Discover Your Options: Top 10 Health Insurance Plans!

Are you ready to take control of your health and well-being? One of the best ways to do that is by making sure you have the right health insurance coverage. With so many options available, it can be overwhelming to figure out which plan is best for you. That’s why we’ve put together a list of the top 10 health insurance plans you need to know about. Let’s dive in and discover your options!

1. HMO (Health Maintenance Organization)

HMOs are a popular choice for many individuals and families, offering comprehensive coverage at an affordable price. With an HMO plan, you’ll have access to a network of healthcare providers who work together to manage and coordinate your care. You’ll also need to choose a primary care physician who will be your main point of contact for all your healthcare needs.

2. PPO (Preferred Provider Organization)

PPO plans offer more flexibility when it comes to choosing healthcare providers. With a PPO plan, you can see any doctor or specialist you want, both in and out of the network. While you’ll pay less out of pocket for in-network care, you’ll still have coverage for out-of-network services. This makes PPO plans a great option for those who want more control over their healthcare choices.

3. EPO (Exclusive Provider Organization)

EPO plans are similar to HMOs in that they require you to stay within a network of providers for all your healthcare needs. However, EPO plans do not require you to choose a primary care physician or get referrals to see specialists. This can be a great option for individuals who want the cost savings of an HMO without the restrictions.

4. POS (Point of Service)

POS plans combine elements of both HMOs and PPOs, giving you the flexibility to choose your healthcare providers while still having a primary care physician manage your care. With a POS plan, you’ll pay less out of pocket for in-network services, but you’ll still have coverage for out-of-network care. This can be a good option for those who want a balance between cost and choice.

5. High Deductible Health Plan (HDHP)

HDHPs are designed for individuals who are willing to take on more out-of-pocket costs in exchange for lower monthly premiums. With an HDHP, you’ll have a high deductible that you’ll need to meet before your insurance kicks in. However, once you reach your deductible, your plan will cover a significant portion of your healthcare costs. HDHPs are often paired with Health Savings Accounts (HSAs) to help you save for medical expenses tax-free.

6. Catastrophic Health Insurance

Catastrophic health insurance is a type of plan that offers coverage for major medical expenses, such as hospital stays or surgeries. These plans have low monthly premiums and high deductibles, making them a good option for young, healthy individuals who don’t expect to need frequent medical care. Catastrophic plans also cover essential health benefits, so you can rest assured knowing you’re protected in case of a serious illness or injury.

7. Short-Term Health Insurance

Short-term health insurance is designed to provide temporary coverage for individuals who are in between jobs or experiencing a life transition. These plans typically last for a few months to a year and offer basic benefits, such as doctor visits and prescription drugs. While short-term plans may not offer the same level of coverage as traditional health insurance, they can be a good option for those who need temporary protection.

8. Medicaid

Medicaid is a state and federally funded program that provides health coverage to low-income individuals and families. Eligibility for Medicaid is based on income and household size, so it’s important to check if you qualify for this program. Medicaid offers comprehensive coverage for essential health services, including doctor visits, hospital stays, and prescription drugs. If you meet the criteria, Medicaid can be a valuable resource for staying healthy without breaking the bank.

9. Medicare

Medicare is a federal health insurance program for individuals age 65 and older, as well as some younger individuals with disabilities. Medicare is divided into several parts, each covering different aspects of healthcare. Part A covers hospital stays, Part B covers doctor visits and outpatient care, and Part D covers prescription drugs. Additionally, Medicare Advantage plans are offered by private insurance companies and provide all-in-one coverage for hospital, medical, and prescription drug costs. If you’re approaching retirement age, it’s important to learn about your Medicare options to ensure you have the coverage you need.

10. Employer-Sponsored Health Insurance

Many employers offer health insurance as part of their benefits package, providing employees with access to affordable coverage through group plans. Employer-sponsored health insurance typically covers a portion of the premium costs, with employees responsible for the remainder. These plans often have a range of coverage options and benefits, making them a convenient choice for many individuals and families. If you’re eligible for employer-sponsored health insurance, be sure to take advantage of this valuable benefit.

