Life Insurance: What Does It Cover?

Life Insurance Explained: The Basics

When it comes to securing your financial future and protecting your loved ones, life insurance plays a crucial role. But what exactly does life insurance cover? Let’s dive into the basics of this invaluable financial tool.

Life insurance is a contract between you and an insurance company, where you pay a premium in exchange for a sum of money (the death benefit) to be paid out to your beneficiaries upon your death. This ensures that your loved ones are taken care of financially after you’re gone.

One of the key things that life insurance covers is the ability to replace your income. If something were to happen to you, your family may struggle to make ends meet without your income. Life insurance can provide them with a financial safety net, ensuring that they can continue to pay bills, mortgage, and other expenses.

Life insurance also covers funeral and burial expenses. Funerals can be costly, and the last thing you want is to burden your family with these expenses during a difficult time. Life insurance can help cover these costs, allowing your family to focus on grieving and healing.

Another important aspect of life insurance coverage is debt repayment. If you have outstanding debts such as a mortgage, car loan, or credit card debt, your life insurance policy can help settle these debts so your family isn’t left with financial obligations.

Additionally, life insurance can cover your children’s education expenses. If you have young children, you may want to ensure that they have access to a quality education even if you’re no longer around. Life insurance can provide funds to cover tuition fees, ensuring that your children can pursue their dreams.

Furthermore, life insurance can cover medical expenses if you were to fall critically ill. Some policies offer living benefits or accelerated death benefits, allowing you to access a portion of the death benefit while you’re still alive to cover medical expenses or other financial needs.

In the event of your death, life insurance can also cover estate taxes. If you have a substantial estate, your beneficiaries may be required to pay estate taxes. Life insurance can provide them with the funds needed to cover these taxes, ensuring that your assets are passed on to your loved ones without a hefty tax burden.

Life insurance can also cover final expenses, such as legal fees and estate administration costs. By having a life insurance policy in place, you can ensure that these expenses are taken care of without depleting your estate.

In conclusion, life insurance is a versatile financial tool that covers a wide range of expenses and provides your loved ones with financial security and peace of mind. By understanding the basics of life insurance coverage, you can make an informed decision about protecting your family’s future.

Life Insurance: What Does It Cover?

Your Guide to Understanding Coverage

Life insurance is a crucial aspect of financial planning that often gets overlooked. Many people have a basic understanding of life insurance, but they may not fully grasp what it covers. In this guide, we will explore the different aspects of life insurance coverage to help you better understand how it can protect your loved ones in the event of your passing.

One of the key components of life insurance coverage is the death benefit. This is the amount of money that is paid out to your beneficiaries upon your death. The death benefit can be used to cover a variety of expenses, such as funeral costs, outstanding debts, and everyday living expenses. It provides a financial safety net for your loved ones during a difficult time.

In addition to the death benefit, life insurance policies can also offer coverage for critical illness or disability. Some policies include riders that provide additional benefits if you are diagnosed with a serious illness or become disabled and are unable to work. This can help alleviate the financial burden of medical bills and lost income, allowing you to focus on your recovery without worrying about money.

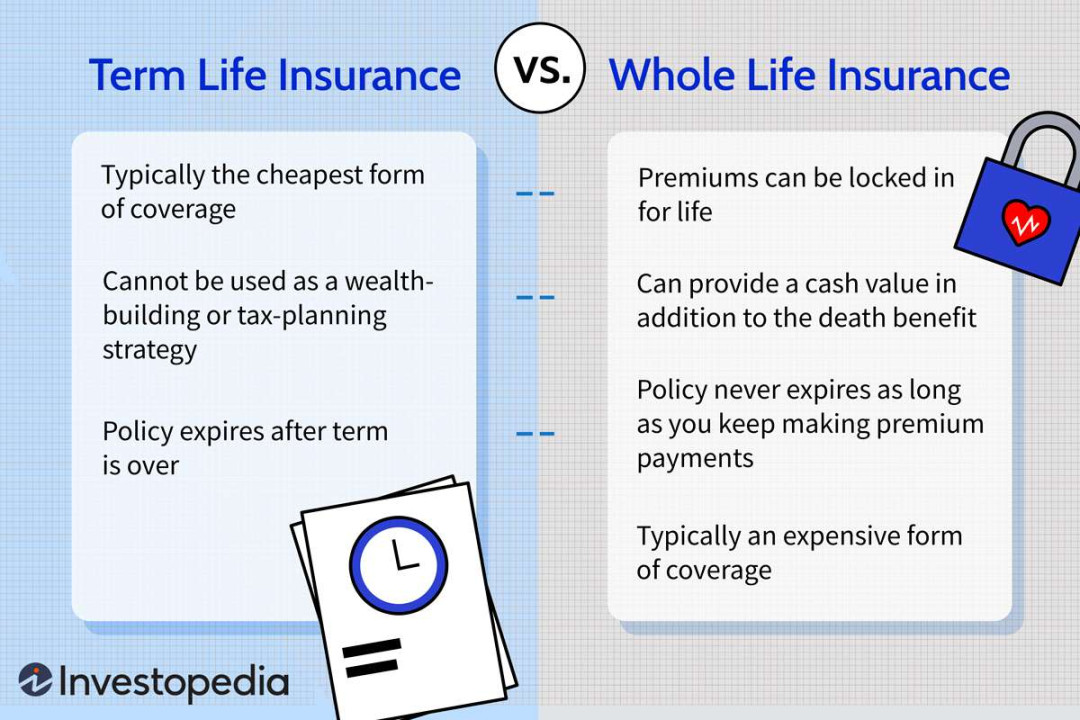

Another aspect of life insurance coverage is the cash value component. Some types of life insurance, such as whole life or universal life policies, accumulate cash value over time. This cash value can be accessed through policy loans or withdrawals and can be used for a variety of purposes, such as supplementing retirement income or paying for your children’s education. It provides a valuable source of liquidity that can be tapped into when needed.

Furthermore, life insurance coverage can also extend to estate planning purposes. By naming beneficiaries and establishing a trust, you can ensure that your assets are distributed according to your wishes after your passing. Life insurance can help cover estate taxes and other expenses, allowing your loved ones to inherit your assets without being burdened by financial obligations.

Additionally, some life insurance policies offer living benefits, such as long-term care coverage. This can provide financial assistance if you require long-term care due to a chronic illness or disability. It can help cover the costs of nursing home care, assisted living facilities, and in-home care services, allowing you to maintain your quality of life without depleting your savings.

In conclusion, life insurance coverage is a multifaceted financial tool that offers a wide range of benefits to policyholders. From the death benefit to critical illness coverage to cash value accumulation, life insurance can provide peace of mind and financial security for you and your loved ones. By understanding the different aspects of life insurance coverage, you can make informed decisions about your financial future and ensure that your loved ones are taken care of in the event of your passing.