Welcome Home! Your Ultimate Guide to Home Insurance

Congratulations on purchasing your first home! As a first-time home buyer, it’s important to protect your investment and ensure that your new sanctuary is safeguarded against any unforeseen events. One of the key ways to do this is by obtaining a comprehensive home insurance policy. In this guide, we will walk you through everything you need to know about home insurance and how to choose the right policy for your needs.

Home insurance, also known as homeowner’s insurance, is a type of property insurance that provides coverage for your home and its contents in the event of damage, theft, or liability claims. It is designed to protect you financially in case of any unexpected incidents that could occur in or around your home.

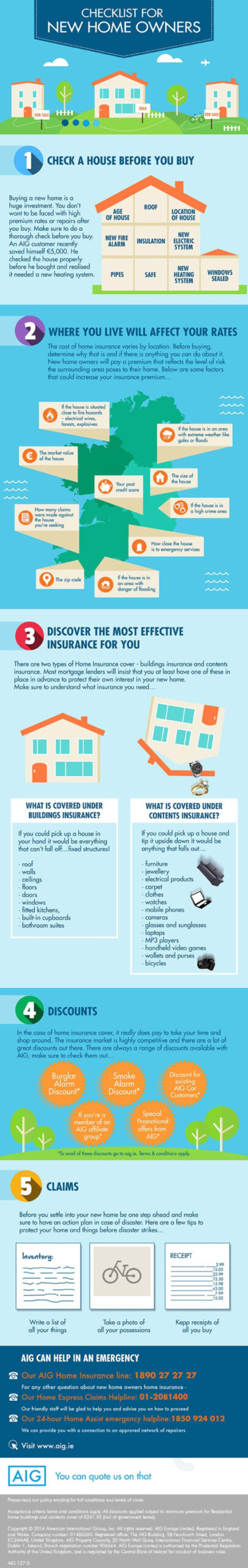

When it comes to home insurance, there are several types of coverage options available. The most common types of coverage include dwelling coverage, which protects the structure of your home, personal property coverage, which covers your belongings inside the home, liability coverage, which protects you in case someone is injured on your property, and additional living expenses coverage, which helps cover the cost of living elsewhere if your home becomes uninhabitable.

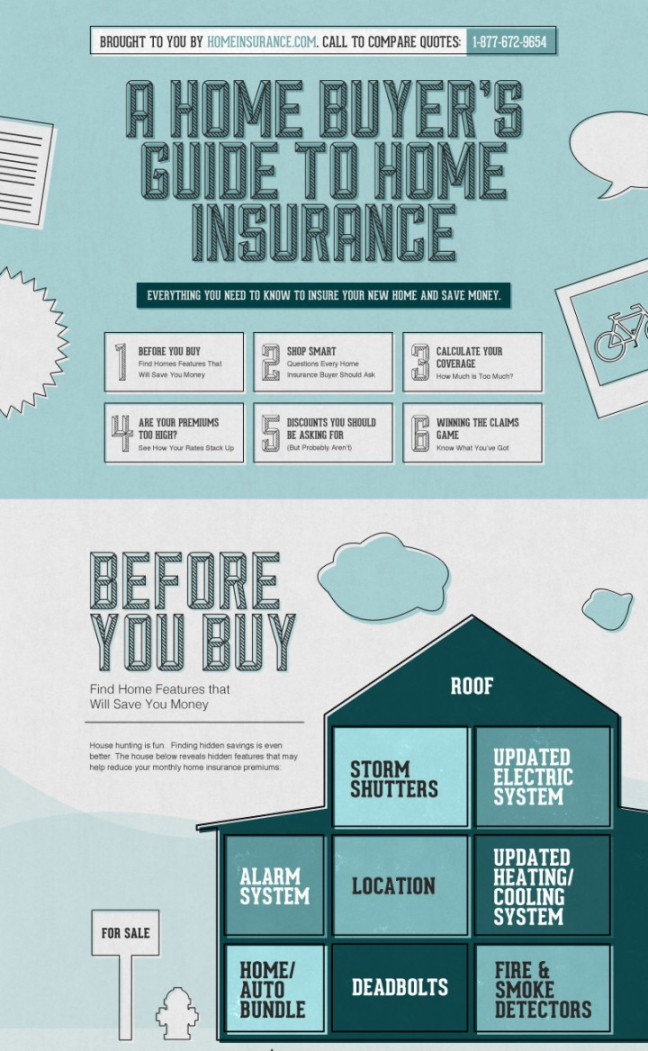

When selecting a home insurance policy, it’s important to consider the value of your home and belongings, as well as any potential risks in your area. Factors such as the age and condition of your home, its location, and the crime rate in your neighborhood can all impact the cost and coverage of your policy.

