Unveiling the Mystery of Whole Life Insurance

When it comes to financial planning, one of the key components that often gets overlooked is life insurance. Many people are familiar with term life insurance, which provides coverage for a specific period of time, but whole life insurance is a different animal altogether. Today, we are going to dive into the details of this coverage and uncover the mystery behind whole life insurance.

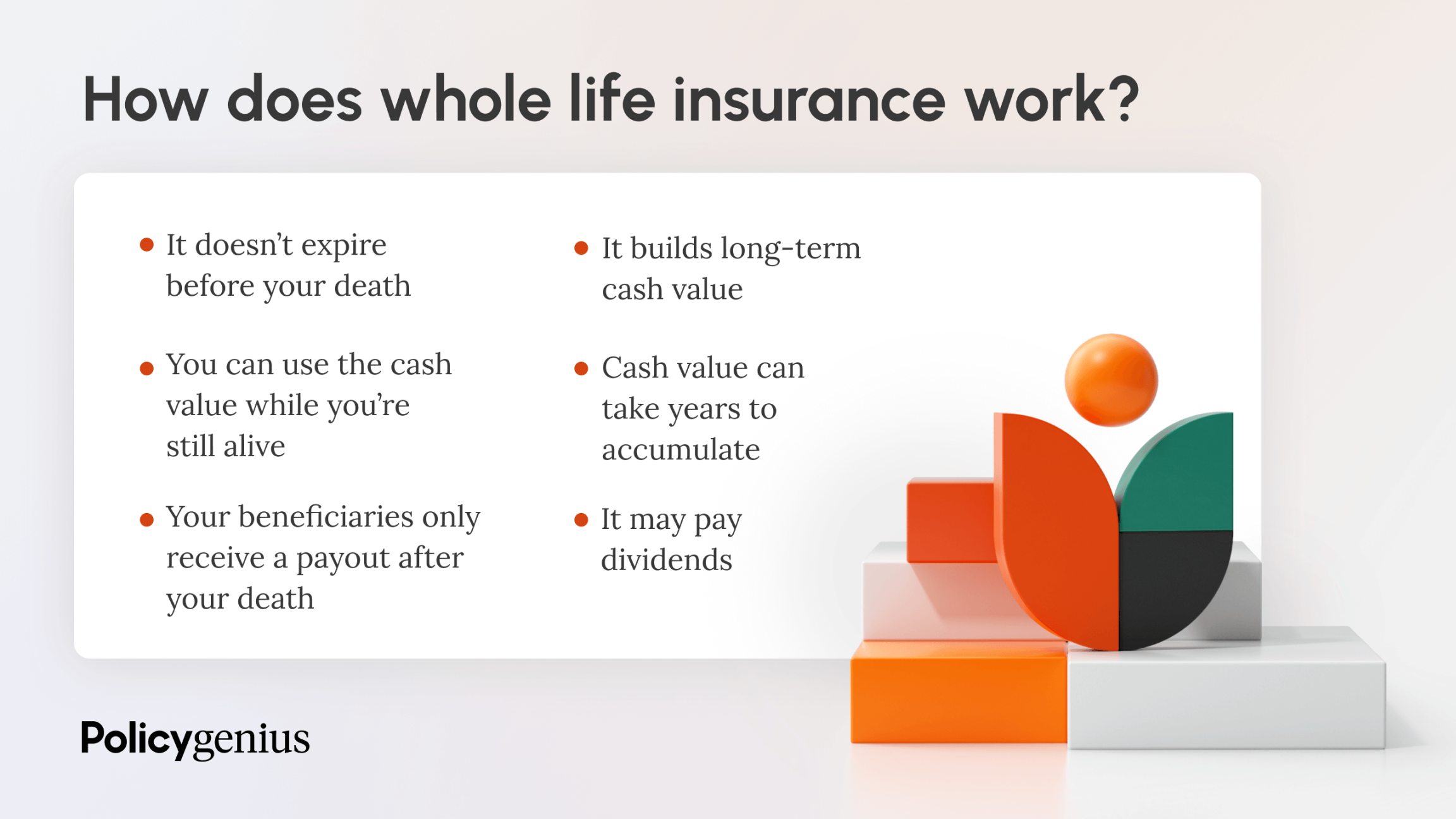

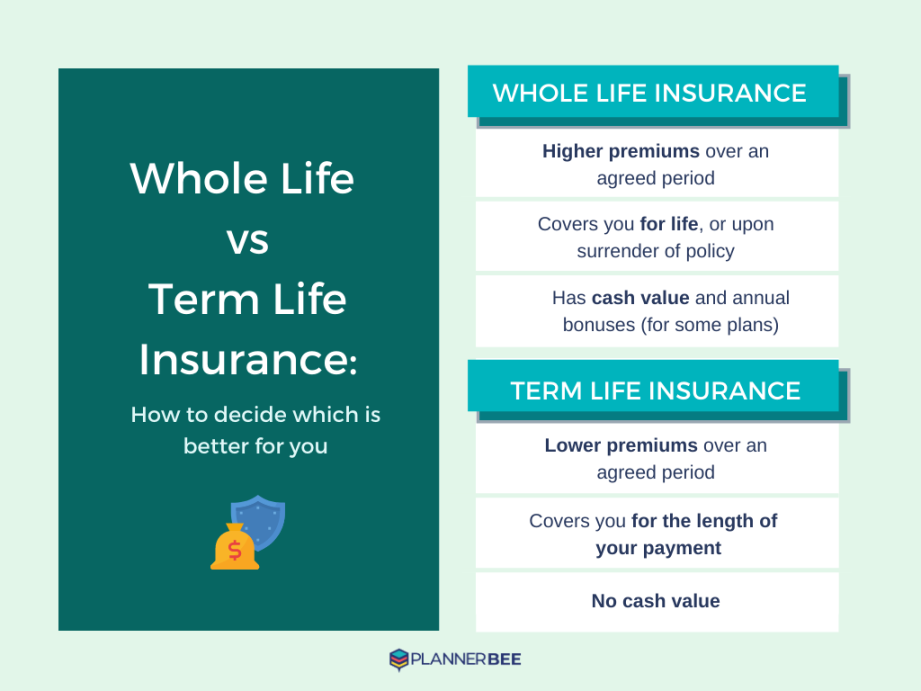

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, as long as premiums are paid. Unlike term life insurance, which only covers you for a specific period of time, whole life insurance offers lifelong protection. This can be a valuable asset for those looking to provide financial security for their loved ones in the event of their passing.

One of the key features of whole life insurance is the cash value component. This is essentially a savings account within the policy that accumulates value over time. As you pay your premiums, a portion of the money goes towards the death benefit, while the rest goes into the cash value account. This account grows tax-deferred and can be accessed during your lifetime through loans or withdrawals.

Another important aspect of whole life insurance is the guaranteed death benefit. This means that no matter when you pass away, your beneficiaries will receive a payout from the policy. This can provide peace of mind knowing that your loved ones will be taken care of financially, regardless of when you pass away.

Whole life insurance also offers the benefit of level premiums. This means that the cost of the policy remains the same throughout your lifetime, making it easier to budget for. With term life insurance, premiums can increase as you age, but with whole life insurance, you lock in a rate that will never change.

