Insurance can often be a confusing and overwhelming topic for many individuals, especially when it comes to worker’s compensation insurance. But fear not, because we are here to help unravel the mysteries of worker’s comp insurance and provide you with everything you need to know to navigate this essential coverage.

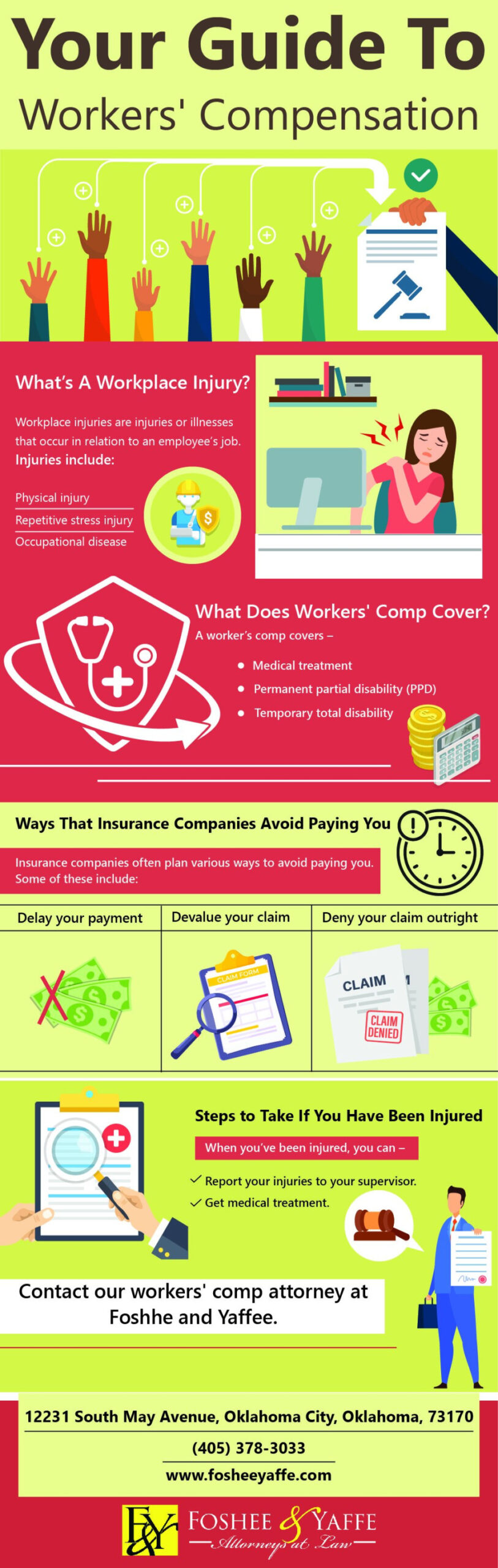

Worker’s comp insurance is a type of insurance that provides benefits to employees who are injured or become ill as a result of their work. This insurance is mandatory for most employers, as it helps protect both employees and employers in the event of a workplace injury or illness.

One of the key components of worker’s comp insurance is that it provides coverage for medical expenses related to the injury or illness. This can include doctor’s visits, hospital stays, prescription medications, and even rehabilitation services. By having this coverage in place, employees can rest assured knowing that they will not be burdened with the high costs of medical treatment if they are injured on the job.

In addition to medical expenses, worker’s comp insurance also provides benefits for lost wages. If an employee is unable to work due to a work-related injury or illness, worker’s comp insurance can provide a portion of their lost wages until they are able to return to work. This helps alleviate the financial stress that can come with being unable to work and ensures that employees can focus on their recovery without worrying about their income.

Worker’s comp insurance also typically covers vocational rehabilitation services, which can help injured employees return to work in a safe and timely manner. These services may include job training, job placement assistance, and even modifications to the workplace to accommodate any disabilities resulting from the injury.

It’s important for both employers and employees to understand the ins and outs of worker’s comp insurance to ensure that they are adequately protected in the event of a workplace injury or illness. Employers should familiarize themselves with their state’s worker’s comp laws and regulations to ensure that they are in compliance and providing the necessary coverage for their employees.

Employees should also be aware of their rights under worker’s comp insurance, including how to report a workplace injury, file a claim, and access the benefits they are entitled to. By understanding the process, employees can ensure that they receive the care and support they need to recover from a work-related injury or illness.

Overall, worker’s comp insurance is a crucial protection for both employees and employers. It provides essential coverage for medical expenses, lost wages, and vocational rehabilitation services in the event of a workplace injury or illness. By unraveling the mysteries of worker’s comp insurance and understanding how it works, both employers and employees can navigate this important coverage with confidence and peace of mind.

Your Ultimate Guide to Navigating Worker’s Comp

Welcome to your ultimate guide to navigating worker’s compensation insurance. Whether you’re a seasoned business owner or just starting out, understanding the ins and outs of worker’s comp insurance is crucial to protecting your employees and your business. In this comprehensive guide, we’ll cover everything you need to know about worker’s comp insurance – from what it is, to how it works, and everything in between.

What is Worker’s Comp Insurance?

Worker’s compensation insurance, also known as worker’s comp, is a type of insurance that provides benefits to employees who are injured or become ill as a result of their job. This insurance is mandatory in most states, and it helps cover medical expenses, lost wages, and rehabilitation costs for employees who are injured on the job. Worker’s comp insurance also protects employers from being sued by employees for workplace injuries, as it provides a no-fault system for compensation.

How Does Worker’s Comp Insurance Work?

Worker’s comp insurance works by providing coverage for employees who are injured or become ill while performing their job duties. When an employee is injured on the job, they can file a worker’s comp claim with their employer’s insurance provider. The insurance provider will then investigate the claim and determine if the injury or illness is covered under the policy. If the claim is approved, the employee will receive benefits to cover medical expenses, lost wages, and rehabilitation costs.

Navigating the Worker’s Comp Claims Process

Navigating the worker’s comp claims process can be confusing, but with the right knowledge and resources, you can make the process smoother for both you and your employees. Here are some key steps to help you navigate the worker’s comp claims process:

1. Report the Injury: The first step in the worker’s comp claims process is to report the injury to your employer as soon as possible. Make sure to provide detailed information about how the injury occurred and the extent of your injuries.

2. Seek Medical Treatment: After reporting the injury, seek medical treatment from a healthcare provider approved by your employer’s insurance provider. Make sure to follow all recommended treatment plans and attend all medical appointments.

3. File a Claim: Your employer or their insurance provider will provide you with the necessary paperwork to file a worker’s comp claim. Make sure to fill out the forms accurately and submit them in a timely manner.

4. Stay in Communication: Throughout the claims process, stay in communication with your employer, their insurance provider, and your healthcare provider. Keep them updated on your recovery progress and any changes in your condition.

5. Follow Up: After filing a worker’s comp claim, follow up with the insurance provider to ensure that your claim is being processed. Be proactive in addressing any issues that may arise during the claims process.

By following these steps and staying informed about the worker’s comp claims process, you can navigate the system with confidence and ensure that your employees receive the benefits they deserve.

Final Thoughts

Worker’s comp insurance is a vital component of protecting your employees and your business from the financial impact of workplace injuries. By understanding how worker’s comp insurance works and navigating the claims process effectively, you can ensure that your employees receive the care and support they need to recover from their injuries. Remember, the key to a successful worker’s comp claim is communication, cooperation, and compliance with the requirements of the insurance policy. With this ultimate guide to navigating worker’s comp, you can confidently navigate the complexities of worker’s comp insurance and protect your most valuable asset – your employees.