Unlocking the Secret to Universal Life Insurance

When it comes to life insurance, there are many options to choose from. One popular choice is universal life insurance, which offers a combination of flexibility and long-term savings. But what exactly is universal life insurance, and how does it work? Let’s unlock the secret to universal life insurance and explore everything you need to know about this type of coverage.

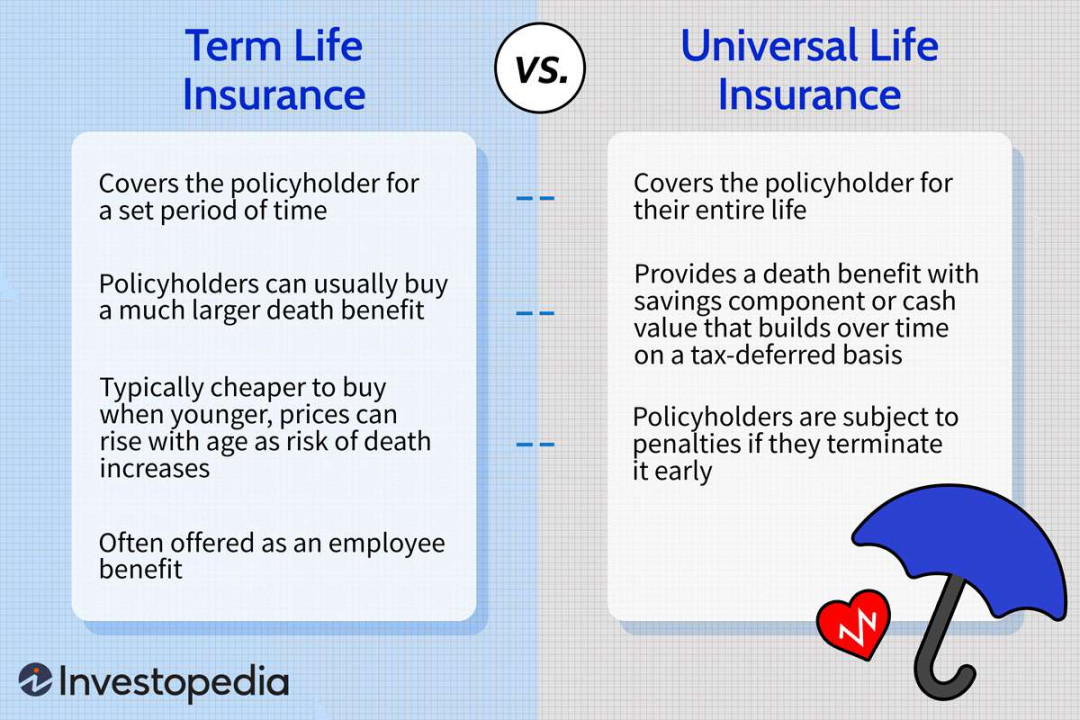

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. Unlike term life insurance, which only provides coverage for a specific period of time, universal life insurance is designed to last a lifetime. This means that as long as you continue to pay your premiums, your policy will remain in effect.

