Embark on Your Health Insurance Journey

Welcome to the exciting world of health insurance! Navigating the ins and outs of health insurance options can seem daunting at first, but fear not – we are here to guide you through every step of the way. Think of this journey as a thrilling adventure filled with twists, turns, and ultimately, the satisfaction of finding the perfect health coverage for you.

Before we begin, it’s important to understand the basics of health insurance. Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured. It helps protect you from high and unexpected medical costs, allowing you to access the healthcare services you need without breaking the bank. There are various types of health insurance plans, each offering different levels of coverage and benefits.

As you embark on your health insurance journey, the first step is to assess your healthcare needs. Consider factors such as your age, overall health, and any existing medical conditions. It’s important to choose a plan that meets your specific healthcare needs and fits your budget. Do you require regular doctor visits or prescription medications? Are you planning for a family and in need of maternity coverage? Understanding your healthcare needs will help you narrow down your options and find the right plan for you.

Next, it’s time to explore the different types of health insurance plans available. Some common options include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point of Service (POS) plans. Each plan has its own network of doctors, hospitals, and other healthcare providers, as well as rules about how you can access care. It’s important to compare the costs, coverage, and restrictions of each plan to determine which one best suits your needs.

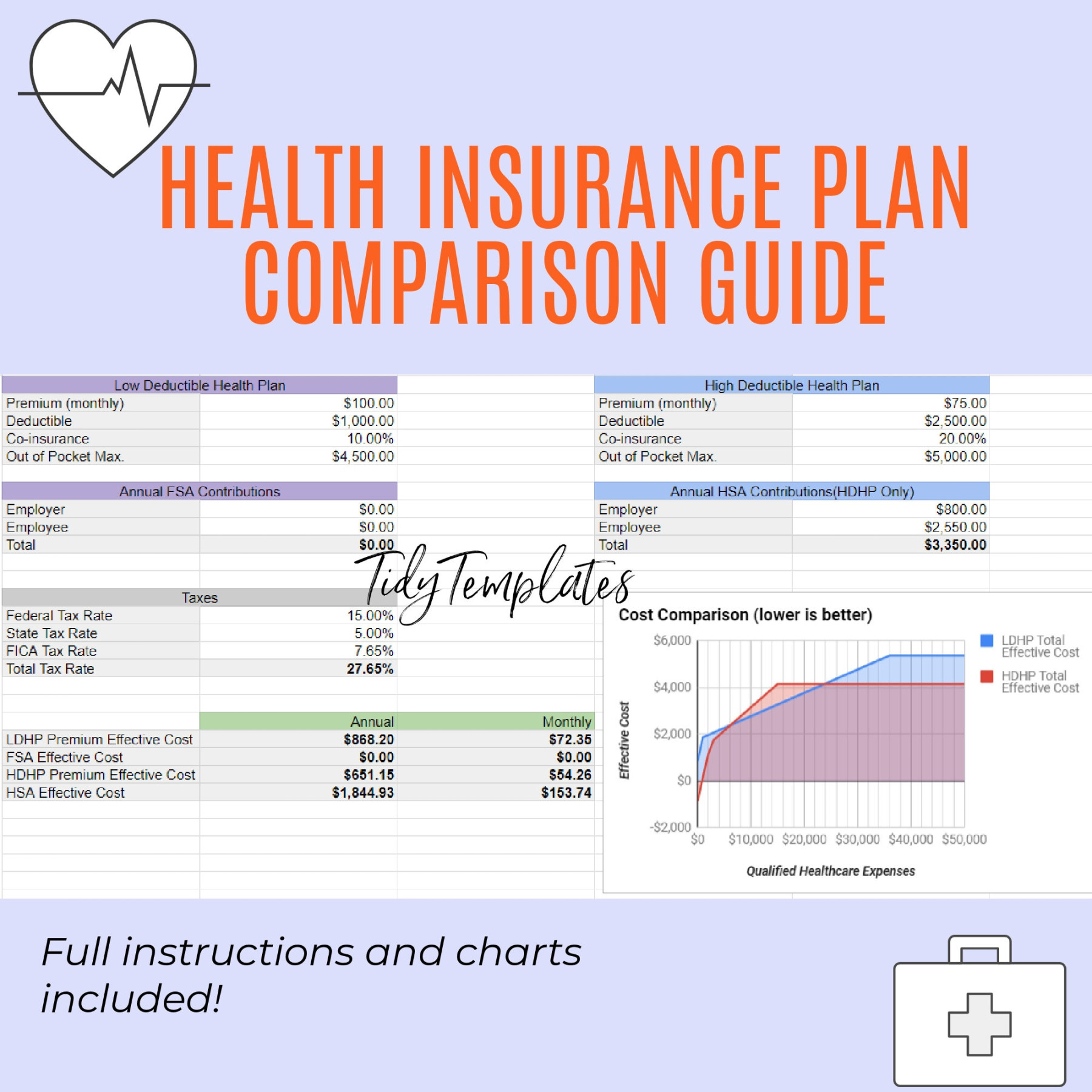

Once you have a better understanding of the types of health insurance plans available, it’s time to start shopping for coverage. You can explore your options through the Health Insurance Marketplace, your employer, or a private insurance provider. Take the time to compare different plans, paying close attention to premiums, deductibles, copayments, and coinsurance. Remember, the cheapest plan may not always be the best option if it doesn’t provide the coverage you need.

As you navigate through the sea of health insurance options, don’t be afraid to ask questions. Reach out to insurance providers, healthcare professionals, or even friends and family members who have experience with health insurance. Understanding the jargon and intricacies of health insurance can be overwhelming, but seeking guidance from others can help simplify the process and ensure you make an informed decision.

Lastly, once you have selected a health insurance plan, it’s important to stay informed and proactive about your coverage. Review your plan’s benefits and limitations, keep track of important dates such as open enrollment periods, and be sure to utilize preventive services covered by your plan. By staying engaged with your health insurance, you can maximize the benefits and protections it provides, ensuring peace of mind and financial security in the face of medical expenses.