To ensure that you are adequately protected, it’s important to assess the value of your home and belongings accurately. Make a detailed inventory of your possessions and estimate their value to determine how much coverage you need. Keep in mind that some items, such as jewelry, artwork, or collectibles, may require additional coverage through a rider or floater.

When shopping for home insurance, it’s a good idea to obtain quotes from multiple insurance providers to compare prices and coverage options. Look for reputable insurance companies with good customer reviews and ratings, and consider bundling your home insurance with other policies, such as auto or life insurance, to receive a discount.

Before purchasing a home insurance policy, be sure to read the fine print and understand the terms and conditions of the policy. Pay attention to the coverage limits, deductibles, and exclusions, and ask your insurance agent or broker to clarify any questions you may have.

In addition to obtaining a home insurance policy, there are several steps you can take to protect your home and reduce the risk of insurance claims. Install smoke alarms, carbon monoxide detectors, and a security system in your home to prevent accidents and theft. Maintain your home by performing regular maintenance and repairs to prevent damage from occurring.

By taking the time to understand home insurance and choosing the right policy for your needs, you can protect your home and belongings and enjoy peace of mind knowing that you are financially secure in case of any unexpected events. Welcome home, and may your new abode be filled with love, laughter, and lasting memories!

Protect Your Peace of Mind with Home Insurance

Congratulations on your new home! As a first-time buyer, you are now embarking on an exciting journey of homeownership. While the process of buying a home can be overwhelming, one important aspect that should not be overlooked is obtaining home insurance.

Home insurance is a crucial investment that can provide you with peace of mind and protection in the event of unforeseen circumstances. Whether it’s a natural disaster, theft, or accidental damage, having the right home insurance policy in place can help alleviate financial burdens and ensure that your investment is safeguarded.

One of the key benefits of home insurance is the protection it offers for your property. Your home is likely one of the most significant investments you will ever make, and it is essential to protect it from any potential risks. With home insurance, you can rest assured knowing that your dwelling, as well as any additional structures on your property, are covered in the event of damage or destruction.

In addition to property protection, home insurance also provides liability coverage. Accidents can happen at any time, and if someone is injured on your property, you could be held liable for their medical expenses and other damages. Home insurance can help cover these costs and protect you from potential lawsuits, giving you peace of mind knowing that you are financially secure.

Furthermore, home insurance can also provide coverage for your personal belongings. From furniture to electronics to clothing, your possessions are valuable and should be protected. In the event of theft or damage, your home insurance policy can help reimburse you for the cost of replacing or repairing your belongings, allowing you to recover without financial strain.

When it comes to choosing a home insurance policy, there are several factors to consider. The type of coverage you need will depend on your specific circumstances, such as the value of your home, the location, and any additional risks you may face. It is essential to assess your needs and work with an insurance agent to find a policy that provides adequate protection for your home and possessions.

Another important consideration when purchasing home insurance is the deductible. The deductible is the amount you will be required to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can help lower your premiums, but it is essential to ensure that you can afford to pay the deductible in the event of a claim.

In addition to property coverage and liability protection, some home insurance policies also offer additional benefits, such as coverage for temporary living expenses if your home is uninhabitable due to a covered loss. These additional benefits can provide you with extra peace of mind and ensure that you are taken care of in any situation.

As a first-time homebuyer, navigating the world of home insurance may seem daunting, but with the right information and guidance, you can make an informed decision that will protect your investment and provide you with peace of mind. Remember, home insurance is not just a requirement – it is a valuable asset that can safeguard your home, belongings, and financial future. So, take the time to explore your options, ask questions, and find a policy that meets your needs. Your home is your sanctuary, and with the right insurance coverage, you can protect your peace of mind and enjoy your new home to the fullest.