The Bright Side of Life Insurance

Life insurance is often seen as a somber topic, associated with thoughts of morbidity and loss. However, there is a bright side to having life insurance that is often overlooked. In fact, life insurance can be a valuable asset that provides peace of mind and financial security for you and your loved ones.

One of the main benefits of life insurance is the financial protection it provides. In the event of your untimely passing, your life insurance policy can provide your loved ones with a lump sum payment that can help cover funeral expenses, outstanding debts, and everyday living expenses. This financial cushion can provide much-needed relief during a difficult time, allowing your loved ones to grieve without the added stress of financial worries.

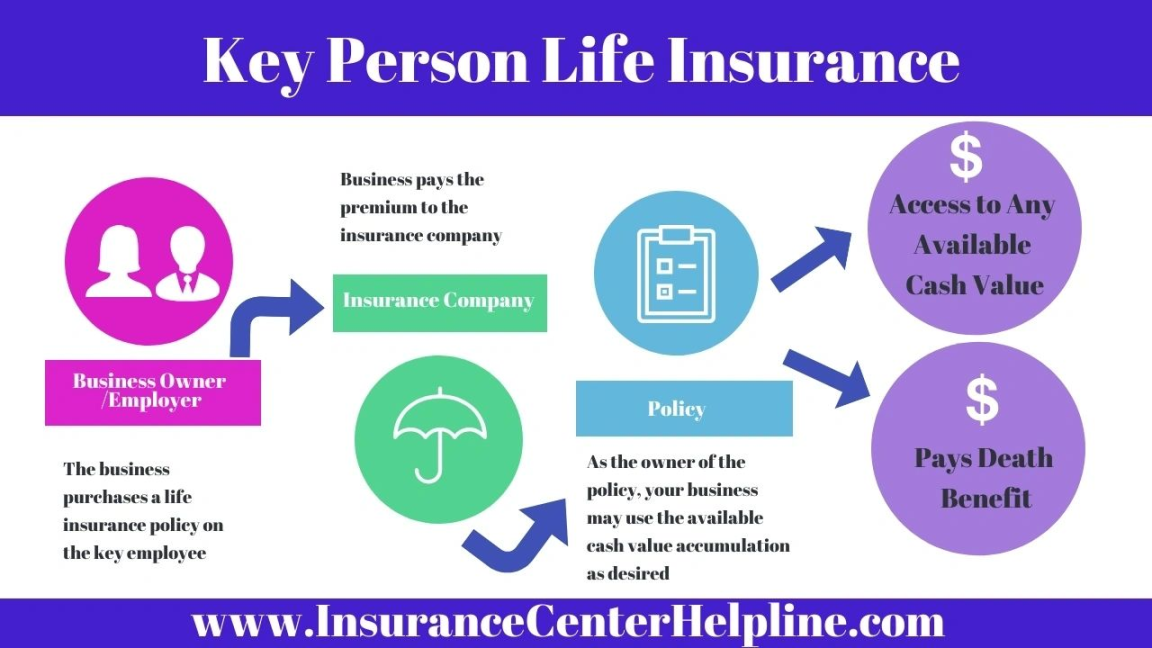

In addition to providing financial protection, life insurance can also be a valuable investment tool. Depending on the type of policy you choose, your life insurance policy can accrue cash value over time. This cash value can be accessed during your lifetime, providing you with a source of emergency funds or a supplemental source of income in retirement.

Another bright side of life insurance is the peace of mind it brings. Knowing that you have a life insurance policy in place can provide a sense of security and comfort, knowing that your loved ones will be taken care of financially in the event of your passing. This peace of mind can allow you to focus on living your life to the fullest, without constantly worrying about what would happen to your loved ones if something were to happen to you.

Life insurance can also provide a sense of empowerment and control over your financial future. By having a life insurance policy in place, you can ensure that your loved ones will be taken care of no matter what life throws your way. This sense of control can be empowering, allowing you to make decisions with confidence and peace of mind, knowing that you have a safety net in place.

Furthermore, life insurance can also be a powerful tool for estate planning. By naming beneficiaries on your life insurance policy, you can ensure that your assets are distributed according to your wishes after your passing. This can help prevent family disputes and ensure that your loved ones are taken care of in the way that you intended.

In conclusion, the bright side of life insurance is often overlooked, but it is worth considering the many benefits that life insurance can provide. From financial protection to peace of mind, life insurance can be a valuable asset that provides security and comfort for you and your loved ones. So, take the time to explore your options and consider investing in a life insurance policy that can help you live your life to the fullest, knowing that you have a safety net in place.

Life Insurance: Why It’s Worth Having

Peace of Mind for the Future

When it comes to planning for the future, one of the most important things you can do is invest in life insurance. While it may not be the most exciting topic to discuss, having a life insurance policy in place can provide you with the peace of mind you need to enjoy the present without worrying about what may happen in the future.

Life insurance is a financial safety net that can provide support for your loved ones in the event of your passing. By paying monthly premiums, you can ensure that your family is protected from financial hardship and able to maintain their quality of life even after you’re gone. This assurance can bring a sense of relief and security that can’t be matched by anything else.

One of the key benefits of life insurance is the ability to cover outstanding debts and expenses. In the event of your passing, your policy can help pay off any remaining mortgage, loans, or credit card debt, ensuring that your family isn’t burdened by these financial obligations. This can provide them with the stability they need to move forward and focus on healing after your loss.

Additionally, life insurance can help replace your income and provide for your family’s ongoing expenses. By calculating your current income and estimating your future financial needs, you can determine the amount of coverage that is right for you. This way, your loved ones won’t have to worry about how they will pay for everyday essentials like groceries, utilities, and school tuition.

Another important aspect of life insurance is the ability to leave a legacy for your family. By naming beneficiaries in your policy, you can ensure that your loved ones receive a financial inheritance that can help them achieve their goals and dreams. Whether it’s funding a child’s education, starting a business, or buying a home, your life insurance policy can provide the means to make these aspirations a reality.

Moreover, life insurance can also help cover final expenses such as funeral costs, medical bills, and estate taxes. By having a policy in place, you can ease the financial burden on your family during a difficult time and allow them to focus on honoring your memory instead of worrying about how they will afford these expenses.

In addition to the practical benefits of life insurance, having a policy can also bring emotional peace of mind. Knowing that your loved ones will be taken care of financially can relieve the stress and anxiety that often comes with thinking about the future. This sense of security can allow you to live more fully in the present and enjoy the time you have with your family without constantly worrying about what may happen if the unexpected occurs.

Overall, life insurance is a valuable investment that can provide you with the peace of mind you need to enjoy life to the fullest. By protecting your loved ones from financial hardship and ensuring that your legacy lives on, a life insurance policy can give you the confidence to face the future with optimism and security. So, don’t wait any longer – consider getting a life insurance policy today and make sure your family’s future is secure.