Cracking the Code: Understanding Auto Insurance Rates

When it comes to auto insurance, the rates can sometimes feel like a mystery. You may be wondering why your neighbor pays less than you do, or why your friend who has a similar car has a completely different premium. But fear not, because we are here to help you crack the code and understand how auto insurance rates are calculated.

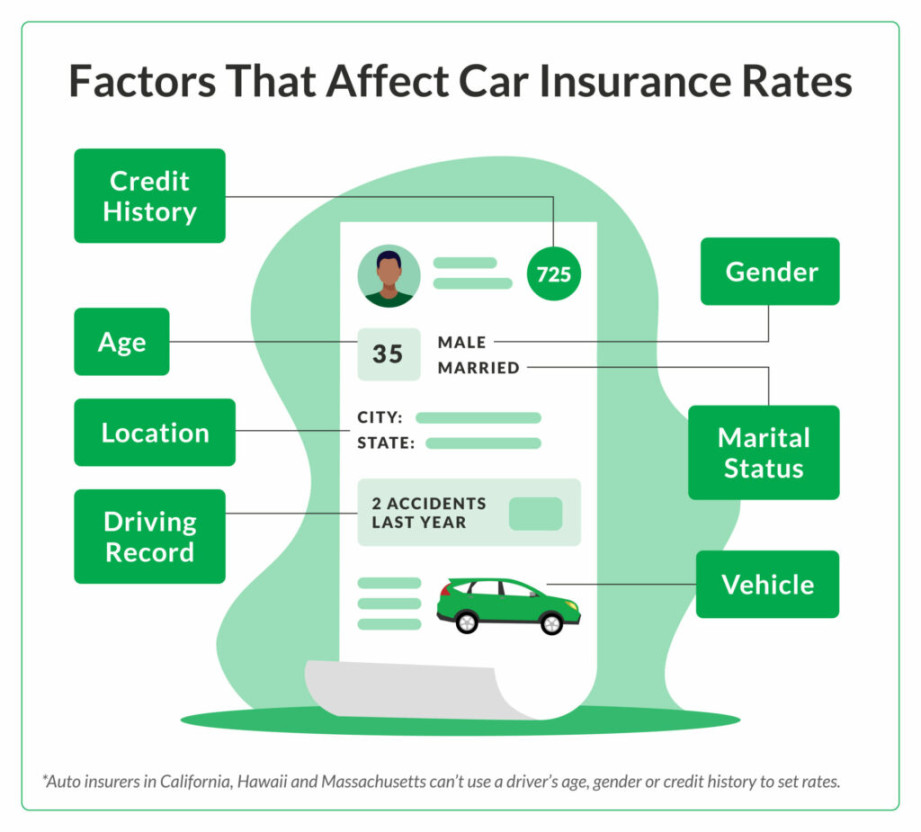

The first factor that influences your auto insurance rate is your driving record. If you have a history of accidents or traffic violations, insurance companies may see you as a higher risk and charge you a higher premium. On the other hand, if you have a clean driving record, you may be eligible for discounts and lower rates.

