Unpacking the Basics

When it comes to planning a trip, there are a million and one things to consider. From booking flights and accommodations to packing your bags and making sure you have all your travel documents in order, the list of tasks can seem never-ending. One thing that often gets overlooked, however, is trip cancellation insurance.

Trip cancellation insurance is a type of travel insurance that can help protect you financially in case you need to cancel or interrupt your trip for a covered reason. While it may seem like an unnecessary expense, understanding the basics of trip cancellation insurance can actually save you a lot of money and headaches in the long run.

So, let’s break it down and unpack the basics of trip cancellation insurance.

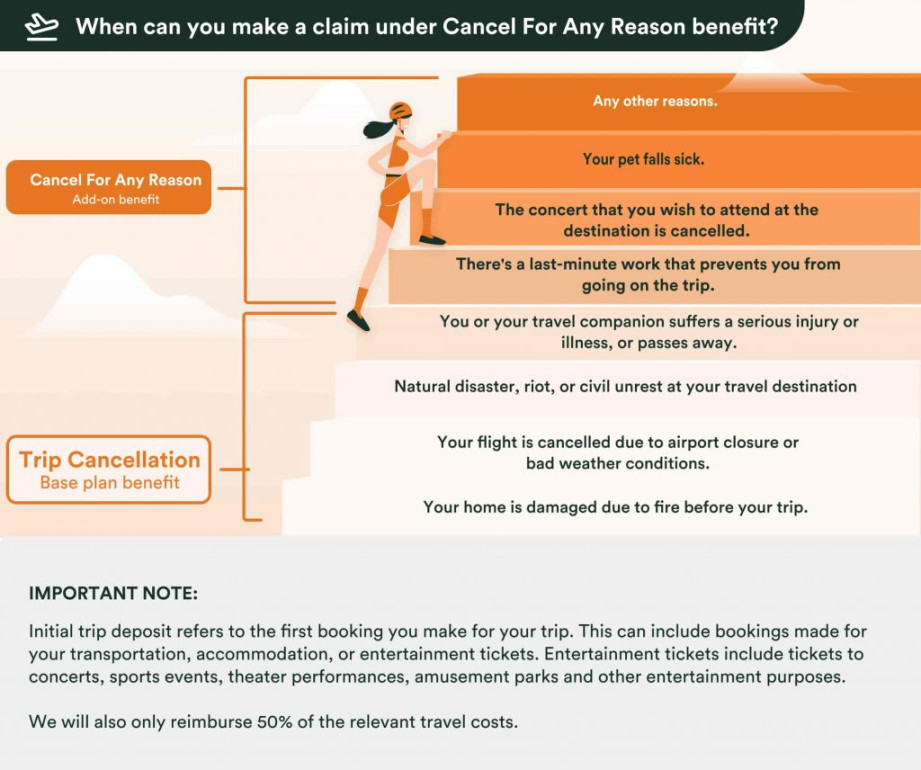

First and foremost, it’s important to understand what trip cancellation insurance actually covers. Generally speaking, trip cancellation insurance can provide reimbursement for non-refundable trip costs if you need to cancel your trip for a covered reason. Covered reasons typically include things like illness or injury, natural disasters, terrorism, or other unforeseen events that are outside of your control.

It’s important to note that not all reasons for canceling a trip will be covered by trip cancellation insurance. For example, if you simply change your mind or decide you no longer want to go on the trip, that would not be a covered reason. It’s always a good idea to carefully review the policy details and speak with a representative from the insurance company to clarify any questions you may have.

In addition to trip cancellation coverage, many policies also include trip interruption coverage. This means that if you need to cut your trip short for a covered reason, such as a family emergency or illness, the insurance can help reimburse you for the unused portion of your trip. This can be especially helpful if you have to unexpectedly return home early and are unable to recoup any of the costs you’ve already paid for the remainder of your trip.

When it comes to purchasing trip cancellation insurance, there are a few key things to keep in mind. First, it’s important to buy the insurance as soon as you book your trip. Most policies require you to purchase the insurance within a certain timeframe of booking your trip in order to be eligible for coverage. Waiting until the last minute to buy insurance can limit your coverage options and may even result in being ineligible for coverage at all.

Another important consideration is the cost of the insurance relative to the cost of your trip. Generally speaking, trip cancellation insurance will cost you a percentage of the total trip cost. It’s important to weigh the cost of the insurance against the potential benefits it can provide in case you need to cancel or interrupt your trip. In some cases, the peace of mind that comes with knowing you’re covered may be well worth the cost.

In conclusion, trip cancellation insurance is an important aspect of travel planning that should not be overlooked. By understanding the basics of trip cancellation insurance and taking the time to carefully review policy details, you can ensure that you’re adequately covered in case the unexpected happens. Remember, it’s always better to be safe than sorry when it comes to protecting yourself and your investment in your travel plans.

Decoding Trip Cancellation Insurance

Planning a trip can be an exciting and exhilarating experience. From choosing the perfect destination to booking flights and accommodations, there are so many details to consider. However, despite our best efforts, sometimes unexpected events can disrupt our travel plans. This is where trip cancellation insurance comes in.

