Discover the Basics of Travel Health Insurance

Traveling can be a thrilling and rewarding experience, but it’s important to prioritize your health and safety while on the go. One way to ensure peace of mind during your adventures is by investing in travel health insurance. This type of insurance is designed to cover medical expenses that may arise while you are traveling abroad, providing you with financial protection and access to quality healthcare.

So, what exactly is travel health insurance and why do you need it? Let’s delve into the basics to help you understand this essential aspect of travel planning.

First and foremost, travel health insurance is a type of insurance that provides coverage for medical emergencies and other healthcare-related expenses while you are traveling outside of your home country. This coverage can include emergency medical treatment, hospital stays, prescription medications, and even medical evacuation in the event of a serious illness or injury.

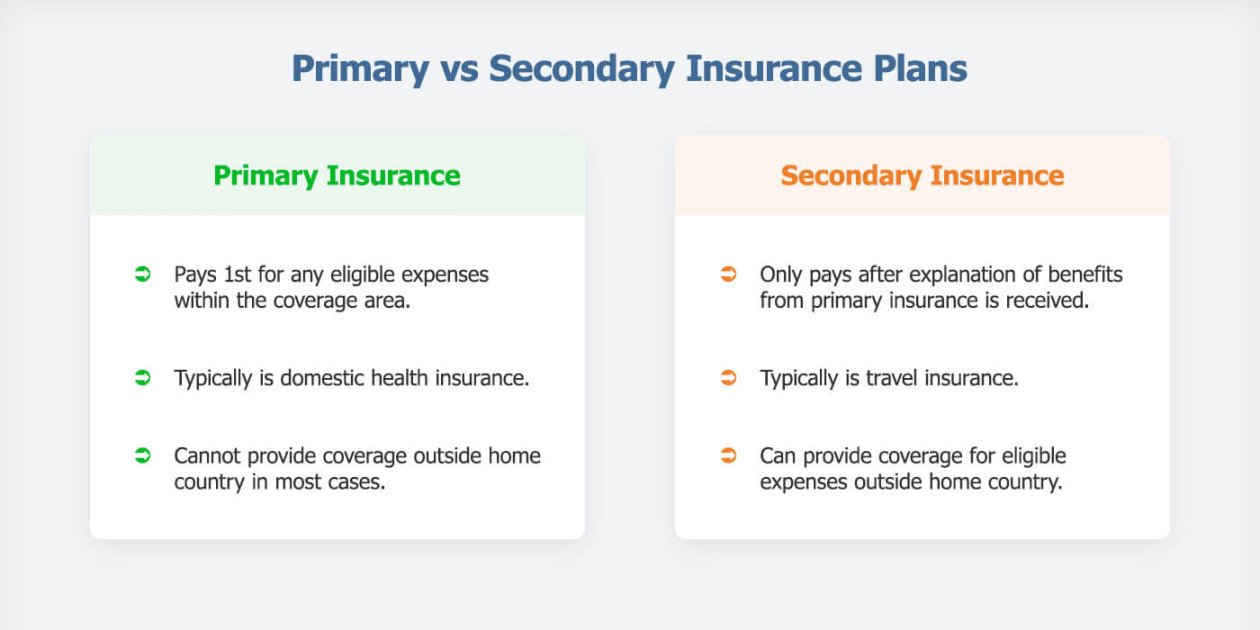

One of the key reasons why travel health insurance is so important is that your regular health insurance policy may not provide adequate coverage when you are abroad. Many health insurance plans have limited or no coverage for international travel, leaving you vulnerable to hefty medical bills if you were to fall ill or get injured while away from home.

Travel health insurance can also help protect you from unexpected medical expenses that may arise due to factors such as language barriers, unfamiliar healthcare systems, and differences in medical practices between countries. Having this coverage can give you peace of mind knowing that you will be able to access the medical care you need without having to worry about the financial repercussions.

When it comes to choosing a travel health insurance plan, there are a few key factors to consider. These include the duration of your trip, the destinations you will be visiting, your age and health status, and any pre-existing medical conditions you may have. It’s important to carefully review the terms and coverage limits of each plan to ensure that it meets your specific needs and provides adequate protection.