In conclusion, there are many health insurance plans available to help you stay protected and healthy. By understanding your options and choosing the right plan for your needs, you can have peace of mind knowing that you’re covered in case of illness or injury. Whether you opt for an HMO, PPO, or employer-sponsored plan, make sure to explore all the benefits and costs associated with each option. With the right health insurance plan in place, you can focus on living your best, healthiest life!

Stay Protected: Learn About the Best Health Coverage!

When it comes to taking care of your health, having the right insurance coverage is essential. With so many options available, it can be overwhelming to figure out which plan is the best fit for you and your family. That’s why we’ve put together a list of the top 10 health insurance plans that you need to know about to stay protected and ensure peace of mind.

1. Blue Cross Blue Shield

Blue Cross Blue Shield is one of the most well-known and trusted health insurance providers in the United States. They offer a wide range of plans to fit different needs and budgets, including HMOs, PPOs, and high-deductible options. With a large network of doctors and hospitals, you can rest assured that you’ll have access to quality care when you need it.

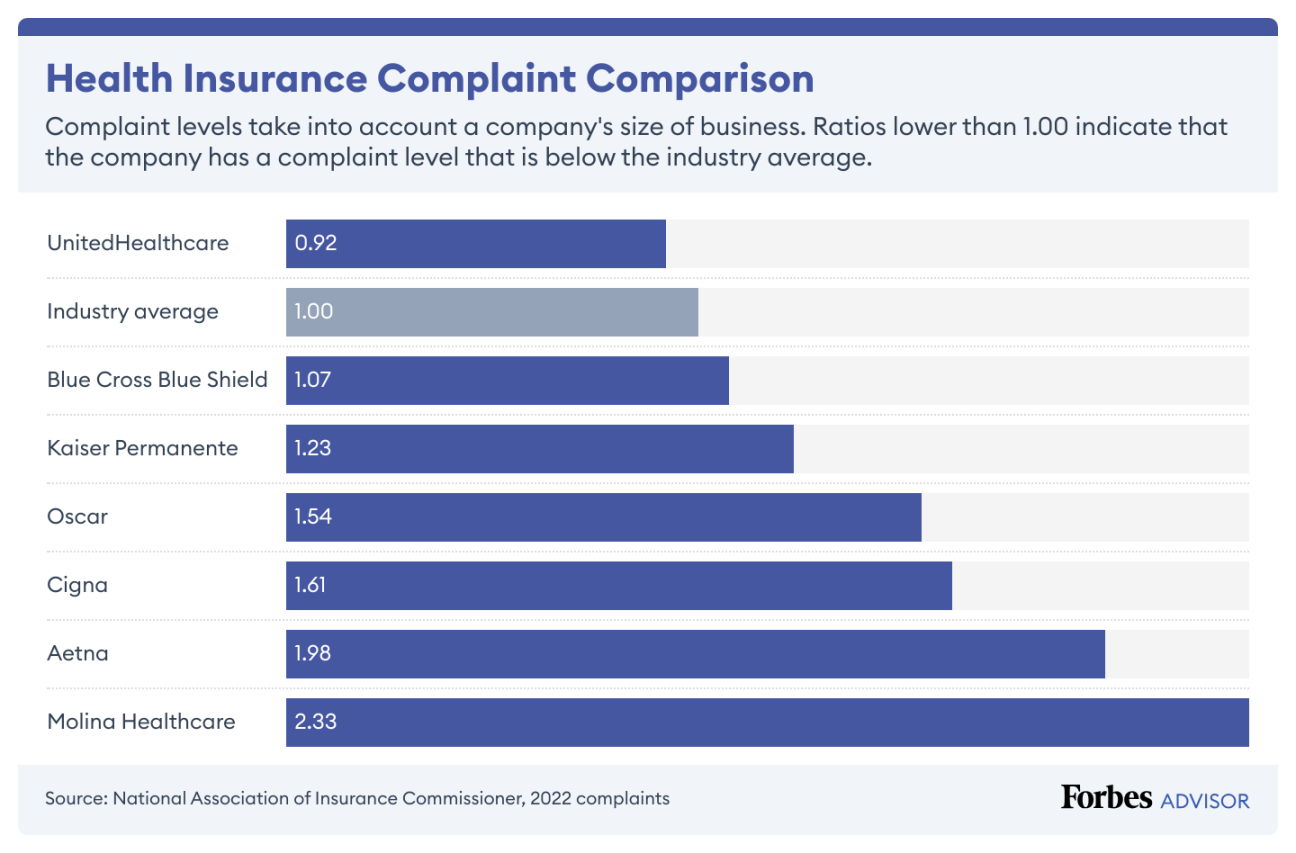

2. Aetna

Aetna is another top health insurance provider that offers comprehensive coverage and a variety of plan options. Whether you’re looking for a basic plan to cover routine care or a more comprehensive plan with added benefits, Aetna has you covered. They also offer wellness programs and resources to help you stay healthy and prevent illness.

3. Cigna

Cigna is known for its excellent customer service and affordable plans. They offer a range of options, including HMOs, PPOs, and high-deductible plans, to fit different needs and budgets. With Cigna, you can access a wide network of providers and take advantage of their wellness programs to stay healthy and save on healthcare costs.

4. United Healthcare

United Healthcare is one of the largest health insurance providers in the country, offering a wide range of plans to fit different needs and budgets. Whether you’re looking for a basic plan to cover routine care or a more comprehensive plan with added benefits, United Healthcare has you covered. They also offer innovative programs and tools to help you manage your health and make informed decisions about your care.

5. Kaiser Permanente