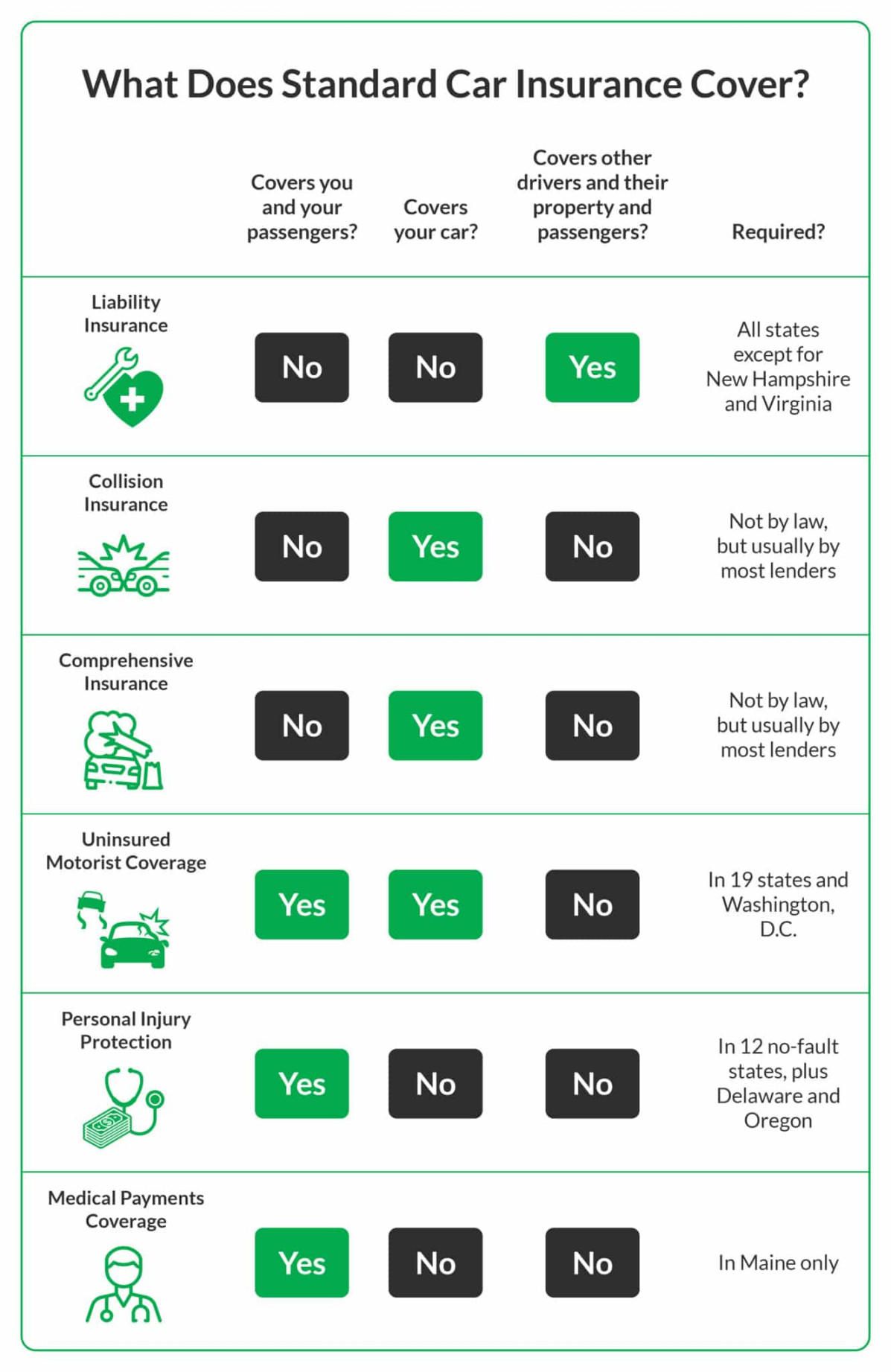

Another important factor that determines your auto insurance rate is the type of coverage you choose. There are several types of coverage options available, including liability, collision, comprehensive, and uninsured motorist coverage. The more coverage you have, the higher your premium is likely to be. It’s important to carefully consider your coverage needs and budget when selecting your policy.

Your age and gender can also play a role in determining your auto insurance rate. Younger drivers are typically charged higher premiums because they are considered more inexperienced and higher risk. Additionally, statistics show that male drivers tend to be involved in more accidents than female drivers, which can result in higher rates for men.

The type of vehicle you drive can also impact your auto insurance rate. Insurance companies take into account factors such as the make and model of your car, its safety features, and its likelihood of being stolen when calculating your premium. Sports cars and luxury vehicles typically have higher insurance rates due to their higher repair costs and theft risk.