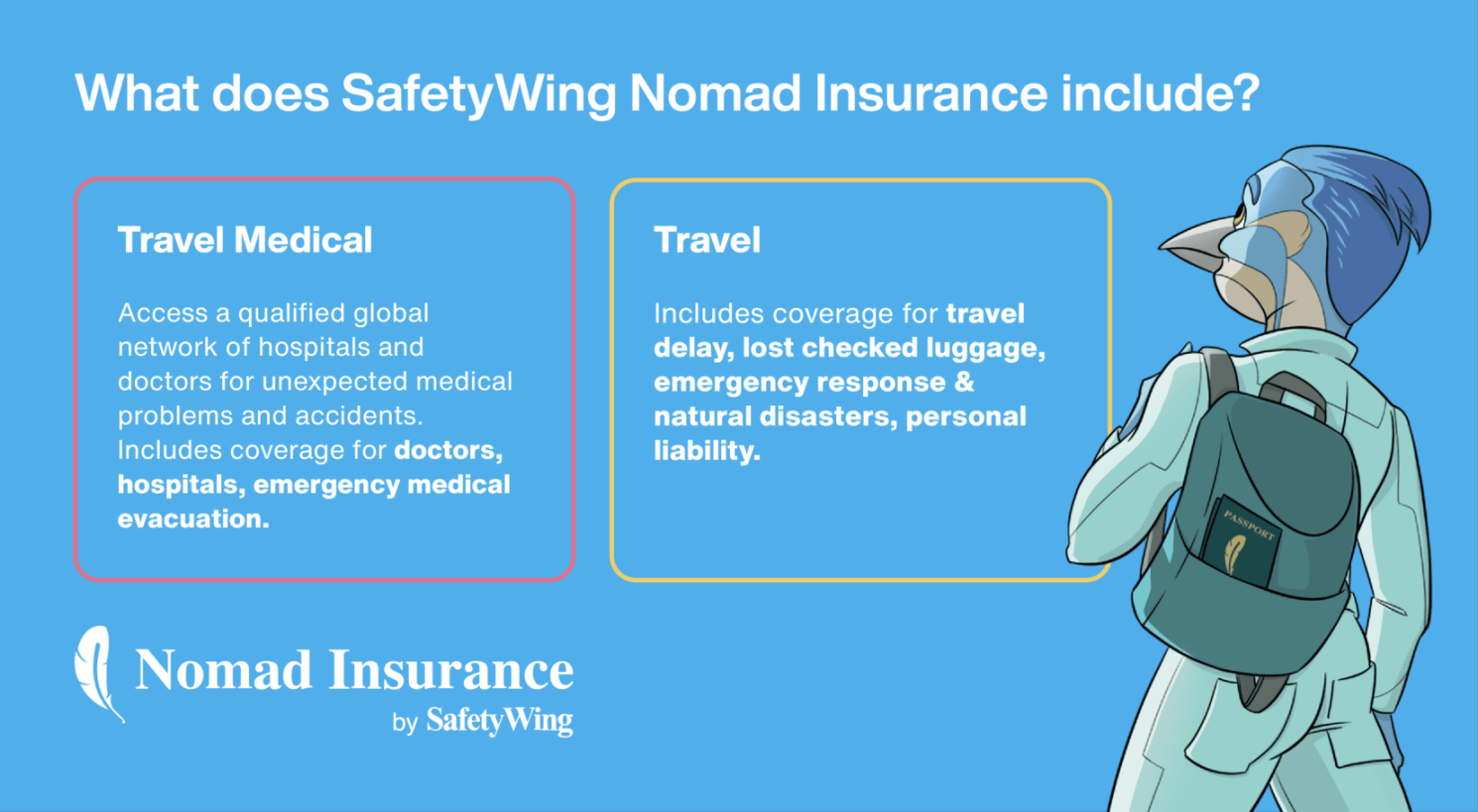

Some travel health insurance plans may also offer additional benefits such as coverage for trip cancellations, lost luggage, and emergency evacuation. These extra features can provide added peace of mind and ensure that you are fully protected throughout your journey.

In addition to medical coverage, travel health insurance can also provide assistance services such as 24/7 emergency hotlines, help with finding local healthcare providers, and language interpretation services. These services can be invaluable in a medical emergency when you may be feeling overwhelmed or confused by the situation.

Overall, travel health insurance is a vital investment for anyone planning to travel internationally. It provides essential protection against unforeseen medical expenses and ensures that you have access to quality healthcare wherever your adventures may take you. By understanding the basics of travel health insurance and choosing a plan that meets your needs, you can enjoy your travels with peace of mind knowing that you are covered in case of any medical emergencies.

Your Guide to Stress-Free Coverage Abroad

Traveling to a foreign country can be an exciting and enriching experience, but it also comes with its fair share of risks. From lost luggage to unexpected illnesses, there are many things that can go wrong while you’re away from home. That’s why having travel health insurance is essential for anyone planning a trip abroad.

But navigating the world of travel health insurance can be confusing and overwhelming. With so many different policies and providers to choose from, how do you know which one is right for you? That’s where this guide comes in. We’ll break down everything you need to know about travel health insurance, so you can travel with peace of mind knowing you’re covered no matter what happens.

First and foremost, it’s important to understand what travel health insurance actually covers. Most policies will include coverage for medical emergencies, such as hospital stays, surgeries, and ambulance services. They may also cover non-emergency medical care, like doctor’s visits and prescription medications. Some policies even offer coverage for dental emergencies and emergency medical evacuation.

In addition to medical coverage, many travel health insurance policies also include coverage for trip cancellations, interruptions, and delays. This can be a lifesaver if your flight gets canceled or if you have to cut your trip short due to a family emergency. Some policies even offer coverage for lost or stolen belongings, including passports and credit cards.

When shopping for travel health insurance, there are a few key factors to consider. First, think about where you’ll be traveling and for how long. Some policies have restrictions on which countries they cover, so make sure the policy you choose includes coverage for your destination. You’ll also want to consider the length of your trip – some policies have a maximum coverage period, so make sure you’re covered for the duration of your stay.

Another important factor to consider is the cost of the policy. Travel health insurance can vary widely in price, so it’s important to compare quotes from different providers to find the best deal. Keep in mind that cheaper isn’t always better – make sure the policy you choose offers adequate coverage for your needs.

It’s also a good idea to check whether your existing health insurance policy covers you while you’re abroad. Some health insurance plans include coverage for international travel, so you may not need a separate travel health insurance policy. However, be aware that many domestic health insurance plans have limitations on coverage outside of your home country, so it’s always a good idea to double-check.

When it comes to making a claim on your travel health insurance policy, the process is usually fairly straightforward. In the event of a medical emergency, contact your insurance provider as soon as possible to let them know what’s happening. They will usually provide you with instructions on how to proceed, such as which hospitals or clinics to visit and what documentation you’ll need to provide.

Overall, having travel health insurance is essential for anyone planning a trip abroad. It provides peace of mind knowing that you’re covered in case of medical emergencies, trip cancellations, or lost belongings. By understanding what travel health insurance covers, shopping around for the best policy, and knowing how to make a claim, you can travel with confidence knowing you’re prepared for whatever comes your way.