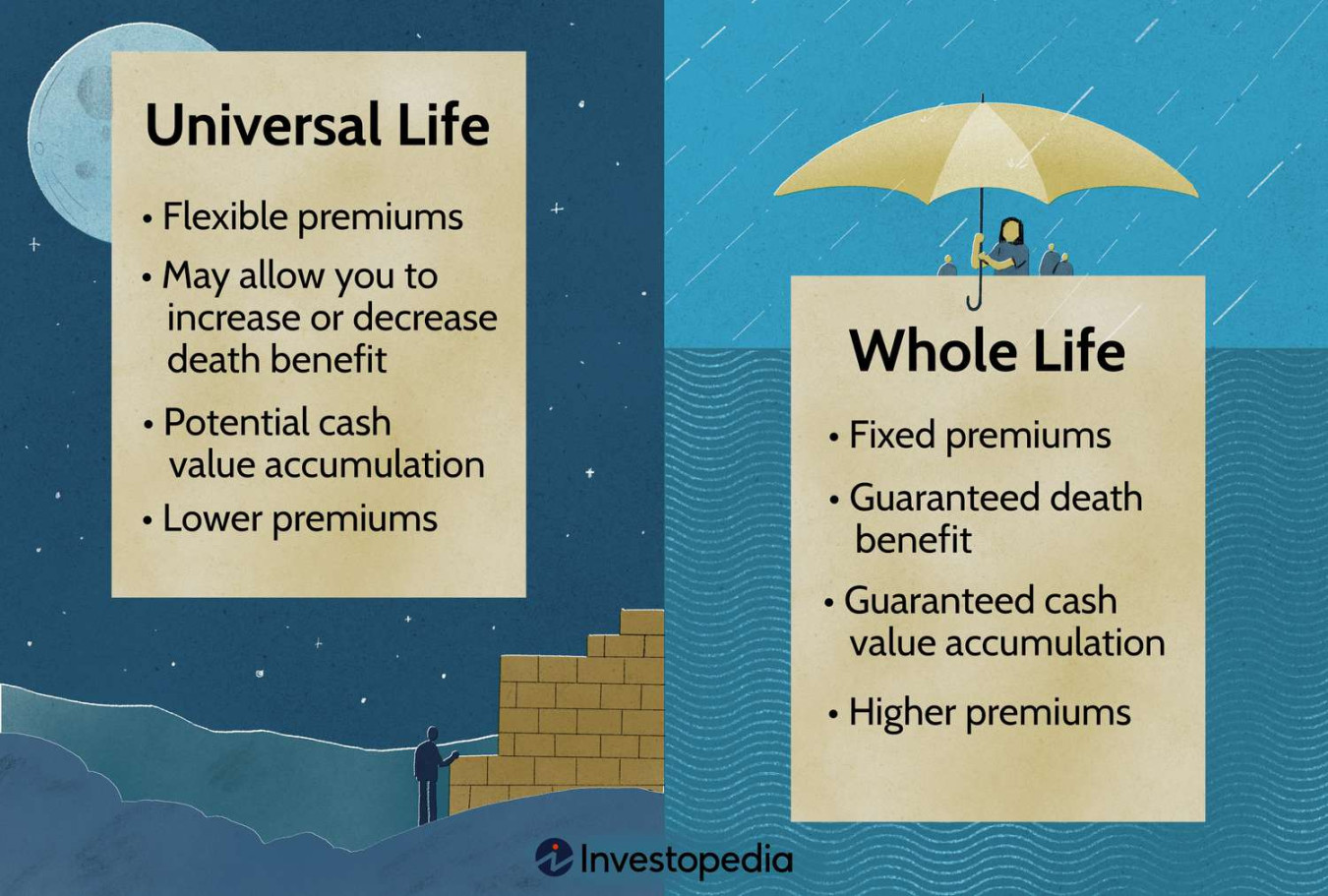

One of the key features of universal life insurance is its flexibility. With this type of coverage, you have the ability to adjust your premium payments and death benefit to suit your changing needs. This can be especially useful if your financial situation changes over time, such as if you get married, have children, or experience a change in income.