Embarking on your health insurance journey may seem like a daunting task, but with the right knowledge and guidance, you can navigate the process with confidence and ease. Remember, finding the right health insurance plan is a crucial step in safeguarding your health and well-being. So buckle up, embrace the adventure, and set sail towards a healthier and happier future!

Navigating Health Insurance Options: A Beginner’s Guide

Embark on Your Health Insurance Journey

When it comes to health insurance, embarking on the journey to find the right coverage can be overwhelming. From understanding the different types of plans to deciphering complex terminology, there is a lot to consider. However, with a little guidance and some patience, you can chart the course to coverage joy.

Charting the Course to Coverage Joy

So, you’ve decided to take the plunge and explore your health insurance options. Congratulations! You’re on the path to securing peace of mind and financial protection for your future health needs. But where do you start? How do you navigate the sea of information and make sense of it all? Don’t worry, we’ve got you covered.

First and foremost, it’s important to understand the different types of health insurance plans available to you. The most common options include HMOs, PPOs, and EPOs, each with its own set of benefits and limitations. HMOs, or Health Maintenance Organizations, typically require you to choose a primary care physician and obtain referrals for specialist care. PPOs, or Preferred Provider Organizations, offer more flexibility in choosing healthcare providers but often come with higher out-of-pocket costs. EPOs, or Exclusive Provider Organizations, combine elements of both HMOs and PPOs, providing a balance of cost savings and provider choice.

Once you have a basic understanding of the types of plans available, the next step is to assess your healthcare needs and budget. Consider factors such as your current health status, prescription medication requirements, and any ongoing medical treatments. It’s also important to think about your financial situation and how much you can comfortably afford to spend on monthly premiums, deductibles, and copayments.

After evaluating your needs and budget, it’s time to compare different health insurance plans. Websites like Healthcare.gov and eHealthInsurance.com offer tools and resources to help you compare plans based on coverage options, costs, and provider networks. Take the time to carefully review each plan’s benefits and limitations, paying close attention to factors like coverage for preventive care, prescription drugs, and out-of-network services.

As you navigate the sea of health insurance options, don’t be afraid to ask for help. Insurance brokers and healthcare navigators are available to assist you in understanding your options and choosing the right plan for your needs. They can help you navigate the enrollment process, answer any questions you may have, and provide guidance on how to maximize your coverage.

Remember, finding the right health insurance plan is a journey, not a destination. Your needs and circumstances may change over time, so it’s important to regularly reassess your coverage and make adjustments as needed. By staying informed, proactive, and flexible, you can chart a course to coverage joy and ensure that you have the protection you need to live a healthy and happy life.