Kaiser Permanente is a unique health insurance provider that offers integrated care through its own network of doctors, hospitals, and clinics. This means that you can receive all of your care in one place, making it convenient and efficient. Kaiser Permanente also offers a range of wellness programs and resources to help you stay healthy and prevent illness.

6. Humana

Humana is a leading health insurance provider that offers a variety of plans to fit different needs and budgets. Whether you’re looking for a basic plan to cover routine care or a more comprehensive plan with added benefits, Humana has you covered. They also offer personalized support and resources to help you manage your health and make informed decisions about your care.

7. Molina Healthcare

Molina Healthcare is a top health insurance provider that focuses on serving low-income individuals and families. They offer affordable plans with comprehensive coverage and access to a network of providers. Molina Healthcare also offers support programs and resources to help you navigate the healthcare system and get the care you need.

8. Ambetter

Ambetter is a popular health insurance provider that offers affordable plans with comprehensive coverage. They offer a range of options, including HMOs, PPOs, and high-deductible plans, to fit different needs and budgets. With Ambetter, you can access a large network of providers and take advantage of their wellness programs to stay healthy and save on healthcare costs.

9. Oscar Health

Oscar Health is a newer health insurance provider that offers innovative plans and tools to help you manage your health. They offer a range of options, including HMOs, PPOs, and high-deductible plans, to fit different needs and budgets. With Oscar Health, you can access a network of virtual and in-person providers and take advantage of their digital tools to make healthcare more convenient and accessible.

10. Centene Corporation

Centene Corporation is a leading health insurance provider that offers affordable plans with comprehensive coverage. They offer a range of options, including Medicaid and marketplace plans, to fit different needs and budgets. With Centene Corporation, you can access a network of providers and take advantage of their care management programs to get the support you need to stay healthy and manage chronic conditions.

In conclusion, choosing the right health insurance plan is essential for protecting yourself and your family and ensuring peace of mind. With the top 10 health insurance plans listed above, you can find the coverage that fits your needs and budget, so you can focus on staying healthy and taking care of yourself. Stay protected and get covered with one of these top health insurance plans today!