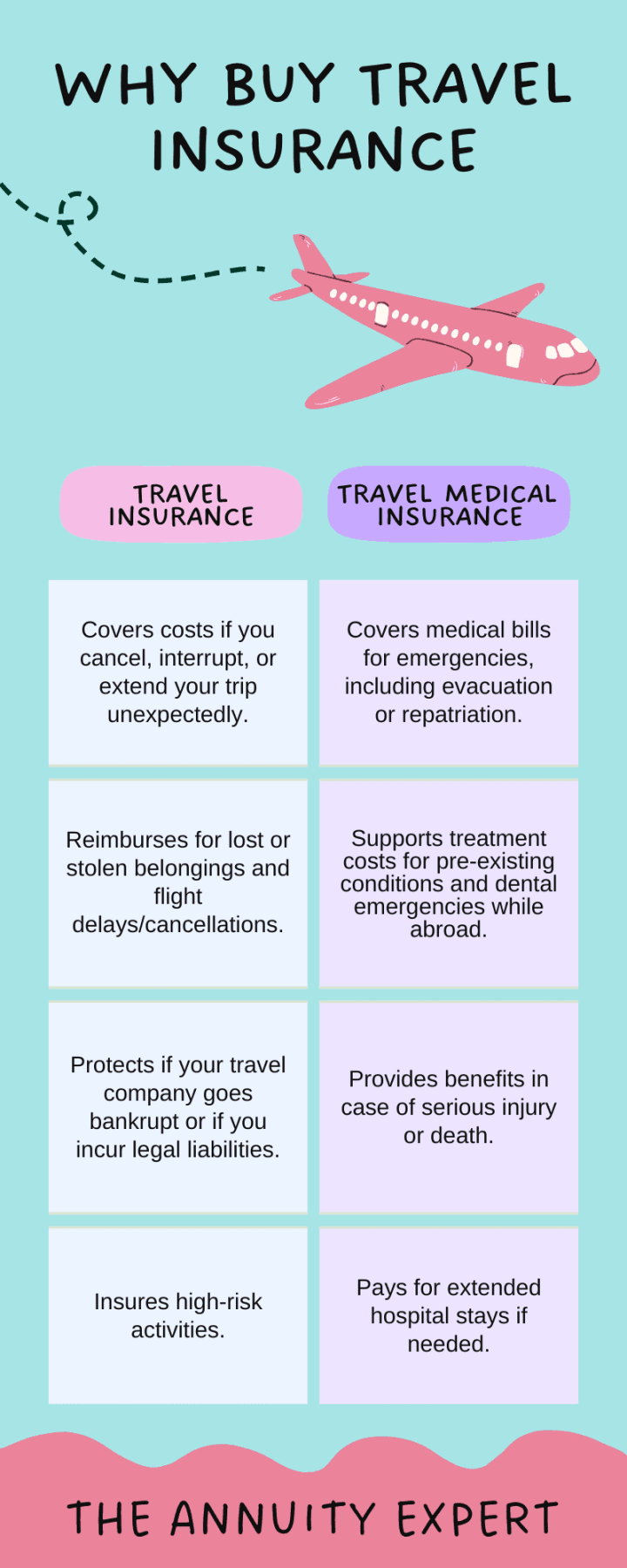

Trip cancellation insurance is a type of coverage that can help protect you financially in the event that you need to cancel or interrupt your trip due to unforeseen circumstances. This insurance can provide coverage for a variety of situations, such as illness, injury, natural disasters, or even job loss.

One of the key benefits of trip cancellation insurance is that it can provide reimbursement for any non-refundable expenses you may have incurred while planning your trip. This can include things like flights, accommodations, tours, and even pre-paid excursions. Without trip cancellation insurance, you could be left out of pocket if you need to cancel your trip for any reason.

When considering trip cancellation insurance, it’s important to carefully review the policy details to understand what is covered and what is not. Some policies may have exclusions for pre-existing medical conditions, acts of terrorism, or extreme sports activities. By understanding the terms of your policy, you can ensure that you have the coverage you need in case of an emergency.

In addition to trip cancellation insurance, there are other types of travel insurance that you may want to consider for your trip. This can include coverage for medical emergencies, lost luggage, or trip delays. By combining different types of coverage, you can create a comprehensive travel insurance package that meets your specific needs.

When purchasing trip cancellation insurance, it’s important to compare different policies to find the one that best suits your needs and budget. Some policies may have higher premiums but offer more comprehensive coverage, while others may be more affordable but have limited coverage. By shopping around and comparing quotes, you can find the right policy for your trip.

In the event that you need to cancel your trip, it’s important to notify your insurance provider as soon as possible. They will be able to guide you through the claims process and help you gather any necessary documentation to support your claim. By following the proper procedures, you can ensure a smooth and efficient claims process.

Overall, trip cancellation insurance can provide peace of mind and financial protection when planning your next adventure. By understanding the benefits and limitations of this type of coverage, you can make informed decisions and enjoy your travels with confidence. So next time you’re planning a trip, consider adding trip cancellation insurance to your checklist and travel worry-free.