Where you live can also affect your auto insurance rate. Urban areas with high population densities and increased traffic congestion tend to have higher rates of accidents and theft, which can result in higher premiums for residents. Additionally, the crime rate in your area can impact your insurance rate, as higher crime rates may lead to increased likelihood of vandalism or theft.

Your credit score is another important factor that insurance companies consider when determining your auto insurance rate. Studies have shown that individuals with higher credit scores are less likely to file insurance claims, so having a good credit score can help lower your premium. It’s important to maintain good credit hygiene to ensure you are getting the best possible rate.

Finally, your driving habits and mileage can also impact your auto insurance rate. If you have a long commute or frequently drive for work, you may be at a higher risk of being involved in an accident, which can result in a higher premium. Some insurance companies offer discounts for low-mileage drivers or those who participate in safe driving programs.

In conclusion, auto insurance rates can be influenced by a variety of factors, including your driving record, coverage options, age, gender, vehicle type, location, credit score, and driving habits. By understanding how these factors can impact your rate, you can make informed decisions when selecting your auto insurance policy. Remember to shop around and compare quotes from multiple insurance companies to ensure you are getting the best coverage at the best price.

Demystifying the Mystique: Unraveling Car Insurance Costs

When it comes to auto insurance, there is often a sense of mystery surrounding how prices are determined. Many people feel overwhelmed by the complex calculations and variables that insurance companies use to set their rates. However, breaking down auto insurance prices doesn’t have to be a daunting task. In this guide, we will demystify the mystique of car insurance costs and provide a simple explanation of how rates are determined.

One of the key factors that influence auto insurance prices is the type of coverage you choose. There are several different types of coverage available, including liability coverage, collision coverage, and comprehensive coverage. Each type of coverage offers a different level of protection, and the more coverage you have, the higher your premiums are likely to be. By understanding the different types of coverage and selecting the right combination for your needs, you can ensure that you are getting the best value for your money.

Another important factor that insurance companies consider when setting rates is your driving record. If you have a history of accidents or traffic violations, you are considered a higher risk driver, and your premiums will reflect that increased risk. On the other hand, if you have a clean driving record, you are likely to enjoy lower rates. By practicing safe driving habits and maintaining a clean record, you can help keep your insurance costs down.

Your age and gender can also impact your auto insurance rates. Younger drivers are statistically more likely to be involved in accidents, so they tend to pay higher premiums. Similarly, men are often charged higher rates than women, as they are considered to be higher risk drivers. While you can’t change your age or gender, you can take steps to mitigate the impact on your rates by driving safely and maintaining a clean record.

The type of vehicle you drive can also affect your auto insurance prices. Insurers consider the make and model of your car, as well as its age and safety features, when determining your rates. Newer, more expensive cars typically cost more to insure, as they are more expensive to repair or replace in the event of an accident. On the other hand, older cars with good safety ratings may be eligible for discounts. By choosing a vehicle that is safe and reliable, you can help lower your insurance costs.

Where you live can also play a role in determining your auto insurance rates. Urban areas with higher rates of traffic congestion and crime tend to have higher premiums, as there is a greater risk of accidents and theft. Additionally, the frequency of severe weather events in your area can impact your rates. By living in a safe neighborhood and taking steps to protect your vehicle from theft and damage, you can potentially lower your insurance costs.

Finally, your credit score can also influence your auto insurance prices. Insurers use credit scores as a factor in determining risk, as there is a correlation between credit history and the likelihood of filing a claim. By maintaining a good credit score, you can demonstrate to insurers that you are a responsible and reliable driver, which may result in lower premiums.

In conclusion, there are a variety of factors that can impact your auto insurance prices. By understanding how rates are determined and taking steps to mitigate risk, you can ensure that you are getting the best value for your money. Remember to compare quotes from multiple insurers to find the most competitive rates, and don’t be afraid to ask questions if you need clarification on any aspect of your policy. With a little knowledge and effort, you can unravel the mystique of car insurance costs and secure the coverage you need at a price you can afford.