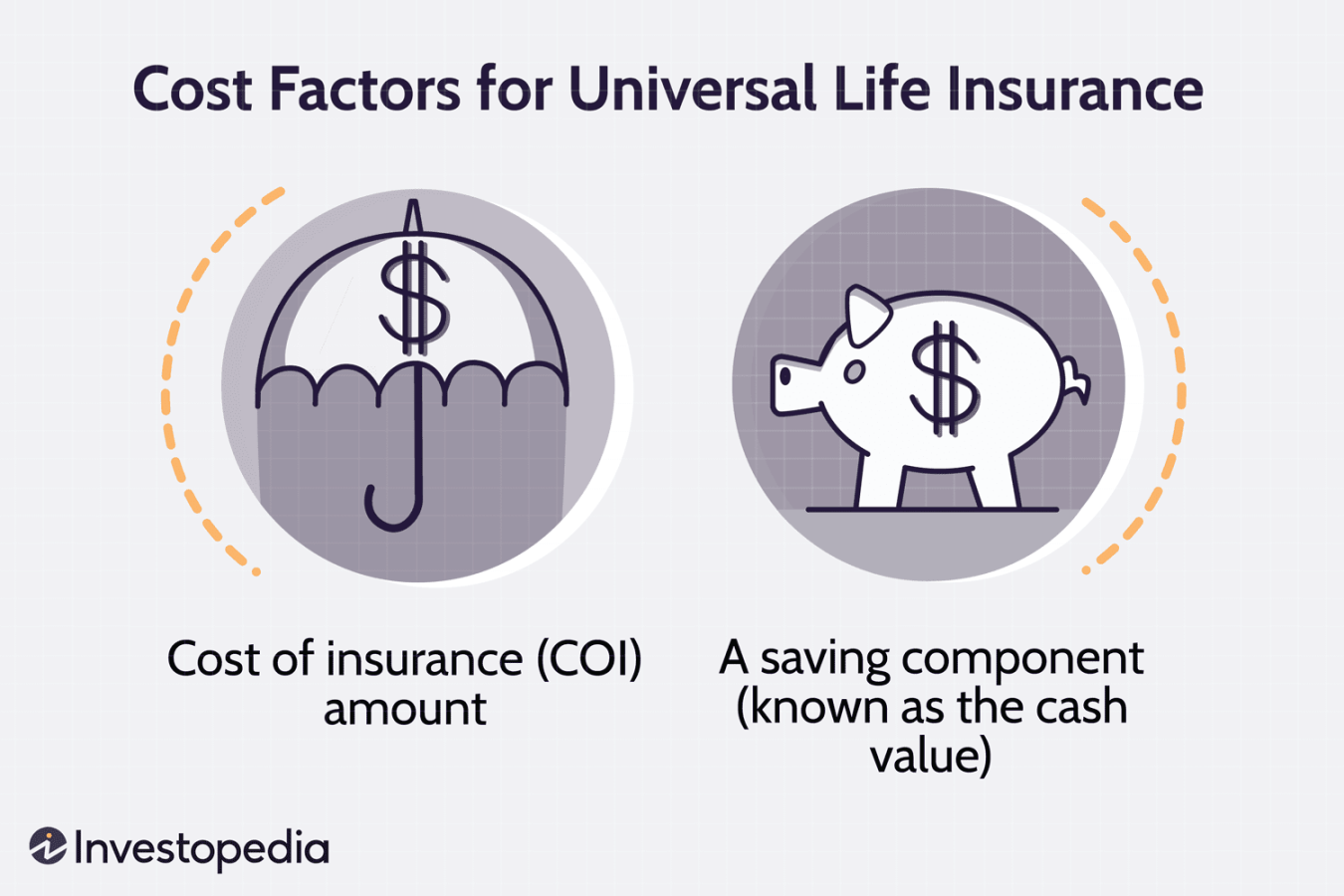

Another important feature of universal life insurance is the cash value component. As you make premium payments, a portion of the money is set aside in a separate account that grows over time. This cash value can be accessed through loans or withdrawals, providing you with a source of funds in case of an emergency or financial need.

One of the biggest advantages of universal life insurance is its ability to accumulate cash value on a tax-deferred basis. This means that you won’t have to pay taxes on the growth of your cash value until you withdraw the funds. This can help your savings grow more quickly and provide you with a tax-efficient way to save for the future.

However, it’s important to note that universal life insurance also comes with some risks. If you don’t pay enough in premiums, your policy could lapse, leaving you without coverage. Additionally, taking out loans or withdrawals from your cash value can reduce the death benefit of your policy and may result in tax consequences.

When considering universal life insurance, it’s important to work with a knowledgeable insurance agent who can help you understand the benefits and risks of this type of coverage. They can help you determine the right amount of coverage for your needs, as well as provide guidance on how to structure your policy to maximize its benefits.

In conclusion, universal life insurance offers a flexible and long-term solution for those looking to protect their loved ones and build savings for the future. By understanding how universal life insurance works and working with a trusted advisor, you can unlock the secret to this valuable type of coverage and secure your financial future.

The Ultimate Guide to Simplifying Life Insurance

Life insurance can be a confusing topic for many individuals. With so many different types of policies and coverage options available, it’s easy to feel overwhelmed when trying to navigate the world of insurance. However, one type of policy that aims to simplify the process is universal life insurance.

Universal life insurance is a flexible type of permanent life insurance that offers both a death benefit and a savings component. It allows policyholders to adjust their premiums and coverage amounts as their needs change over time. This makes it an attractive option for individuals who want the flexibility to tailor their policy to their specific needs.

One of the key features of universal life insurance is its cash value component. This component allows policyholders to accumulate savings on a tax-deferred basis. The policyholder can use these savings to pay premiums, take out loans, or make withdrawals. This can be particularly useful for individuals who want to have access to their policy’s cash value while still maintaining coverage.

Another advantage of universal life insurance is its flexibility. Policyholders have the option to adjust their premiums and coverage amounts as needed. This can be beneficial for individuals who experience changes in their financial situation, such as a new job, marriage, or the birth of a child. With universal life insurance, policyholders have the freedom to make changes to their policy to ensure it continues to meet their needs.

Additionally, universal life insurance offers a death benefit that is paid out to beneficiaries upon the policyholder’s passing. This can provide peace of mind to individuals who want to ensure that their loved ones are financially protected in the event of their death. The death benefit can be used to cover funeral expenses, pay off debts, or provide for the policyholder’s dependents.

When considering universal life insurance, it’s important to work with a knowledgeable insurance agent who can explain the policy’s features and benefits in detail. An agent can help individuals determine the appropriate coverage amount, premium amount, and savings options for their specific needs. They can also provide guidance on how to make changes to the policy as needed.

In conclusion, universal life insurance offers a simplified approach to life insurance that provides flexibility, savings opportunities, and a death benefit to policyholders. By understanding the features and benefits of universal life insurance, individuals can make informed decisions about their insurance coverage and ensure that their loved ones are financially protected in the future. If you’re looking for a straightforward and customizable life insurance option, consider exploring universal life insurance as a viable solution.