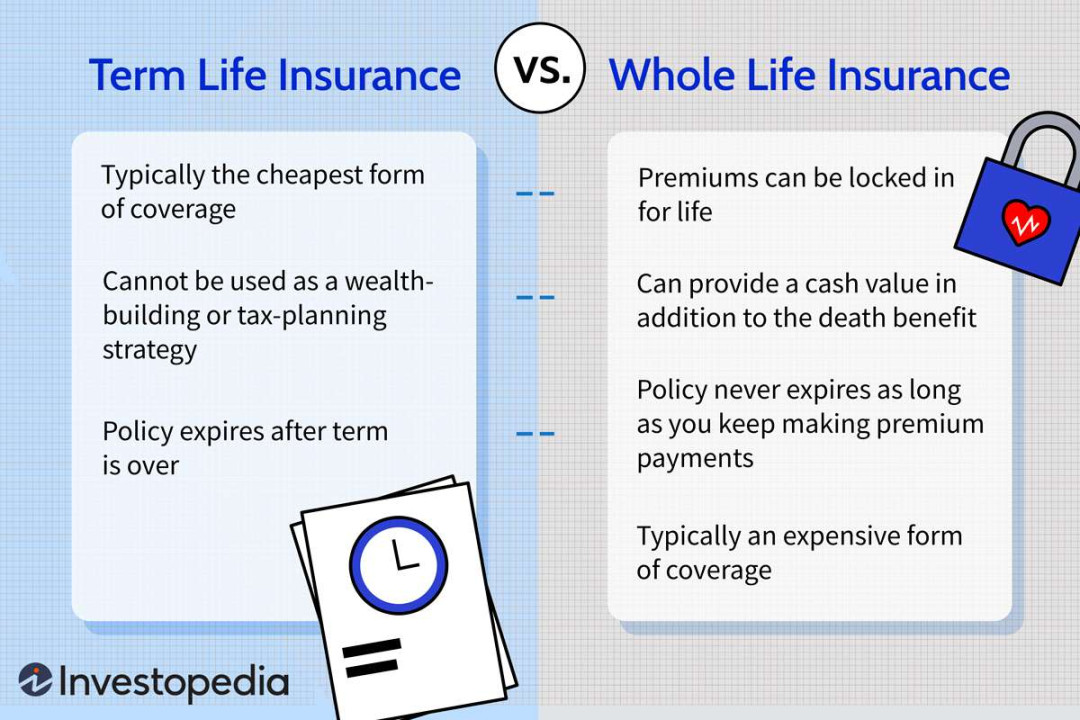

Term life insurance is a type of policy that provides coverage for a specific period of time, usually anywhere from 10 to 30 years. If the insured individual passes away during the term of the policy, their beneficiaries will receive a death benefit. Term life insurance is typically more affordable than whole life insurance, making it a popular choice for those who are looking for basic coverage without breaking the bank.

On the other hand, whole life insurance is a permanent policy that provides coverage for the insured’s entire life. In addition to the death benefit, whole life insurance also has a cash value component that grows over time. This cash value can be borrowed against or used to supplement retirement income. While whole life insurance premiums are typically higher than term life insurance premiums, the policy provides lifelong coverage and a guaranteed payout to beneficiaries.

So, how do you decide between term and whole life insurance? It ultimately comes down to your individual needs and financial goals. If you’re looking for affordable coverage for a specific period of time, term life insurance may be the right choice for you. It’s a great option for young families who want to ensure their loved ones are taken care of in the event of an unexpected tragedy.

On the other hand, if you’re looking for lifelong coverage and the opportunity to build cash value over time, whole life insurance may be the better option. Whole life insurance is a great choice for those who want to leave a legacy for their loved ones or have a source of tax-free income in retirement.

It’s important to consider your current financial situation, as well as your long-term goals, when deciding between term and whole life insurance. Think about how much coverage you need, how long you need it for, and what you hope to achieve with your policy. Consulting with a financial advisor can also help you make an informed decision that aligns with your unique circumstances.

In the end, both term and whole life insurance have their own benefits and drawbacks. Whether you choose term life insurance or whole life insurance, the most important thing is to have a policy in place to protect your loved ones and provide peace of mind. So take the time to explore your options, weigh the pros and cons, and make a decision that works best for you and your family.

Choosing the Right Policy for Your Future

When it comes to securing your financial future, choosing the right insurance policy is crucial. With so many options available, it can be overwhelming to decide between term and whole life insurance. Each type of policy has its own unique benefits and drawbacks, so it’s important to carefully consider your individual needs and goals before making a decision.

Term life insurance is a popular choice for many people due to its affordability and simplicity. This type of policy provides coverage for a specific period of time, typically ranging from 10 to 30 years. If the policyholder passes away during the term, their beneficiaries will receive a death benefit. However, once the term ends, the coverage expires and the policyholder will need to either renew the policy at a higher rate or purchase a new policy.

On the other hand, whole life insurance offers lifelong coverage and includes a cash value component that grows over time. This type of policy is more expensive than term life insurance, but it provides additional benefits such as the ability to borrow against the cash value or receive dividends. Whole life insurance can also serve as an investment vehicle, offering a way to build wealth over time while still providing financial protection for your loved ones.

When deciding between term and whole life insurance, it’s important to consider your long-term financial goals. If you’re primarily looking for affordable coverage to protect your family in the event of your passing, term life insurance may be the best option for you. However, if you’re interested in building wealth and leaving a financial legacy for future generations, whole life insurance could be a better fit.

Another factor to consider is your current financial situation. If you have limited funds available for insurance premiums, term life insurance may be more feasible in the short term. However, if you have the means to invest in a whole life insurance policy, the long-term benefits and financial security it provides may outweigh the higher initial costs.

It’s also important to think about your overall risk tolerance and financial stability. Whole life insurance offers a guaranteed death benefit and cash value growth, making it a more secure option for those who prefer stability and predictability in their financial planning. On the other hand, term life insurance may be a better choice for individuals who are comfortable with taking on more risk in exchange for lower premiums and the potential for higher returns elsewhere.

Ultimately, the decision between term and whole life insurance comes down to your individual needs, goals, and financial situation. It’s important to carefully evaluate your options and consult with a financial advisor or insurance agent to determine the best policy for your future. By taking the time to consider all factors and make an informed decision, you can ensure that you have the right insurance coverage in place to protect your loved ones and secure your financial legacy for years to come.