The Importance of Life Insurance for Seniors

As our parents age, it becomes increasingly important to think about their financial security and well-being. One crucial aspect of this is ensuring that they have adequate life insurance coverage. While many seniors may feel that life insurance is unnecessary at this stage in their lives, the reality is that it can provide invaluable peace of mind for both them and their loved ones.

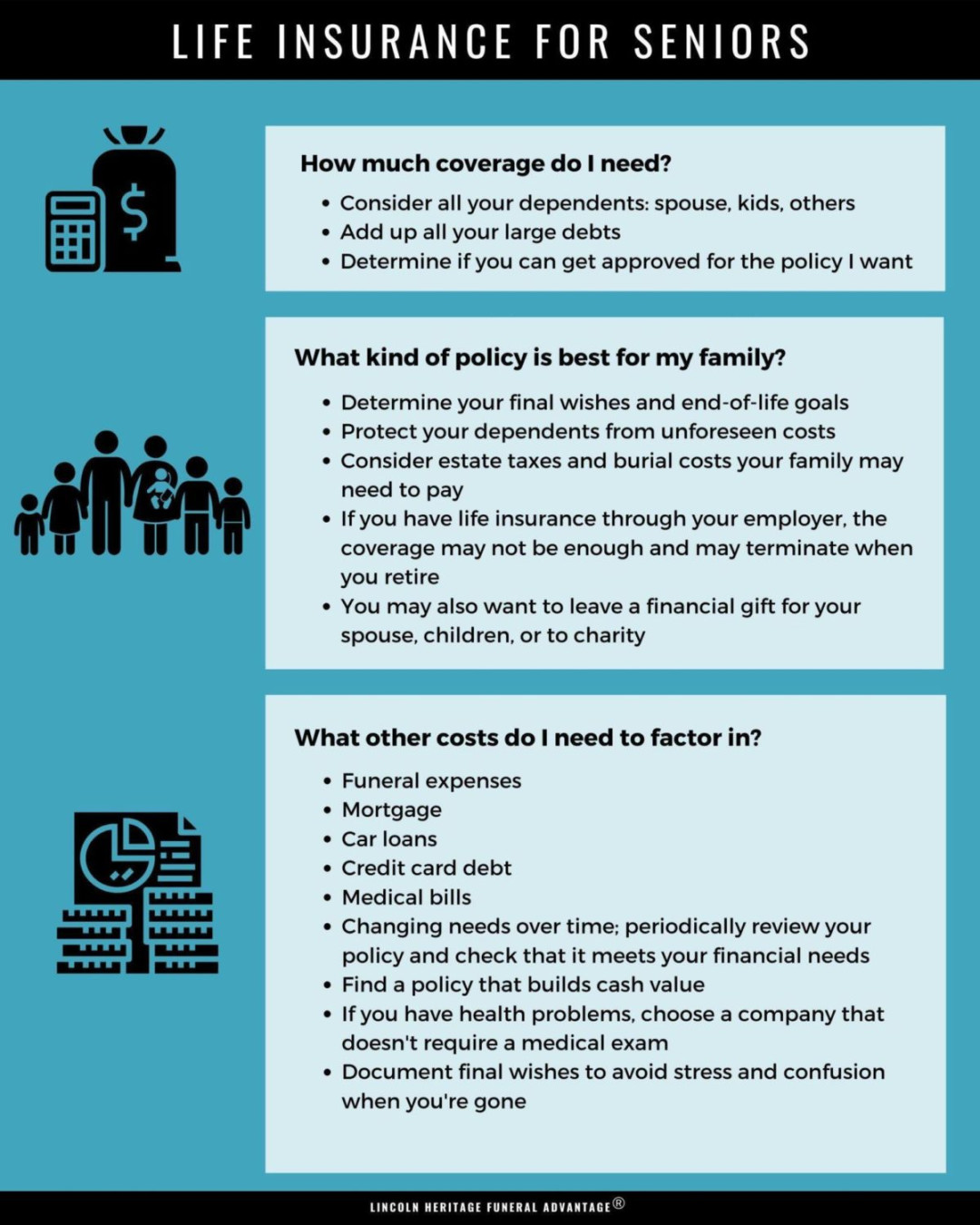

Life insurance for seniors matters for a variety of reasons. Firstly, it can help cover end-of-life expenses such as funeral costs, medical bills, and outstanding debts. These expenses can add up quickly, and having a life insurance policy in place can alleviate the financial burden on surviving family members. Additionally, life insurance can provide a source of income replacement for any dependents that seniors may have, ensuring that their loved ones are taken care of in the event of their passing.

