Protect Your Haven: Get Quotes for Home Insurance Today!

Your home is more than just a building; it’s your sanctuary, your haven, your safe place. It’s where you make memories with your loved ones, where you retreat after a long day, and where you feel most comfortable. That’s why it’s crucial to protect your home with the right insurance coverage.

Home insurance provides you with financial protection in case of unexpected events such as natural disasters, fires, theft, and more. It gives you peace of mind knowing that you won’t have to bear the financial burden alone if something were to happen to your home.

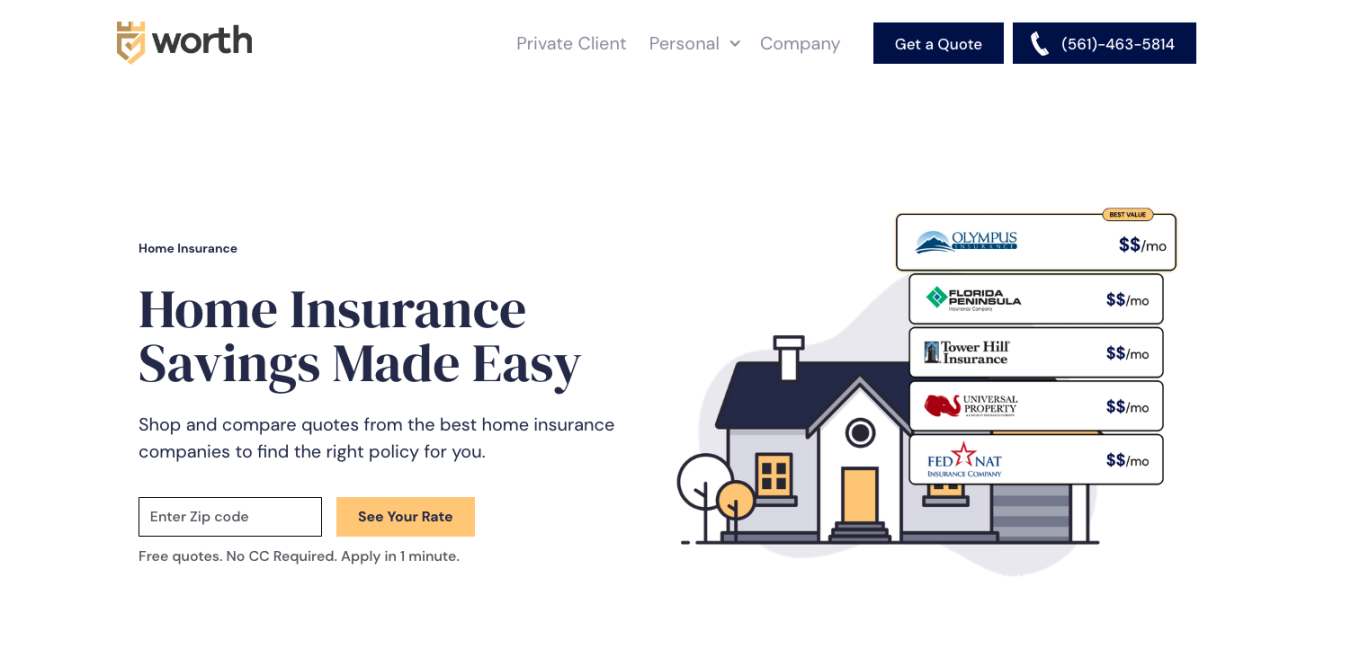

Getting quotes for home insurance is the first step towards safeguarding your haven. By comparing different insurance policies and their prices, you can choose the coverage that best suits your needs and budget. It’s essential to shop around and not settle for the first quote you receive, as prices can vary significantly between insurance companies.

When getting quotes for home insurance, there are a few key factors to consider. First and foremost, you need to assess the value of your home and its contents accurately. Make a detailed inventory of all your belongings and estimate their total value to ensure you have enough coverage in case of a loss.

Next, consider the location of your home. Homes in areas prone to natural disasters such as hurricanes, earthquakes, or floods may require additional coverage. Make sure to disclose all relevant information about your home’s location to insurance providers to get an accurate quote.

Additionally, think about the level of coverage you need. Basic home insurance policies typically cover the structure of your home, personal belongings, liability protection, and additional living expenses in case you need to temporarily relocate. However, you may want to consider adding extra coverage for valuable items such as jewelry, artwork, or electronics.

Another factor to keep in mind when getting quotes for home insurance is your deductible. The deductible is the amount you’ll have to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but make sure you can afford to pay it in case of a claim.

It’s also essential to consider the reputation and financial stability of the insurance company you choose. You want to make sure that they will be able to fulfill their obligations in case you need to file a claim. Look for reviews and ratings from other policyholders to get an idea of the company’s customer service and claims process.

In today’s digital age, getting quotes for home insurance has never been easier. Many insurance companies offer online quote tools that allow you to input your information and receive a personalized quote in minutes. You can compare quotes from multiple providers side by side to find the best coverage at the best price.

Don’t wait until it’s too late to protect your haven. Get quotes for home insurance today and give yourself the peace of mind knowing that your home is safeguarded against life’s uncertainties. Your home is worth protecting, so take the time to find the right coverage for your needs. Get started today and rest easy knowing that your haven is safe and secure.

Turn Your House into a Home Sweet Home with the Right Coverage!

When it comes to turning a house into a home, there are many factors to consider – from choosing the right color scheme to finding the perfect furniture pieces. However, one aspect that should not be overlooked is ensuring that your home is adequately protected with the right insurance coverage.

Home insurance is essential for providing financial protection in the event of unexpected disasters such as fire, theft, or natural disasters. It not only covers the physical structure of your home but also your personal belongings and liability in case someone is injured on your property.

By getting quotes for home insurance, you can find the right coverage that fits your needs and budget. With the right policy in place, you can have peace of mind knowing that your home is protected no matter what comes your way.

When looking for home insurance quotes, there are a few key factors to consider. First and foremost, it’s important to assess the value of your home and belongings to determine how much coverage you need. You’ll also want to consider any special circumstances, such as living in a high-risk area or owning valuable items that may require additional coverage.

In addition to considering the coverage amounts, it’s also important to compare premiums from different insurance providers. While cost is certainly a factor, it’s equally important to consider the reputation and customer service of the insurance company. You want to choose a provider that is reliable and responsive when you need to file a claim.

Another important aspect to consider when getting quotes for home insurance is the type of coverage included in the policy. There are different types of policies available, including basic coverage, which typically covers the structure of your home and some personal belongings, and more comprehensive policies that offer additional protections such as coverage for natural disasters or high-value items.

By taking the time to get quotes for home insurance and comparing different options, you can ensure that you have the right coverage in place to protect your home and belongings. It’s an investment in your peace of mind and financial security, knowing that you have a safety net in place in case the unexpected happens.

In conclusion, turning your house into a home sweet home involves more than just decorating and furnishing – it also means ensuring that your home is adequately protected with the right insurance coverage. By getting quotes for home insurance and choosing the right policy for your needs, you can rest easy knowing that your home is protected no matter what life throws your way. So don’t delay – get quotes for home insurance today and make sure your home sweet home is truly a safe haven for you and your family.