Navigating the Maze of Home Insurance Claims

Home insurance is a crucial investment for homeowners, providing protection and peace of mind in the event of unexpected disasters or accidents. However, when it comes to filing a claim, the process can often feel like navigating a confusing maze. Understanding the ins and outs of home insurance claims can help make the process smoother and less stressful.

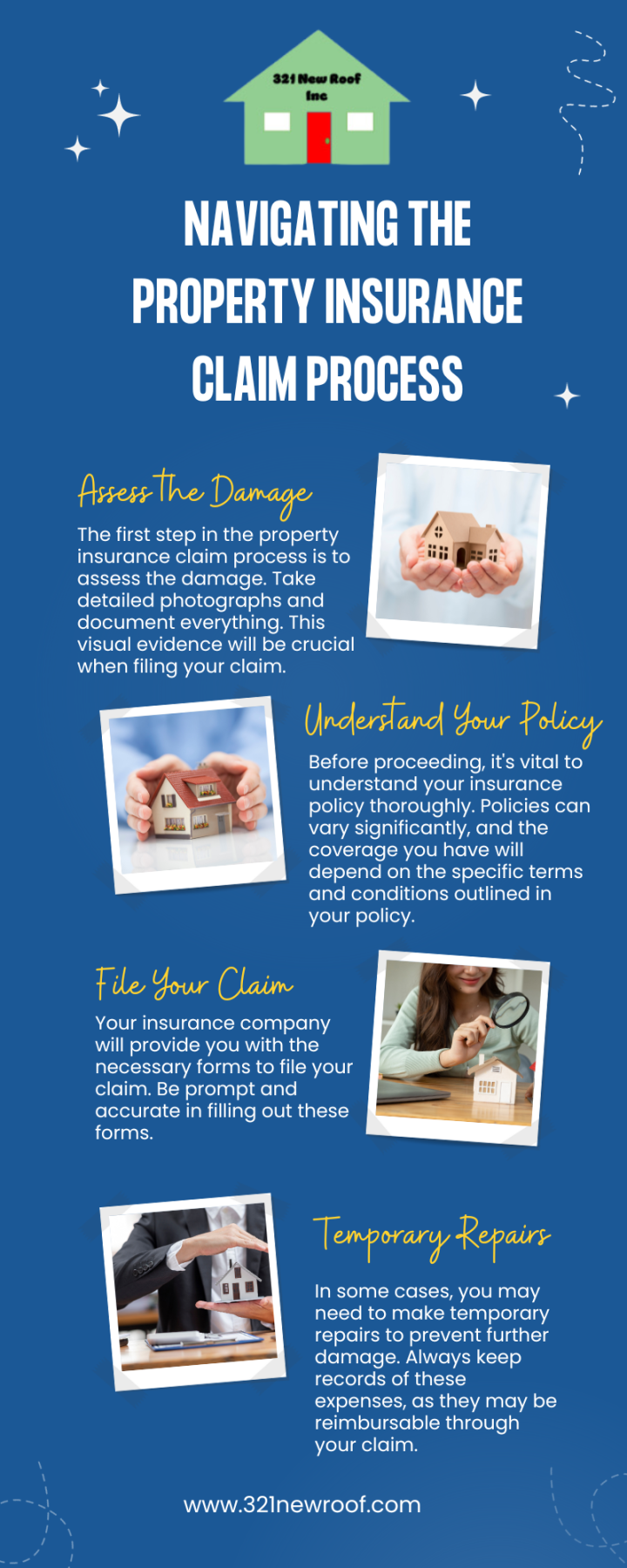

When disaster strikes, whether it’s a burst pipe, a house fire, or damage from a storm, the first step is to contact your insurance company as soon as possible. Most policies require that you report the claim within a certain timeframe, so it’s important to act quickly. Be prepared to provide detailed information about the damage, including photos if possible. The more information you can provide, the easier it will be for the insurance company to process your claim.

