Unveiling the Mystery of Full Coverage

When it comes to car insurance, there are many different types of coverage options available. One of the most popular and comprehensive options is full coverage car insurance. But what exactly does full coverage entail? And how does it differ from other types of insurance? Let’s dive into the mystery of full coverage and uncover all its secrets.

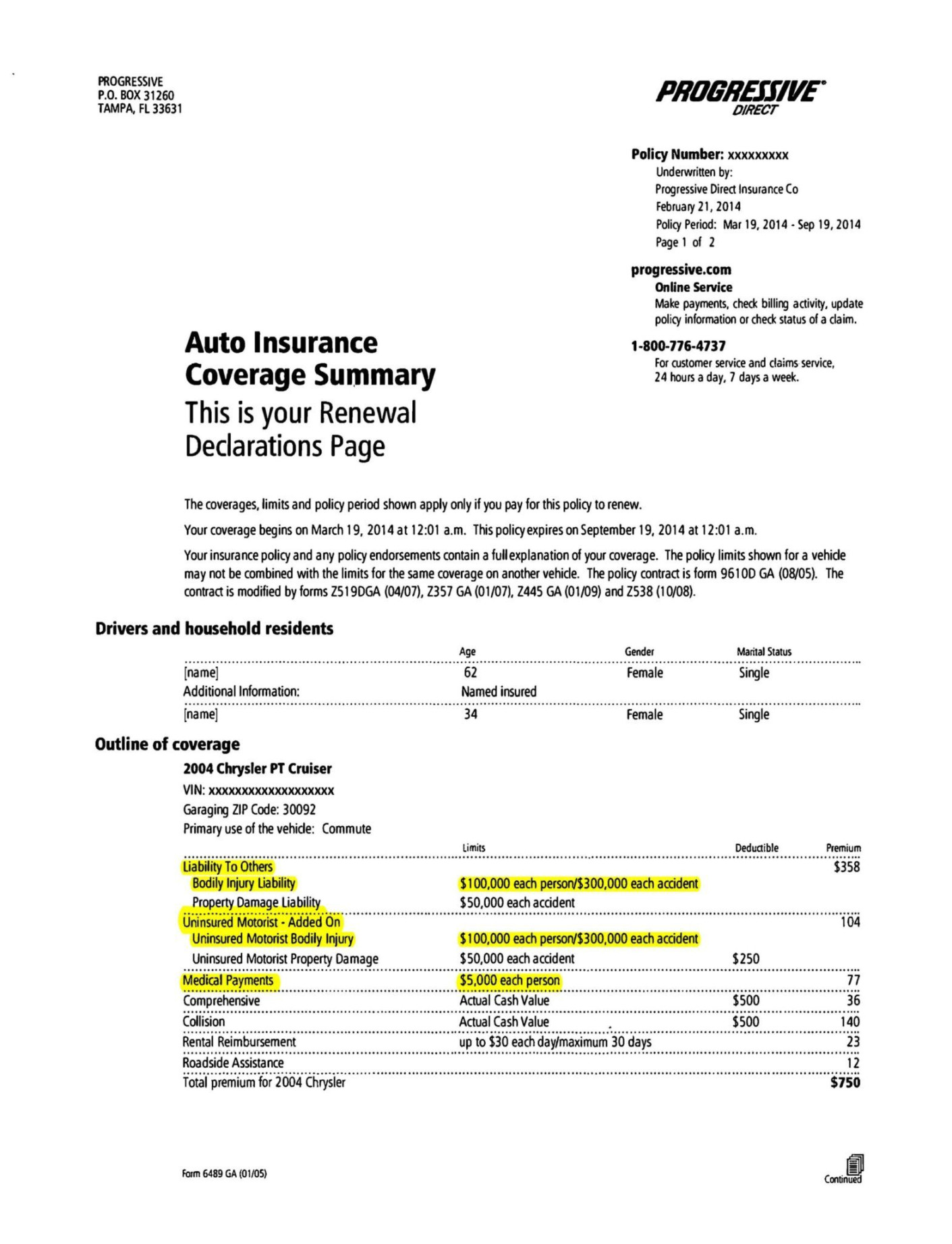

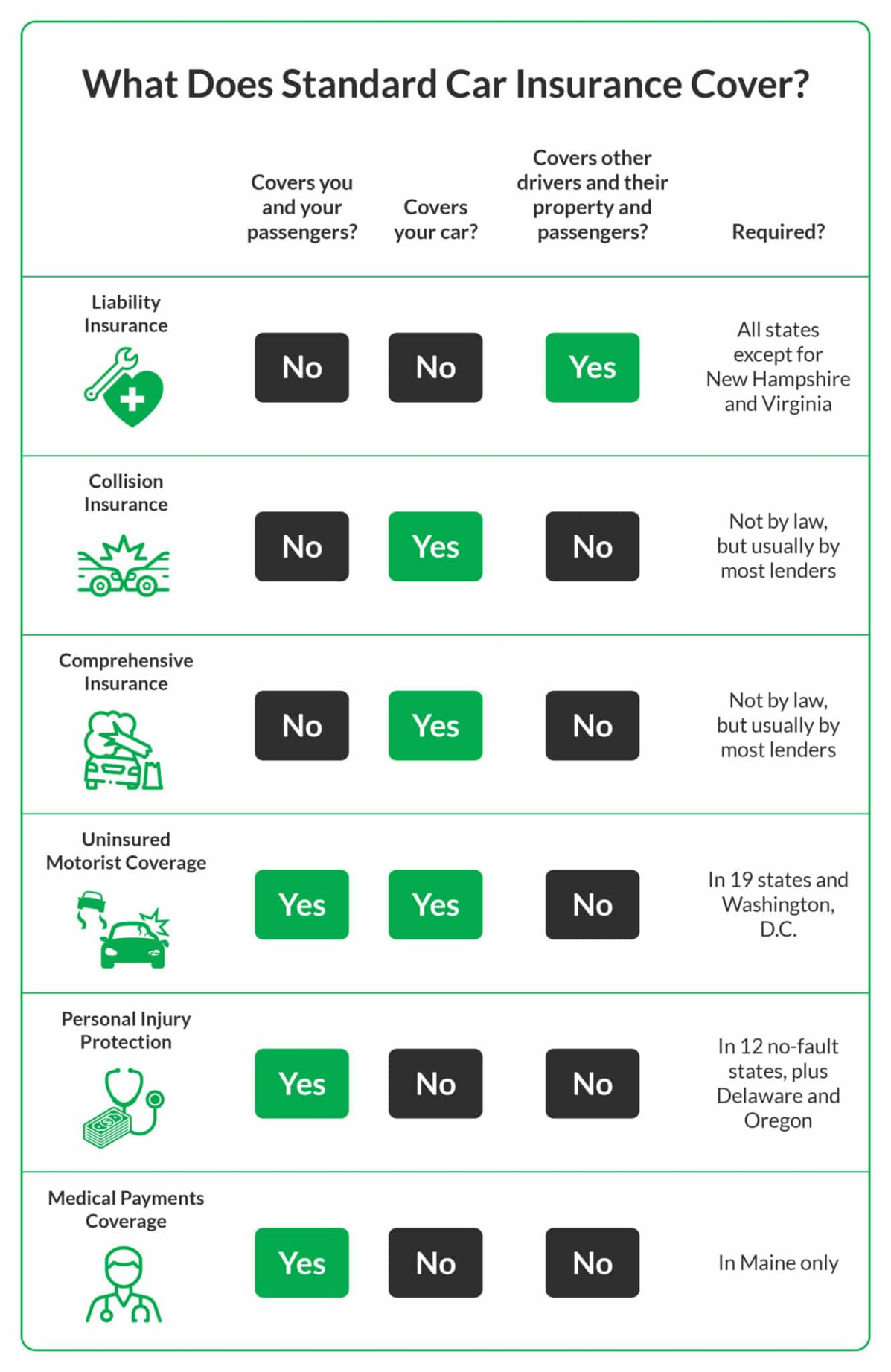

Full coverage car insurance is a type of insurance that provides a wide range of coverage for your vehicle. It typically includes both liability coverage and physical damage coverage. Liability coverage helps protect you in case you are found at fault in an accident and need to pay for damages to another person’s vehicle or property. Physical damage coverage, on the other hand, helps cover the cost of repairs to your own vehicle in case of an accident.

One of the key benefits of full coverage car insurance is that it provides protection in a wide variety of scenarios. Whether you are involved in a minor fender bender or a major collision, full coverage insurance can help cover the costs of repairs or replacements. This can provide peace of mind knowing that you are financially protected in case of an accident.

In addition to covering damage to your vehicle, full coverage car insurance can also provide coverage for theft, vandalism, and natural disasters. This means that if your car is stolen, broken into, or damaged in a storm, you may be able to file a claim with your insurance company to help cover the cost of repairs or replacements.

Another important aspect of full coverage car insurance is that it often includes uninsured or underinsured motorist coverage. This type of coverage helps protect you in case you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Uninsured or underinsured motorist coverage can help cover medical expenses, lost wages, and other costs associated with an accident.