Another important aspect of life insurance for seniors is estate planning. By having a life insurance policy in place, seniors can ensure that their assets are distributed according to their wishes after they pass away. This can help prevent any potential disputes among family members and provide a clear plan for the future. Life insurance can also help cover estate taxes and other financial obligations, ensuring that seniors can leave a legacy for their loved ones without burdening them with additional costs.

Moreover, life insurance can provide seniors with a sense of security and peace of mind knowing that their loved ones will be taken care of financially. It can also help protect any remaining assets and provide a financial safety net for unexpected expenses or emergencies. By investing in a life insurance policy, seniors can rest easy knowing that they have a plan in place for the future.

There are many different types of life insurance policies available for seniors, including term life insurance, whole life insurance, and universal life insurance. It’s important for seniors to carefully consider their options and choose a policy that best fits their individual needs and circumstances. Working with a financial advisor or insurance agent can help seniors navigate the complex world of life insurance and make informed decisions about their coverage.

In conclusion, life insurance for seniors is a crucial aspect of financial planning that should not be overlooked. It can provide seniors with peace of mind, financial security, and a clear plan for the future. By investing in a life insurance policy, seniors can ensure that their loved ones are taken care of and their assets are protected. Taking care of mom and dad means making sure they have the necessary safeguards in place, and life insurance is an important tool in achieving this goal.

Ensuring a Bright Future for Mom and Dad

When it comes to caring for our aging parents, there are many factors to consider. From finding the right assisted living facility to ensuring they have access to quality healthcare, the list of responsibilities can seem endless. However, one crucial aspect of caring for our elderly loved ones that is often overlooked is the importance of life insurance.

Life insurance for seniors is a vital tool in ensuring a bright future for mom and dad. While many people may think that life insurance is only for younger individuals with dependents, the truth is that seniors can also benefit greatly from having a policy in place. Here are a few reasons why life insurance for seniors matters:

1. Financial Security: As our parents age, their financial needs may increase. From medical expenses to long-term care costs, the financial burden on seniors can be significant. Having a life insurance policy can provide a safety net for mom and dad, ensuring that they have the financial security they need to enjoy their golden years without worry.

2. Legacy Planning: For many seniors, leaving a legacy for their loved ones is a top priority. Life insurance can be an essential tool in legacy planning, allowing mom and dad to leave a financial gift for their children or grandchildren. Whether it’s paying off debts, funding education expenses, or simply leaving a financial cushion for their heirs, life insurance can help seniors ensure that their legacy lives on.

3. Covering Final Expenses: One of the most practical reasons to have life insurance as a senior is to cover final expenses. From funeral costs to outstanding debts, the financial burden of end-of-life expenses can be overwhelming for families. Having a life insurance policy in place can help alleviate this burden, ensuring that mom and dad’s final wishes are carried out without putting a strain on their loved ones.

4. Peace of Mind: Perhaps the most important reason why life insurance for seniors matters is the peace of mind it provides. Knowing that mom and dad are financially protected in the event of their passing can bring comfort to both seniors and their families. It allows seniors to enjoy their retirement years without worrying about the financial implications of their passing, and it gives their loved ones the assurance that they will be taken care of.

In conclusion, life insurance for seniors is a crucial component of ensuring a bright future for mom and dad. From providing financial security and legacy planning to covering final expenses and offering peace of mind, a life insurance policy can make a significant difference in the lives of seniors and their families. By prioritizing life insurance as part of their overall care plan, we can help our aging parents enjoy their golden years with confidence and security.