Once you’ve filed a claim, the insurance company will assign an adjuster to assess the damage. The adjuster will inspect your home, evaluate the extent of the damage, and determine the cost of repairs or replacement. It’s important to cooperate with the adjuster and provide any additional information they may request. Keep records of all communication with the adjuster, including emails, phone calls, and written correspondence.

After the adjuster has completed their assessment, the insurance company will provide you with a settlement offer. This offer is based on the adjuster’s evaluation of the damage and may cover the cost of repairs, replacement items, and additional living expenses if you are unable to stay in your home. Review the settlement offer carefully and make sure you understand what is covered and what is not. If you have any questions or concerns, don’t hesitate to contact your insurance company for clarification.

If you’re unhappy with the settlement offer or believe that you are entitled to more compensation, you have the right to appeal the decision. Most insurance companies have a process for appealing a claim, which may involve submitting additional documentation or requesting a second opinion from another adjuster. It’s important to follow the appeal process carefully and provide any evidence that supports your case.

Navigating the maze of home insurance claims can be a daunting task, but with patience, persistence, and a clear understanding of the process, you can ensure that you receive fair compensation for your losses. By staying organized, communicating effectively with your insurance company, and seeking help when needed, you can make the claims process as smooth and stress-free as possible.

In conclusion, home insurance claims don’t have to be a source of anxiety or frustration. With the right knowledge and approach, you can navigate the maze of home insurance claims with confidence and peace of mind. Remember to stay proactive, informed, and patient throughout the process, and don’t hesitate to seek help or guidance if you need it. Your home is your most valuable asset, and it’s important to protect it with the right insurance coverage and a solid understanding of the claims process.

Simplifying the Process for Peace of Mind

Home insurance claims can often feel like a daunting and overwhelming process. From documenting the damage to negotiating with insurance companies, there are many steps involved in getting your home back in order after a disaster. However, by taking a systematic approach and breaking down the process into manageable steps, you can simplify the process and achieve peace of mind during a stressful time.

The first step in simplifying the home insurance claims process is to familiarize yourself with your insurance policy. Take the time to review your policy and understand what is covered and what is not. Knowing the details of your policy can help you avoid any surprises when it comes time to file a claim. Additionally, make sure to keep a copy of your policy in a safe place where you can easily access it in case of an emergency.

Once you have a good understanding of your policy, the next step is to document the damage to your home. Take detailed photographs of the affected areas and make a list of any items that have been damaged or destroyed. This documentation will be crucial when filing your claim and can help ensure that you receive the compensation you are entitled to.

When it comes time to file your claim, it is important to do so in a timely manner. Most insurance policies have a deadline for filing claims, so be sure to act quickly. Contact your insurance company as soon as possible to start the claims process. Be prepared to provide all of the documentation you have gathered, including photos and lists of damaged items.

During the claims process, it is important to stay organized and keep detailed records of all communication with your insurance company. Keep track of any phone calls, emails, and letters exchanged, as well as any promises or agreements made. Having a clear record of all interactions can help prevent misunderstandings and ensure that your claim is processed smoothly.

As your claim is being processed, be prepared to negotiate with your insurance company if necessary. Insurance companies may try to offer you a lower settlement than you deserve, so be prepared to advocate for yourself and provide evidence to support your claim. If you are having trouble reaching a fair settlement, consider seeking help from a public adjuster or legal counsel.

Once your claim has been approved and you have received your settlement, it is important to use the funds wisely. Make a plan for repairing or replacing the damaged items in your home and prioritize the most essential repairs first. Keep track of all expenses related to the claim and be sure to document any repairs or replacements made.

By following these steps and staying organized throughout the home insurance claims process, you can simplify the process and achieve peace of mind during a challenging time. With a clear understanding of your policy, thorough documentation of the damage, and effective communication with your insurance company, you can navigate the claims process with confidence and ensure that you receive the compensation you deserve.