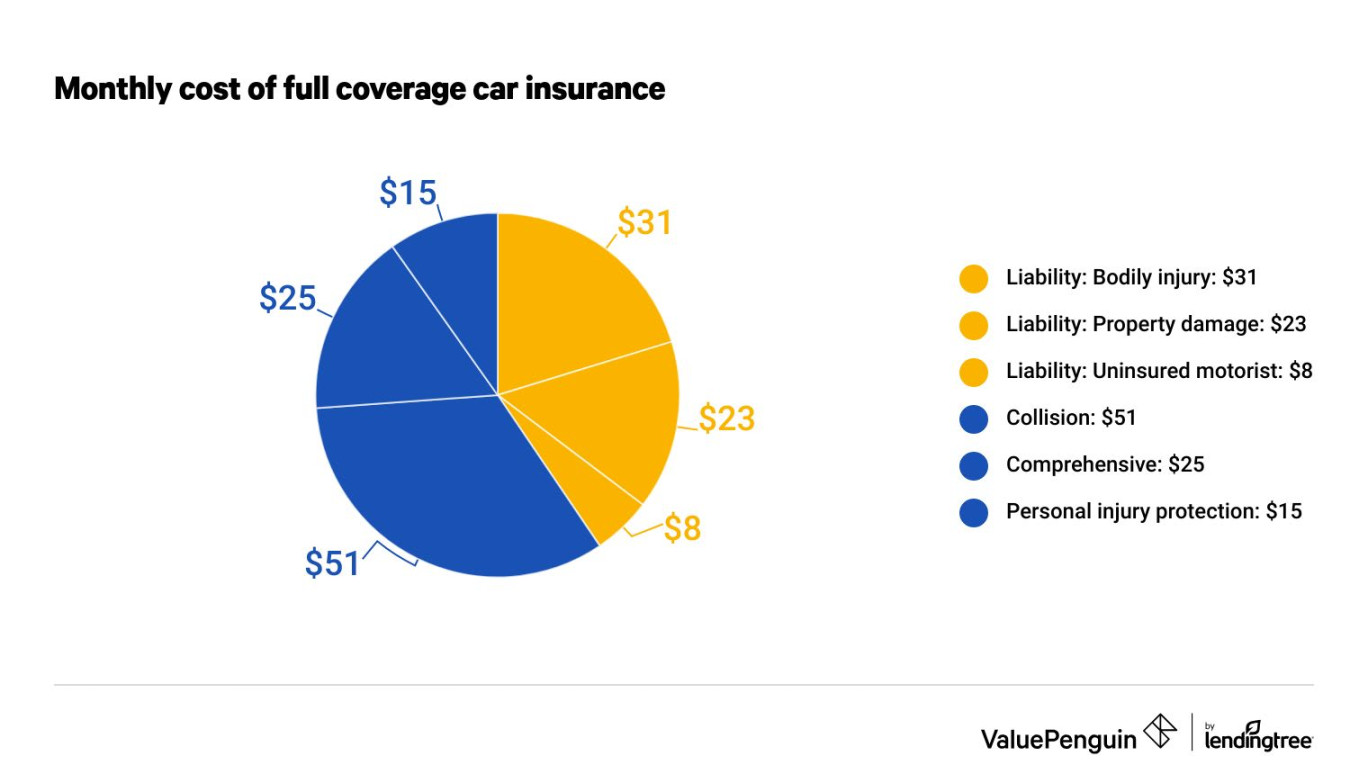

It’s important to note that full coverage car insurance is typically more expensive than other types of insurance. This is because it provides more comprehensive coverage and therefore carries a higher risk for the insurance company. However, the peace of mind and financial protection that full coverage provides can often outweigh the higher cost.

In conclusion, full coverage car insurance is all about providing comprehensive protection for your vehicle in a wide range of scenarios. From accidents to theft to natural disasters, full coverage insurance can help cover the costs of repairs or replacements and provide peace of mind knowing that you are financially protected. While full coverage insurance may be more expensive than other types of insurance, the benefits it provides make it a valuable investment for many drivers.

The Ins and Outs of Comprehensive Insurance

When it comes to car insurance, there are many different types of coverage to choose from. One of the most important and often misunderstood types of coverage is comprehensive insurance. Comprehensive insurance is a type of coverage that helps protect you from a wide range of risks that can damage your car, but it’s important to understand exactly what it covers and how it works.

Comprehensive insurance is often referred to as full coverage because it provides a higher level of protection than basic liability insurance. While liability insurance only covers damage you cause to other people or their property, comprehensive insurance covers damage to your own vehicle caused by things like theft, vandalism, natural disasters, and accidents that are not the result of a collision with another vehicle.

One of the key benefits of comprehensive insurance is that it can help cover the cost of repairing or replacing your car if it is damaged in a non-collision event. For example, if your car is stolen or vandalized, comprehensive insurance can help cover the cost of repairs or replacement. It can also help cover the cost of repairing or replacing your car if it is damaged by a natural disaster such as a flood, fire, or falling tree branch.

In addition to covering damage to your own vehicle, comprehensive insurance can also help cover the cost of damage to other people’s property that is caused by your car. For example, if a tree falls on your car during a storm and then damages your neighbor’s fence, comprehensive insurance can help cover the cost of repairing the fence.

It’s important to note that comprehensive insurance does not cover damage to your car that is caused by a collision with another vehicle. For that type of coverage, you would need collision insurance. However, by combining comprehensive insurance with collision insurance and liability insurance, you can create a comprehensive car insurance policy that provides protection against a wide range of risks.

When shopping for comprehensive insurance, it’s important to consider the level of coverage you need and how much you can afford to pay in premiums. The cost of comprehensive insurance can vary depending on factors such as the value of your car, your driving record, and where you live. It’s a good idea to compare quotes from multiple insurance companies to find the best coverage at the most affordable price.

In conclusion, comprehensive insurance is an important type of coverage that can provide valuable protection for your car against a wide range of risks. By understanding what comprehensive insurance covers and how it works, you can make an informed decision about whether it’s the right choice for you. Remember, comprehensive insurance is all about giving you peace of mind and protecting your investment in your vehicle.