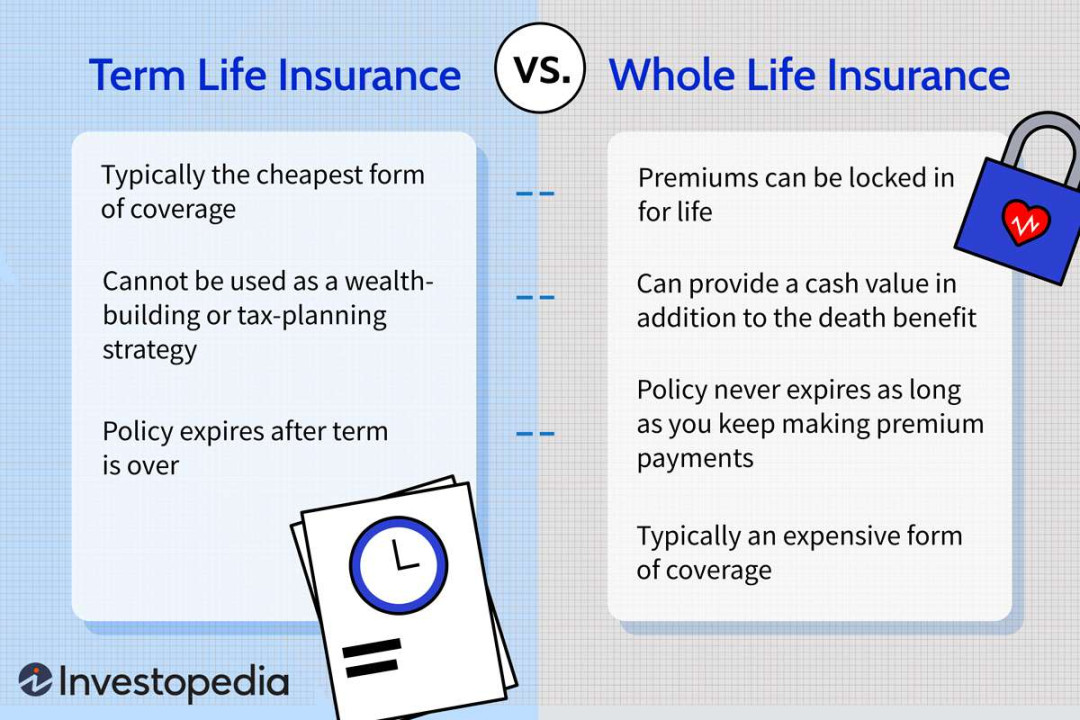

It’s important to note that whole life insurance can be more expensive than term life insurance, but the added benefits and guarantees can make it a worthwhile investment for many. It’s also worth considering the potential for cash value growth over time, which can provide a source of funds for emergencies or retirement.

In conclusion, whole life insurance is a valuable tool for those looking to provide financial security for their loved ones and build a savings account for the future. By understanding the key features and benefits of whole life insurance, you can make an informed decision about whether this type of coverage is right for you. So don’t let the mystery of whole life insurance scare you away – dive in and discover the possibilities it can offer for your financial future.

Let’s Dive into the Details of this Coverage

When it comes to financial planning, one of the most important aspects to consider is insurance. And within the realm of insurance, whole life insurance is a popular choice for many individuals. But what exactly is whole life insurance and why is it so important to understand its details? Let’s dive into the specifics of this coverage and break down everything you need to know.

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder’s life. Unlike term life insurance, which only covers a specific period of time, whole life insurance offers lifelong protection as long as the premiums are paid. This means that no matter when the policyholder passes away, their beneficiaries will receive a death benefit.

One of the key features of whole life insurance is the cash value component. As the policyholder pays their premiums, a portion of the money is invested by the insurance company, which grows over time. This cash value can be accessed by the policyholder through loans or withdrawals, providing a source of funds for various needs such as emergencies, education expenses, or retirement income.

Another important aspect to consider is the guaranteed death benefit of whole life insurance. Unlike other types of insurance that may have variable death benefits based on market performance, whole life insurance guarantees a specific amount to be paid out to the beneficiaries. This can provide peace of mind knowing that loved ones will be financially protected no matter what.

Additionally, whole life insurance offers tax advantages that can benefit policyholders in the long run. The death benefit is typically paid out income tax-free to the beneficiaries, providing a valuable source of funds without the burden of taxes. The cash value component also grows tax-deferred, allowing for potential tax-free withdrawals or loans in the future.

It’s important to note that whole life insurance premiums are typically higher than term life insurance premiums. This is because whole life insurance provides lifelong coverage and includes the cash value component, making it a more comprehensive and long-term financial tool. However, the peace of mind and financial security that whole life insurance offers can outweigh the higher cost for many individuals.

When considering whole life insurance, it’s essential to review the policy details carefully. Understanding the terms and conditions of the policy, as well as the benefits and potential drawbacks, is crucial in making an informed decision. Working with a knowledgeable insurance agent or financial advisor can help navigate the complexities of whole life insurance and ensure that the coverage meets your specific needs and goals.

In conclusion, whole life insurance is a valuable financial tool that offers lifelong protection, cash value accumulation, guaranteed death benefits, and tax advantages. By diving into the details of this coverage and understanding its intricacies, you can make a well-informed decision that aligns with your financial objectives. So, consider whole life insurance as part of your comprehensive financial plan and enjoy the peace of mind it can provide for you and your loved ones.