Unraveling the Mystery of Business Interruption Insurance

Business Interruption Insurance: What’s That All About?

Business interruption insurance is one of those things that many business owners have heard of but don’t quite understand. It’s like a mysterious unicorn that lurks in the shadows of the insurance world, waiting to be discovered. But fear not, dear reader, for I am here to unravel the mystery and shed some light on this often overlooked but incredibly important aspect of business insurance.

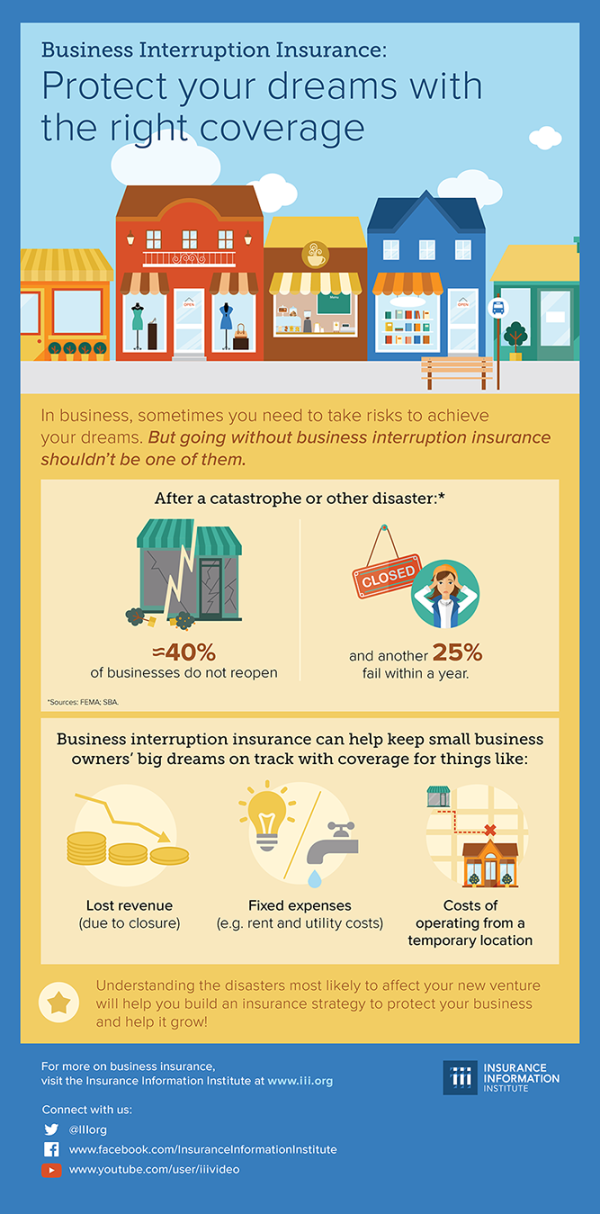

So, what exactly is business interruption insurance? In a nutshell, it’s a type of insurance that helps protect your business in the event of a disaster or other unforeseen event that causes your business to temporarily shut down. This could be anything from a fire or flood to a global pandemic like we’ve seen with COVID-19. Basically, it’s there to help cover the loss of income and help you get back on your feet as quickly as possible.

Now, you might be thinking, But wait, isn’t that what my property insurance is for? Well, yes and no. While property insurance does cover physical damage to your business property, it doesn’t typically cover the loss of income that occurs when your business is forced to close its doors. That’s where business interruption insurance comes in. It’s like the Robin to your property insurance’s Batman, swooping in to save the day when things go awry.

But how does it work, you ask? Let’s break it down. When you purchase business interruption insurance, you’ll typically select a coverage limit based on your business’s projected income. If your business is then forced to close due to a covered event, the insurance will kick in to help cover the income you would have otherwise earned during that time. This can include things like rent or mortgage payments, employee salaries, and other ongoing expenses that don’t just disappear when your business is closed.

But here’s where things get a bit tricky. Business interruption insurance isn’t a one-size-fits-all solution. There are different types of coverage available, and it’s important to choose the right one for your business. Some policies may have specific exclusions or limitations that you’ll want to be aware of, so it’s always a good idea to read the fine print and discuss your options with an insurance professional.

Another important thing to consider is the waiting period before your coverage kicks in. This is typically a set number of days after the initial event that triggers the coverage, so it’s important to plan ahead and make sure you have enough cash flow to cover your expenses during this time. It’s like having a backup plan for your backup plan, just in case.

So, why is business interruption insurance so important? Well, for starters, it can be a lifesaver when disaster strikes. Imagine if your business had to close its doors for weeks or even months due to a fire or natural disaster. Without business interruption insurance, you could be facing a significant financial loss that could potentially put you out of business for good. But with the right coverage in place, you can rest easy knowing that you have a safety net to help you weather the storm.

In conclusion, business interruption insurance is like having a superhero on standby, ready to swoop in and save the day when disaster strikes. It’s a vital piece of the puzzle when it comes to protecting your business finances and ensuring that you can bounce back quickly from any unexpected setbacks. So, if you haven’t already looked into getting coverage for your business, now is the time to unravel the mystery and discover the peace of mind that comes with knowing you’re covered.

Get the Lowdown on How to Protect Your Business Finances

Running a business can be a rollercoaster ride of ups and downs. One moment, you’re celebrating a successful marketing campaign that brought in a slew of new customers, and the next, you’re dealing with unexpected expenses that threaten to put your company in financial jeopardy. That’s where business interruption insurance comes in – to help protect your bottom line when the unexpected strikes.

So, what exactly is business interruption insurance, and how can it help you safeguard your business finances? Let’s delve into the nitty-gritty details and get the lowdown on this essential form of coverage.

Business interruption insurance, also known as business income insurance, is a type of policy that provides financial protection to business owners in the event of a disaster or unforeseen event that disrupts their operations. This could include natural disasters like fires or floods, equipment breakdowns, or even a global pandemic like the one we’re currently experiencing.

The goal of business interruption insurance is to help cover the loss of income that occurs when a business is forced to close its doors temporarily due to a covered event. This could include lost revenue, ongoing expenses like rent and utilities, and even payroll costs for employees who are unable to work during the closure.

One of the key benefits of business interruption insurance is that it can help businesses stay afloat during challenging times and avoid having to dip into their savings or take out loans to cover expenses. By providing a financial safety net, this type of coverage can give business owners peace of mind knowing that they have a lifeline to rely on when the unexpected happens.

To determine the amount of coverage needed for business interruption insurance, it’s important to consider factors such as the business’s revenue and expenses, as well as the potential impact of a disruption on its operations. Working closely with an insurance agent or broker can help ensure that you have the right level of coverage to protect your business finances effectively.

In addition to covering lost income and ongoing expenses, business interruption insurance can also provide coverage for additional expenses that may arise as a result of a covered event. This could include the cost of relocating to a temporary business location, renting equipment to replace damaged items, or even hiring temporary staff to help get the business back up and running.

When shopping for business interruption insurance, it’s essential to review the policy terms and conditions carefully to understand what is covered and what is excluded. Some policies may have specific limitations or waiting periods before coverage kicks in, so it’s crucial to be aware of these details to ensure you have the protection you need when you need it most.

In conclusion, business interruption insurance is a valuable tool for business owners looking to protect their finances and ensure the long-term success of their operations. By providing a financial safety net in times of crisis, this type of coverage can help businesses weather the storm and emerge stronger on the other side. So, if you want to safeguard your business finances and keep your operations running smoothly, consider adding business interruption insurance to your risk management strategy today.